Asia-Pacific Drilling and Completion Fluids Market by Type (Water-Based, Synthetic-Based, Oil-Based, Others), by Application (Onshore, Offshore), by Country - Analysis and Forecast to 2019

The Asia-Pacific drilling & completion fluid market is estimated to grow at a CAGR of 4.7% from 2014 to 2019. Although China holds the largest share in the Asia-Pacific drilling & completion fluid market, the segment in Indonesia is expected to grow at the fastest CAGR of 5.7% during the forecast period of 2014 to 2019. The growth of the Asia-Pacific drilling & completion fluid market is driven by factors such as discoveries of shale gas reserves in Asia-Pacific region and overall growth in the drilling activities across the region. However, factors such as highly volatile crude oil market, strict government regulations to start new exploration activities, and environmental concerns related to exploration activities may restrain the growth of the Asia-Pacific market in the coming years.

In this report, the Asia-Pacific drilling & completion fluid market has been broadly classified on the basis of base fluid, application, and geography. The main countries considered for the market analysis are China, Australia, Thailand, India, and Indonesia, among others. Water-based, oil-based, and synthetic-based systems are the main categories of drilling and completion fluids in Asia-Pacific, in terms of base fluids. The applications of the market are onshore and offshore.

The Asia-Pacific market was estimated to have acquired a share of 15% of the global drilling & completion fluid market in 2014. The bulk of the drilling activities in Asia-Pacific are onshore activities. China and Thailand hold a substantial share of the offshore drilling activities, with the maximum offshore wells drilled in these regions. The drilling and completion fluid market for onshore applications is dominated by China, India, and Indonesia. The drilling & completion fluid market in China is primarily driven by factors including shale gas exploration and growth in drilling activities.

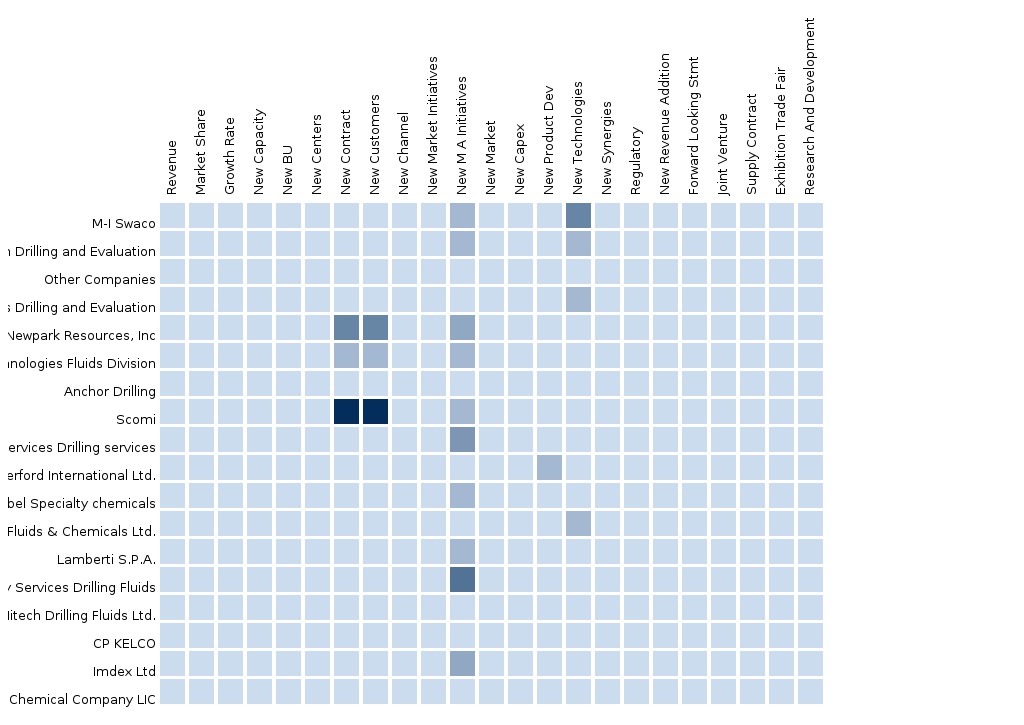

The Asia-Pacific drilling & completion fluid market is a competitive market with a number of market players. Currently, the market is estimated to be dominated by top players such as Baker Hughes Inc., Halliburton, and M-I SWACO, among others. Acquisitions, partnerships, agreements, collaborations, and joint ventures are the key strategies adopted by most market players to achieve growth in the Asia-Pacific drilling & completion fluid market.

Reasons to Buy the Report:

From an insight perspective, this research report has focused on various levels of analysis—industry analysis (industry trends and PEST analysis), market share analysis of top players, supply chain analysis, and company profiles, which together provide the basic views on the competitive landscape; emerging and high-growth segments of the market; high-growth countries and their respective regulatory policies; government initiatives; and market drivers, restraints, and opportunities.

The report will enrich both established firms as well as new entrants/smaller firms to gauge the pulse of the market, which in turn will help the firms in garnering a greater share of the Asia-Pacific market. Firms purchasing the report could use any one or combination of the below mentioned five strategies (market penetration, product development/innovation, market development, market diversification, and competitive assessment) for strengthening their market share.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on drilling and completion fluids offered by the top 10 players of the Asia-Pacific drilling & completion fluid market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the Asia-Pacific drilling & completion fluid market

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for drilling & completion fluids, across geographies

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Asia-Pacific drilling & completion fluid market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of the leading players in the Asia-Pacific drilling & completion fluid market

Table of Contents

1 Introduction (Page No. - 9)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of Drilling & Completion Fluid Market

2.2 Arriving At the Asia-Pacific Drilling & Completion Fluid Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 19)

4 Market Overview (Page No. - 21)

4.1 Introduction

4.2 Market Drivers and Inhibitors

4.3 Key Market Dynamics

4.3.1 Impact Analysis

5 Asia-Pacific Drilling & Completion Fluid Market, By Application (Page No. - 26)

5.1 Introduction

5.2 Asia-Pacific Drilling and Completion Fluid Market, Onshore Area, By Country

5.3 Asia-Pacific Drilling and Completion Fluid Market, Offshore Area, By Country

5.4 Sneak View: Asia-Pacific Drilling and Completion Fluid Market, By Application

6 Asia-Pacific Drilling & Completion Fluid Market, By Base Fluid (Page No. - 32)

6.1 Introduction

6.2 Asia-Pacific Water-Based Drilling and Completion Fluid Market, By Geography

6.3 Asia-Pacific Oil-Based Drilling and Completion Fluid Market, By Geography

6.4 Asia-Pacific Synthetic-Based Drilling and Completion Fluid Market, By Geography

7 Asia-Pacific Drilling and Completion Fluid Market, By Geography (Page No. - 38)

7.1 Introduction

7.2 China Drilling and Completion Fluid Market

7.2.1 China Drilling and Completion Fluid Market, By Application

7.2.2 China Drilling and Completion Fluid Market, By Type

7.3 Australia Drilling and Completion Fluid Market

7.3.1 Australia Drilling and Completion Fluid Market, By Application

7.3.2 Australia Drilling and Completion Fluid Market, By Type

7.4 Thailand Drilling and Completion Fluid Market

7.4.1 Thailand Drilling and Completion Fluid Market, By Application

7.4.2 Thailand Drilling and Completion Fluid Market, By Type

7.5 India Drilling and Completion Fluid Market

7.5.1 India Drilling and Completion Fluid Market, By Application

7.5.2 India Drilling and Completion Fluid Market, By Type

7.6 Indonesia Drilling and Completion Fluid Market

7.6.1 Indonesia Drilling and Completion Fluid Market, By Application

7.6.2 Indonesia Drilling and Completion Fluid Market, By Type

8 Asia-Pacific Drilling and Completion Market: Competitive Landscape (Page No. - 66)

8.1 Drilling Completion Market: Company Share Analysis

8.2 Mergers & Acquisitions

8.3 Contracts

8.4 New Product & Technology Launches

8.5 Joint Ventures

9 Asia-Pacific Drilling and Completion Fluid Market, By Company (Page No. - 71)

9.1 M-I Swaco

9.1.1 Overview

9.1.2 Key Financials

9.1.3 Product and Service Offerings

9.1.4 Related Developments

9.2 Baker Hughes Inc.

9.2.1 Overview

9.2.2 Key Financials

9.2.3 Product and Service Offering

9.2.4 Related Developments

9.3 Halliburton

9.3.1 Overview

9.3.2 Key Financials

9.3.3 Product and Service Offerings

9.3.4 Related Developments

9.4 Newpark Resources Inc.

9.4.1 Overview

9.4.2 Key Financials

9.4.3 Product and Service Offerings

9.4.4 Related Developments

9.5 Tetra Technologies Inc.

9.5.1 Overview

9.5.2 Key Financials

9.5.3 Product and Service Offerings

9.5.4 Related Developments

9.6 National Oilwell Varco

9.6.1 Overview

9.6.2 Key Financials

9.6.3 Product and Service Offerings

9.6.4 Related Developments

9.7 Scomi Group Bhd

9.7.1 Overview

9.7.2 Key Financials

9.7.3 Product Portfolio

9.7.4 Related Developments

9.8 Weatherford International Ltd

9.8.1 Overview

9.8.2 Key Financials

9.8.3 Product Portfolio

9.8.4 Recent Developments

9.9 Global Drilling Fluids & Chemicals Ltd.

9.9.1 Overview

9.9.2 Key Financials

9.9.3 Product and Services

9.9.4 Recent Developments

List of Tables (52 Tables)

Table 1 Asia-Pacific Drilling and Completion Fluid Peer Market Size, 2013 (USD MN)

Table 2 Asia-Pacific Drilling & Completion Fluid Market, By Application, 2013 (USD MN)

Table 3 Number of New Wells, By Geography, 2013

Table 4 Asia-Pacific Drilling & Completion Fluid Market: Drivers and Inhibitors

Table 5 Asia-Pacific Drilling & Completion Fluid Market, By Application, 2013 - 2019 (USD MN)

Table 6 Asia-Pacific Drilling & Completion Fluid Market Types, 2013-2019 (USD MN)

Table 7 Asia-Pacific Drilling and Completion Fluids Market, By Application, 2013 - 2019 (USD MN)

Table 8 Asia-Pacific Drilling and Completion Fluids Application Market, Onshore Area, By Country, 2013 - 2019 (Usd Million)

Table 9 Asia-Pacific Drilling and Completion Fluid Market, Offshore Area, By Country, 2013 - 2019 (Usd Million)

Table 10 Asia-Pacific Drilling and Completion Fluid Market, By Type, 2013-2019 (Usd Million)

Table 11 Asia-Pacific Water –Based System Fluid Market, By Country, 2013–2019 (Usd Million)

Table 12 Asia-Pacific Oil-Based System Fluid Market, By Country, 2013 - 2019 (Usd Million)

Table 13 Asia-Pacific Synthetic-Based System Fluid Market, By Country, 2013 - 2019 (Usd Million)

Table 14 Asia-Pacific Drilling and Completion Fluid Market, By Country, 2013 - 2019 (Usd Million)

Table 15 China Drilling and Completion Fluid Market, By Application, 2013-2019 (Usd Million)

Table 16 China Drilling and Completion Fluid Market, By Type, 2013 - 2019 (Usd Million)

Table 17 Australia Drilling and Completion Fluid Market, By Application, 2013 - 2019 (Usd Million)

Table 18 Australia Drilling and Completion Fluid Market, By Type, 2013 - 2019 (Usd Million)

Table 19 Thailand Drilling and Completion Fluid Market, By Application, 2013 - 2019 (Usd Million)

Table 20 Thailand Drilling and Completion Fluid Market, By Type, 2013 - 2019 (Usd Million)

Table 21 India Drilling and Completion Fluid Market, By Application, 2013 - 2019 (Usd Million)

Table 22 India Drilling and Completion Fluid Market, By Type, 2013 - 2019 (Usd Million)

Table 23 Indonesia Drilling and Completion Fluid Market, By Application, 2013 - 2019 (Usd Million)

Table 24 Indonesia Drilling and Completion Fluid Market, By Type, 2013 – 2019 (Usd Million)

Table 25 Drilling & Completion Fluid Market: Company Share Analysis, 2013 (%)

Table 26 Asia-Pacific Drilling and Completion Fluid Market: Mergers , & Acquisitions

Table 27 Asia-Pacific Drilling and Completion Fluid Market: Contract

Table 28 Drilling and Completion Fluid Market:New Product & Technology Launches

Table 29 Asia-Pacific Drilling & Completion Fluid Market: Joint Ventures

Table 30 Schlumberger Key Operational Data, 2009-2013 (USD MN)

Table 31 Schlumberger Key Financials By Business Segment, 2009-2013 (USD MN)

Table 32 Schlumberger By Geographical Regions (Usd Million)

Table 33 Baker Hughes Incorporated: Key Operating Data, 2008 - 2013 (Usd Millon)

Table 34 Baker Hughes Incorporated.: Revenue By Business Segment, 2009 - 2013 (Usd Millon)

Table 35 Baker Hughes Incorporated.: Revenue By Geographical Segment, 2009 - 2013 (Usd Millon)

Table 36 Halliburton.: Key Operations Data, 2009 - 2013 (USD MN)

Table 37 Halliburton Key Financials, By Business Segment, 2009 - 2013 (USD MN)

Table 38 Halliburton Key Financials, By Geographical Regions, 2009-2013 (Usd Million)

Table 39 Newpark Resources Inc Key Operations Data, 2009 - 2013 (USD MN)

Table 40 Newpark Resources Inc: Key Financials, By Business Segment,2009 - 2013 (USD MN)

Table 41 Newpark Resources Inc Key Financials, By Geographic Segment, 2009 - 2013 (USD MN)

Table 42 Tetra Technologies Inc, Key Operations Data, 2009 - 2013 (USD MN)

Table 43 Tetra Technologies Inc, Key Financials, By Business Segment, 2009 - 2013 (USD MN)

Table 44 Tetra Technologies Inc, Key Financials, By Geographic Segment, 2009 - 2013 (USD MN)

Table 45 : National Oilwell Varco Inc.Key Operational Data, 2009 - 2013 (USD MN)

Table 46 National Oilwell Varco : Key Financials, By Business Segment, 2009 - 2013 (USD MN)

Table 47 National Oilwell Varco :Key Financials, By Geographic Segment, 2009 - 2013 (USD MN)

Table 48 Scomi Group, Key Operational Data, 2010-2014 (USD MN)

Table 49 Scomi Group, Key Financials, By Business Segment,2010-2014 (USD MN)

Table 50 Weatherford International, Key Operational Data, 2009-2013 (USD MN)

Table 51 Weatherford Market Revenue, By Business Segments 2009 - 2013 (USD MN)

Table 52 Weatherford Key Data Geographic Segments 2009 - 2013 (USD MN)

List of Figures (53 Figures)

Figure 1 Drilling and Completion Fluids Market: Segmentation & Coverage

Figure 2 Drilling & Completion Fluid Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macroindicator-Based Approach

Figure 8 Asia-Pacific Drilling & Completion Fluid Market: Snapshot, 2013

Figure 9 Asia-Pacific Drilling & Completion Fluid Market, By Application, 2014 Vs 2019

Figure 10 Asia-Pacific Drilling & Completion Fluid Market Application, By Country, 2013 (USD MN)

Figure 11 Asia-Pacific Drilling and Completion Fluid Market, By Application, 2013-2019 (USD MN)

Figure 12 Asia-Pacific Drilling and Completion Fluids Application Market, Onshore Area, By Country, 2013 - 2019 (USD MN)

Figure 13 Asia-Pacific Drilling and Completion Fluid Market, Offshore Area, By Country, 2013 - 2019 (USD Million)

Figure 14 Sneak View: Asia-Pacific Drilling and Completion Fluid Market

Figure 15 Asia-Pacific Drilling and Completion Fluid Market, By Type, 2014-2019 (USD Million)

Figure 16 Asia-Pacific Water Based System Fluid Market, By Country, 2013–2019 (USD Million)

Figure 17 Asia-Pacific Oil-Based System Fluid Market, By Country, 2013 - 2019 (USD Million)

Figure 18 Asia-Pacific Synthetic-Based System Fluid Market, By Country, 2013 - 2019 (USD Million)

Figure 19 Asia-Pacific Drilling and Completion Fluid Market: Growth Analysis, By Country, 2014 & 2019 (USD Million)

Figure 20 China Drilling and Completion Fluid Market Overview, 2014 & 2019 (%)

Figure 21 China Drilling and Completion Fluid Market, By Application, 2013-2019 (USD Million)

Figure 22 China Drilling and Completion Fluid Market: Application Snapshot

Figure 23 China Drilling and Completion Fluid Market, By Type, 2013 - 2019 (USD Million)

Figure 24 China Drilling and Completion Fluid Market Share, By Type, 2014&2019 (%)

Figure 25 Australia Drilling and Completion Fluid Market Overview, 2014 & 2019 (%)

Figure 26 Australia Drilling and Completion Fluid Market, By Application, 2013-2019 (USD Million)

Figure 27 Australia Drilling and Completion Fluid Market: Application Snapshot

Figure 28 Australia Drilling and Completion Fluid Market, By Type, 2013 - 2019 (USD Million)

Figure 29 Australia Drilling and Completion Fluid Market Share, By Type, 2014-2019 (%)

Figure 30 Thailand Drilling and Completion Fluid Market Overview, 2014 & 2019 (%)

Figure 31 Thailand Drilling and Completion Fluid Market, By Application, 2013 - 2019 (USD Million)

Figure 32 Thailand Drilling and Completion Fluid Market: Application Snapshot, 2014 & 2019

Figure 33 Thailand Drilling and Completion Fluid Market, By Type, 2014 - 2019 (USD Million)

Figure 34 Thailand Drilling and Completion Fluid Market: By Type, 2014-2019 (%)

Figure 35 India Drilling and Completion Fluid Market Overview, 2014 & 2019 (%)

Figure 36 India Drilling and Completion Fluid Market, By Application, 2013 - 2019 (USD Million)

Figure 37 India Drilling and Completion Fluid Market: Application Snapshot,2014&2019

Figure 38 India Drilling and Completion Fluid Market, By Type, 2013 - 2019 (USD Million)

Figure 39 India Drilling and Completion Fluid Market: By Type, 2014-2019 (%)

Figure 40 Indonesia Drilling and Completion Fluid Market Overview, 2014 & 2019 (%)

Figure 41 Indonesia Drilling and Completion Fluid Market, By Application, 2013 - 2019 (USD Million)

Figure 42 Indonesia Drilling and Completion Fluid Market: Application Snapshot

Figure 43 Indonesia Drilling and Completion Fluid Market, By Type, 2013 - 2019 (USD Million)

Figure 44 Indonesia Drilling and Completion Fluid Market: By Type, 2014 & 2019 (%)

Figure 45 Drilling & Completion Fluid Market: Company Share Analysis, 2013 (%)

Figure 46 Schlumberger Revenue Mix, 2013 (%)

Figure 47 Baker Hughes Inc.: Reveue Mix, 2013 (%)

Figure 48 Halliburton: Revenue Mix, 2013 (%)

Figure 49 New Park Resources Inc : Revenue Mix, 2013 (%)

Figure 50 Tetra Technologies Inc., Revenue Mix, 2013 (%)

Figure 51 National Oilwell Varco: Revenue Mix, 2013 (%)

Figure 52 Scomi Group: Revenue Mix, 2014 (%)

Figure 53 Weatherford International : Revenue Mix, 2013 (%)

The key objective of drilling & completion fluids is to provide lubrication and decrease the friction in a drilling activity; cooling of a wellbore; and the removal of rock cuttings by transporting them to the drilling surface, as the rock cuttings are mixed with the fluids. The Asia-Pacific region is one of the fastest-growing markets for drilling and completion fluids, mainly owing to the rise in drilling and exploration activities in China, India, Australia, and Indonesia, among others. Australia and China have huge shale reserves where drilling activities are in the initial stage; thus, they are expected to become huge markets for drilling and completion fluids in the coming years. The growing population, improvements in economic conditions, and high rate of migration towards big cities, accelerated by industrial development, has raised the energy demand in Asia-Pacific.

The report analyzes the drilling and completion fluids market in Asia-Pacific on the basis of base fluid, application, and geography. In terms of geography, the report has been segmented into China, Australia, Thailand, India, and Indonesia. The drilling and completion fluid segments, in terms of base fluid, are water-based systems, oil-based systems, and synthetic-based systems, among others (including aerated foam, gaseous agents, and air as a base fluid mixed with various additives). The application areas covered in the report are onshore and offshore areas.

The growing demand for energy can be catered to only by increasing the production of hydrocarbons, which is carried out by enhanced oil recovery to boost the production or by drilling new wells. These factors have led to an upsurge in the demand for drilling and completion fluids. The drilling and completion fluids market is highly competitive, owing to the presence of a large number of global and local players. The increase in the demand for drilling fluids as well as its growth in an emerging market has encouraged companies to adopt mergers and acquisitions as a strategy to grow in the market. Canadian Energy Services (Canada) and M-I SWACO (U.S.) are the key industry players of drilling and completion fluids. Both the companies have acquired the local drilling fluid manufacturers to increase their market share and strengthen their position in the Asia-Pacific market. Furthermore, Halliburton (U.S.) and Baker Hughes (U.S.) account for a significant market share due to their strong geographic presence and brand names.

The report provides an extensive competitive landscaping of drilling and completion fluid manufacturers operational in the Asia-Pacific market. The key players are Schlumberger Ltd., Halliburton Co., Baker Hughes Inc., and Weatherford International Ltd., among others. The market shares, new product/service launches, M&A, and product portfolios of the key market players have been detailed in the report.

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement