Global Toluene Diisocyanate Market by Application (Polyurethane Foam & Polyurethane CASE), by Geography (Asia-Pacific, Europe, North America & RoW) – Analysis & Forecast to 2019

The Global Toluene Diisocyanate Market, along with its end-products, has witnessed a linear growth in the past few years, and this growth is estimated to increase in the coming years. Toluene diisocyanate (TDI) is a member of the diisocyanate family associated with the polyurethane chemistry. TDI is extensively used in the manufacturing of flexible polyurethane foams. These foams have numerous applications in different industries including furniture, automotive, footwear, and others. These foams are used as high resiliency foams for bedding and upholstery in furniture industry, in paints, coatings & adhesives for the construction industry, insulators in the appliance industry, and in other applications.

The toluene diisocyanate market is experiencing an enormous growth, which is expected to continue in the near future, mainly driven by the highly growing regions, such as Asia-Pacific followed by Europe and North America. A considerable amount of investments are made by various market players to serve the end-user application industries in the future. The Asia-Pacific region is the main toluene diisocyanate market that accounted for about 38.0% market share of the total world market demand in 2014. The region is further expected to show a high growth in the future, mainly due to the increasing demand in the end-user industries.

Almost 88.0% of the total toluene diisocyanate demand was for the polyurethane foam application in 2014, due to a high demand in the end-user industries.

The drivers of the industry are growth in emerging economies, high demand in polyurethane market, and technological advancement. This study basically aims to estimate the global market of toluene diisocyanate for 2014 and to project its estimated demand by 2019. This market research study provides a detailed qualitative and quantitative analysis of the Asian Toluene Diisocyanate Market. We have used various secondary sources, such as encyclopedia, directories, industry journals, and databases to identify and collect information useful for this extensive commercial study of the toluene diisocyanate market.

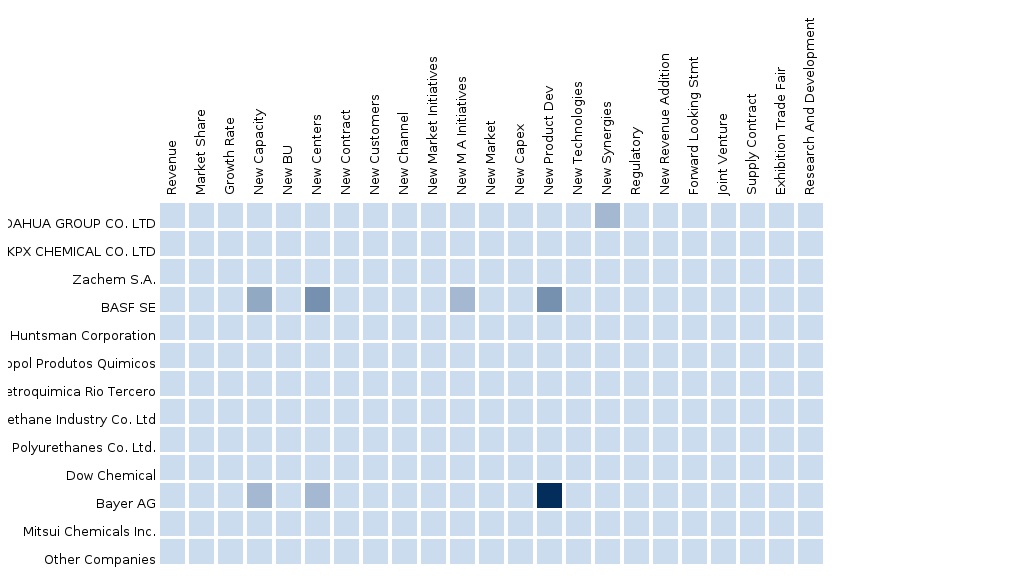

The competitive scenarios of the top players in the toluene diisocyanate market have been discussed in detail. We have also profiled leading players of this industry with their recent developments and other strategic industry activities. These include key toluene diisocyanate manufacturers, such as BASF Corporation (U.S.), Bayer AG (Germany), Birsodchem (U.S.), KPX Fine Chemical Company Ltd. (South Korea), Yantai Juli Isocyanic Ester Co. (China), Vencorex (U.S.), and others.

Scope of the report:

This research report categorizes the global market for toluene diisocyanate on the basis of applications, end-user industries, and geographies along with the forecasted volume, value, and trends in each of the submarkets.

On the basis of applications:

- Polyurethane Foam

- Polyurethane CASE

Each application is described in detail in the report with volume and revenue forecasts for each application.

On the basis of geography:

- Asia-Pacific

- Europe

- North America

- Rest of the World

Table Of Contents

1 Introduction (Page No. - 10)

1.1 Objectives Of The Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem Of Toluene Diisocyanate Market

2.2 Arriving At The Toluene Diisocyanate Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.3 Assumptions

3 Executive Summary (Page No. - 19)

4 Market Overview (Page No. - 21)

4.1 Introduction

4.2 Toluene Diisocyanate Market: Comparison With Parent Market

4.3 Market Drivers And Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

4.6 Vendor Side Analysis

5 Toluene Diisocyanate Market, By Application (Page No. - 28)

5.1 Introduction

5.2 Toluene Diisocyanate In Polyurethane Foam, By Geography

5.3 Toluene Diisocyanate In Polyurethane Case, By Geography

6 Toluene Diisocyanate Market, By Geography (Page No. - 35)

6.1 Introduction

6.2 Asia-Pacific Toluene Diisocyanate Market

6.3 Europe Toluene Diisocyanate Market

6.4 North America Toluene Diisocyanate Market

6.5 Rest Of The World Toluene Diisocyanate Market

7 Toluene Diisocyanate Market: Competitive Landscape (Page No. - 47)

7.1 Toluene Diisocyanate Market: Company Share Analysis

7.2 Joint Ventures

7.3 Expansions

7.4 Acquisitions

8 Toluene Diisocyanate Market, By Company (Page No. - 50)

8.1 Bayer Ag

8.2 Basf Se

8.3 Mitsubishi Chemical Holding Corporation

8.4 Kpx Fine Chemicals Company Ltd.

8.5 Borsodchem Zrt

9 Appendix (Page No. - 61)

9.1 Customization Options

9.1.1 Technical Analysis

9.1.2 Low-Cost Sourcing Locations

9.1.3 Regulatory Framework

9.1.4 Impact Analysis

9.1.5 Trade Analysis

9.1.6 Historical Data And Trends

9.2 Related Reports

9.3 Introducing Rt: Real Time Market Intelligence

9.3.1 Rt Snapshots

List Of Tables

Table 1 Global Toluene Diisocyanate Peer Market Size, 2014 (Usd Mn)

Table 2 Global Toluene Diisocyanate Application Market, 2014 (Usd Trn)

Table 3 Global Toluene Diisocyanate Market: Comparison With Parent Market, 2013–2019 (Usd Mn)

Table 4 Global Toluene Diisocyanate Market: Drivers And Inhibitors

Table 5 Global Toluene Diisocyanate Market, By Application, 2014 - 2019 (Usd Mn)

Table 6 Global Toluene Diisocyanate Market, By Application, 2013 - 2019 (Kt)

Table 7 Global Toluene Diisocyanate Market, By Geography, 2013 - 2019 (Usd Mn)

Table 8 Global Toluene Diisocyanate Market, By Geography, 2013 - 2019 (Kt)

Table 9 Global Toluene Diisocyanate Market: Comparison With Application Market, 2012 - 2019 (Usd Bn)

Table 10 Global Toluene Diisocyanate Market, By Application, 2013 - 2019 (Usd Mn)

Table 11 Global TDI: Market, By Application, 2013 - 2019 (Kt)

Table 12 Global TDI In Polyurethane Foam, By Geography,2013 - 2019 (Usd Mn) 32

Table 13 Global TDI In Polyurethane Foam, By Geography,2013 - 2019 (Kt) 32

Table 14 Global TDI In Polyurethane Case, By Geography,2013 - 2019 (Usd Mn) 34

Table 15 Global TDI In Polyurethane Case, By Geography,2013 - 2019 (Kt) 34

Table 16 Global TDI Market, By Geography, 2013 - 2019 (Usd Mn)

Table 17 Global TDI Market, By Geography, 2013 - 2019 (Kt)

Table 18 Asia-Pacific TDI Market, By Application,2013-2019 (Usd Mn) 39

Table 19 Asia-Pacific TDI Market, By Application, 2013-2019 (Kt)

Table 20 Europe TDI Market, By Application, 2013 - 2019 (Usd Mn)

Table 21 Europe TDI Market, By Application, 2013 - 2019 (Kt)

Table 22 North America TDI Market, By Application,2013 - 2019 (Usd Mn) 43

Table 23 North America TDI Market, By Application,2013-2019 (Kt) 43

Table 24 Rest Of The World TDI Market, By Application,2013 - 2019 (Usd Mn) 45

Table 25 Rest Of The World TDI Market, By Application,2013-2019 (Kt) 45

Table 26 TDI Market: Company Share Analysis, 2013 (%)

Table 27 Global TDI Market: Joint Ventures

Table 28 Global TDI Market: Expansions

Table 29 Global TDI Market: Acquisitions

Table 30 Bayer Ag: Key Financials, 2010-2014 (Usd Mn)

Table 31 Basf Se: Key Financials, 2009-2013 (Usd Mn)

Table 32 Mitsubishi Chemical Holding Corporation.: Key Financials,2010 - 2013 (Usd Mn) 57

List Of Figures

Figure 1 Global Toluene Diisocyanate Market: Segmentation & Coverage

Figure 2 Toluene Diisocyanate Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Global TDI Market Snapshot

Figure 8 TDI Market: Growth Aspects

Figure 9 TDI Market: Comparison With Parent Market

Figure 10 Global TDI Market, By Application, 2014 Vs 2019

Figure 11 TDI Market: Demand Side Analysis

Figure 12 TDI Market: Demand Side Analysis

Figure 13 TDI: Application Market Scenario

Figure 14 Global TDI Market, By Application, 2014 - 2019 (Usd Mn)

Figure 15 Global TDI Market, By Application, 2014 - 2019 (Kt)

Figure 16 Global TDI Market In Polyurethane Foam,By Geography, 2013 - 2019 (Usd Mn) 32

Figure 17 Global TDI Market In Polyurethane Case, By Geography, 2013 - 2019 (Usd Mn)

Figure 18 Global TDI Market: Growth Analysis, By Geography, 2014-2019 (Usd Mn)

Figure 19 Global TDI Market: Growth Analysis, By Geography, 2014-2019 (Kt)

Figure 20 Asia-Pacific TDI Market, By Application,2013-2019 (Usd Mn) 38

Figure 21 Asia-Pacific TDI Market: Application Snapshot

Figure 22 Europe TDI Market, By Application, 2013-2019 (Usd Mn)

Figure 23 Europe TDI Market: Application Snapshot

Figure 24 North America TDI Market, By Application,2013 - 2019 (Usd Mn) 43

Figure 25 North America TDI Market: Application Snapshot

Figure 26 Rest Of The World TDI Market, By Application,2013 - 2019 (Usd Mn) 45

Figure 27 Rest Of The World TDI Market: Application Snapshot

Figure 28 TDI Market: Company Share Analysis, 2013 (%)

Figure 29 Bayer Ag: Revenue Mix, 2013 (%)

Figure 30 Contribution Of Material Science Segment Towards Compmay Revenues: Revenues, 2010-2014 (Usd Mn)

Figure 31 Basf Se: Revenue Mix, 2013 (%)

Figure 32 Contribution Of Chemicals Segment Towards Company Revenues,2009-2013 (Usd Mn) 54

Figure 33 Mitsubishi Chemical Holding Corporation Revenue Mix, 2013 (%)

Toluene diisocyanate (TDI) is a member of the diisocyanate family associated with polyurethane chemistry. TDI is extensively used in manufacturing of flexible polyurethane foams. These foams have numerous applications in different industries including furniture, automotive, footwear, and others. These foams are used as high resiliency foams for bedding and upholstery in the furniture industry, in paints, coatings & adhesives for the construction industry, insulators in the appliance industry, and in other applications.

The Global Toluene Diisocyanate Market is witnessing a steady growth on account of increasing applications, technological advancements, and the growing demand in the end-user industries. The global market for toluene diisocyanate was estimated at 2,011.6 KT in 2014 and is further forecasted to grow at a CAGR of 4.7% from 2014 to 2019. The Asia-Pacific dominated the global toluene diisocyanate market and consumed nearly 38.1% of the global consumption volume in 2014.

This market was valued at $ 6,195.6 million in 2014 and is projected to grow at a CAGR of 5.4% during the forecast period from 2014 to 2019. The market, by application, was led by the polyurethane foam segment in 2014, with an 88.0% share. The Asia-Pacific region is a key market for toluene diisocyanate in the global market.

The key players in the Asia-Pacific Toluene Diisocyanate Market include BASF Corporation (U.S.), Bayer AG (Germany), Birsodchem (U.S.), KPX Fine Chemical Company Ltd. (South Korea), Yantai Juli Isocyanic Ester Co. (China), Vencorex (U.S.), and others.

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Asia-Pacific Toluene Diisocyanate (TDI) The Asia-Pacific toluene diisocyanate market is witnessing a strong growth due to the boom in the automobile and construction sectors. This market is estimated to reach $3,935 million by 2019, growing at a CAGR of 6.47% from 2014 to 2019. Rapid growth in the automobile and construction sectors in China and India are driving the growth of this market. |

Upcoming |

|

North America Toluene diisocyanate (TDI) The North American toluene diisocyanate market is witnessing high growth because of emerging markets for various end-user applications. This market is estimated to reach $1,667 million by 2019, growing at a CAGR of 6.14% from 2014 to 2019. The key driver of the market is the growth in the end-use segment of the polyurethane industry, the excellent physical properties provided by the TDI-made flexible PU foams, and emerging markets. |

Upcoming |

|

Europe Toluene Diisocyanate (TDI) The European toluene diisocyanate market is witnessing rapid growth due to growing applications in end-user industries. This market is estimated to reach $1,881 million by 2019, growing at a CAGR of 5.37% from 2014 to 2019. The key driver of the market is the increased usage of TDI in the construction and electronic sector. |

Upcoming |