The Asia-Pacific Mobile and Wireless Backhaul market is expected to grow from $2,534.7 million in 2013 to $5,155.8 million in 2018 at a CAGR of 15.3% during the period 2014-2018. The market is primarily driven by the growing huge number of internet and telecom network subscribers with requirements of backhaul as solution to all type of small cell deployments.

Mobile and wireless backhaul is a method by which one can convey the information among the end-users nodes and central base station or network access point. The increase in smart phone and other mobile instruments has been provided with alternative networks like 4G and 3G for quick telecom connectivity. Small cell is new technology advancement in the mobile wireless technology market which shall satisfy high bandwidth needs.

Countries in Asia-Pacific region have very huge number of subscribers for internet and mobile technology mainly due to its huge population. Moreover, they have not achieved their saturation i.e. penetration level is still very less which implies further substantial increase in this number in the coming years. So the adoption rate of mobile and wireless backhaul will be high in Asia-Pacific region.

MicroMarketMonitor endeavor’s the customer to have a deep analysis of Asia-Pacific Mobile and Wireless Backhaul market. The report provides a competitive benchmarking of leading players in this market such as Ericsson, Huawei, NEC, NSN, ZTE, and Alcatel-Lucent. The report gives the financial analysis which includes CAGR and market share of the different region, vendors, and also overall adoption scenario, competitive landscape, key drivers, restraints, and opportunities.

Asia-Pacific Mobile and Wireless Backhaul Market Report Options:

- Asia-Pacific Mobile and Wireless Backhaul Market segmentation covered in this report are:

- By Equipments: Microwave, Millimeter Wave, Sub-6 GHz, and Test and Measurement

- By Services: Network Services, Systems Integration, and Professional Services

Customization Options:

With MMM assessment, we will best meet your company’s specific customization needs. Following customization options provide comprehensive industry standard and deep dive analysis:

- Asia-Pacific Mobile and Wireless Backhaul Market Solutions Matrix

- Comprehensive analysis and benchmarking by equipments, and by services in the Asia-Pacific Mobile and Wireless Backhaul market

- Asia-Pacific Mobile and Wireless Backhaul Market Competitive Benchmarking

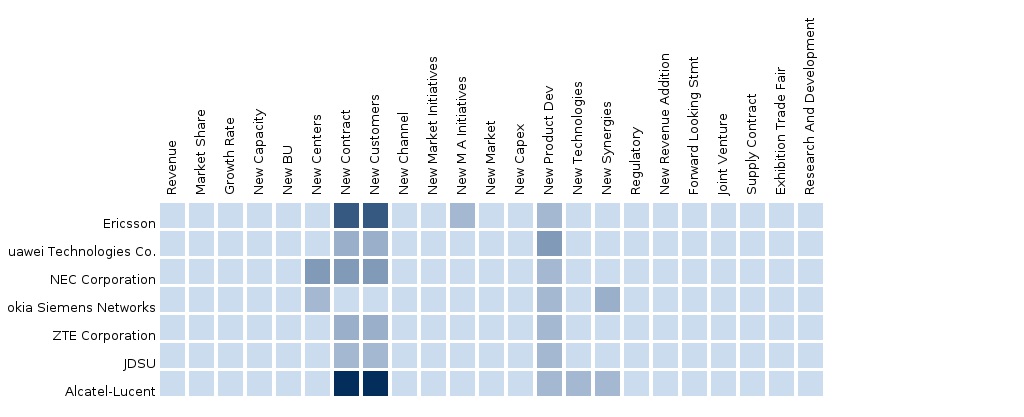

- Value-chain evaluation using events, developments, market data for vendors in the market ecosystem, across various market segmentation and categorization

- Unearth hidden opportunities by connecting related markets using cascaded value chain analysis. For instance, we can qualify the growth in Asia-Pacific Mobile and Wireless Backhaul market due to corresponding growth in equipments market like Microwave, Millimeter Wave, Sub-6 GHz, and Test and Measurement

- Asia-Pacific Mobile and Wireless Backhaul Market Vendor Landscaping

- Vendor market watch and predictions, vendor market shares and offerings, categorization of adoption trends and market dominance (Leaders, Challengers, Followers, and Nicher)

- Entry of mobile vendors in Asia-Pacific region and there Innovative steps in mobile technology

- Asia-Pacific Mobile and Wireless Backhaul Market Data Tracker

- Country specific market forecast and analysis

- Identification of key end-user segments by country

- Asia-Pacific Mobile and Wireless Backhaul Market Emerging Vendor Landscape

- Evaluate Tier-2/3 vendors’ market offerings using a 2X2 framework (realizing Leaders, Challengers, Followers, Nichers)

- Asia-Pacific Mobile and Wireless Backhaul Market Channel Analysis

- Channel/distribution partners/alliances for tier-1 vendors. Application specific products being build towards the customer end of value chain

- Asia-Pacific Mobile and Wireless Backhaul Market Client Tracker

- Listing and analysis of deals, case studies, R&D investments, events, discussion forums, campaigns, alliances and partners of tier-1 and tier-2/3 vendors for the last 3 years

- Asia-Pacific Mobile and Wireless Backhaul Technology Watch

- Update on the current technology trends across different industry verticals in Asia-Pacific Mobile and Wireless Backhaul market.

1 Introduction

1.1 Key Take-aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Key Data Points

1.5.2 Data Triangulation And Market Forecasting

1.6 Forecast Assumptions

2 Executive Summary

2.1 Abstract

2.2 Overall Market Size

3 Market Overview

3.1 Market Definition

3.2 Market Evolution

3.3 Market Segmentation

3.4 Market Dynamics

3.4.1 Drivers

3.4.2 Restraints And Challenges

3.4.3 Opportunities

3.4.4 Impact Analysis Of DRO

3.5 Value Chain

3.6 Mobile And Wireless Backhaul Technologies

3.6.1 Introduction

3.6.2 Technology Requirements

3.6.2.1 Seamless Migration

3.6.2.2 Scalability

3.6.3 LTE

3.6.4 Hspa/Hspa+

3.6.5 Wimax

3.6.6 Satellite

3.6.7 Optical Wireless Broadband

4 APAC Mobile Wireless and Backhaul Market Size And Forecast By Equipment

4.1 Introduction

4.2 Microwave Equipment

4.2.1 Overview

4.2.2 Market Size And Forecast By Countries

4.3 Millimeter Wave Equipment

4.3.1 Overview

4.3.2 Market Size And Forecast By Countries

4.4 Sub-6 Ghz Equipment

4.4.1 Overview

4.4.2 Market Size And Forecast By Countries

4.5 Test And Measurement Equipment

4.5.1 Overview

4.5.2 Market Size And Forecast By Countries

5 APAC Mobile Wireless and Backhaul Market Size And Forecast By Services

5.1 Introduction

5.2 Network Services

5.2.1 Overview

5.2.2 Market Size And Forecast By Countries

5.3 System Integration

5.3.1 Overview

5.3.2 Market Size And Forecast By Countries

5.4 Professional Services

5.4.1 Overview

5.4.2 Market Size And Forecast By Countries

6 APAC Mobile Wireless and Backhaul Market Size And Forecast By Countries

6.1 Introduction

6.2 Parfait Charts

6.3 India

6.3.1 Overview

6.3.2 Market Size And Forecast

6.3.2.1 Market Size And Forecast By Equipment

6.3.2.2 Market Size And Forecast By Services

6.4 China

6.4.1 Overview

6.4.2 Market Size And Forecast

6.4.2.1 Market Size And Forecast By Equipment

6.4.2.2 Market Size And Forecast By Services

6.5 Japan

6.5.1 Overview

6.5.2 Market Size And Forecast

6.5.2.1 Market Size And Forecast By Equipment

6.5.2.2 Market Size And Forecast By Services

6.6 Rest of APAC

6.6.1 Overview

6.6.2 Market Size And Forecast

6.6.2.1 Market Size And Forecast By Equipment

6.6.2.2 Market Size And Forecast By Services

7 APAC Mobile Wireless and Backhaul Market Landscape

7.1 Competitive Landscape

7.1.1 Ecosystems And Roles

7.1.2 Portfolio Comparison

7.1.2.1 Overview

7.1.2.2 Product Category Mapping

7.2 End User Landscape

7.2.1 End User Analysis

8 Company Profiles (MMM View, Overview, Products & Services, Financials, Swot Analysis, Strategy & Analyst Insights)

8.1 Alcatel-Lucent

8.2 Broadcom Corporation

8.3 Brocade

8.4 Cisco

8.5 Ericsson

8.6 Fujitsu

8.7 Huawei

8.8 Jdsu

8.9 NEC

8.10 Nokia Siemens Networks

8.11 Orange Telecom

8.12 Telco Systems

8.13 Tellabs

8.14 Vitesse Semiconductor

8.15 ZTE

Appendix

List Of Tables

Table 1 APAC Market Size, 2013 – 2019 ($Billion, Y-O-Y %)

Table 2 APAC Mobile And Wireless Backhaul Market Size, By Equipment And Services, 2013 – 2019 ($Million)

Table 3 APAC Mobile And Wireless Backhaul Market, By Equipment And Services, 2013 – 2019, Y-O-Y (%)

Table 4 APAC Equipment Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 5 APAC Equipment Market Size, By Types, 2013 – 2019 ($Million)

Table 6 APAC Equipment Market, By Types, 2013 – 2019, Y-O-Y (%)

Table 7 APAC Equipment Market Size, By Countries, 2013 – 2019 ($Million)

Table 8 APAC Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 9 APAC Microwave Equipment Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 10 APAC Microwave Equipment Market , By Countries, 2013 – 2019 ($Million)

Table 11 APAC Microwave Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 12 APAC Millimeter Wave Equipment Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 13 APAC Millimeter Wave Equipment Market , By Countries, 2013 – 2019 ($Million)

Table 14 APAC Millimeter Wave Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 15 APAC Sub-6 Ghz Equipment Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 16 APAC Sub-6 Ghz Equipment Market, By Countries, 2013 – 2019 ($Million)

Table 17 APAC Sub-6 Ghz Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 18 APAC Test And Measurement Equipment Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 19 APAC Test And Measurement Equipment Market, By Countries, 2013 – 2019 ($Million)

Table 20 APAC Test And Measurement Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 21 APAC Service Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 22 APAC Service Market, By Types, 2013 – 2019 ($Million)

Table 23 APAC Service Market, By Types, 2013 – 2019 Y-O-Y (%)

Table 24 APAC Service Market, By Countries, 2013 – 2019 ($Million)

Table 25 APAC Service Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 26 APAC Network Service Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 27 APAC Network Service Market, By Countries, 2013 – 2019 ($Million)

Table 28 APAC Network Service Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 29 APAC System Integration Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 30 APAC System Integration Market, By Countries, 2013 – 2019 ($Million)

Table 31 APAC System Integration Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 32 APAC Professional Services Market, 2013 – 2019 ($Million, Y-O-Y %)

Table 33 APAC Professional Services Market, By Countries, 2013 – 2019 ($Million)

Table 34 APAC Professional Services Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 35 APAC Market, By Countries, 2013 – 2019 ($Million)

Table 36 APAC Market, By Countries, 2013 – 2019, Y-O-Y (%)

Table 37 APAC Market Size, By Equipment And Services, 2013 – 2019 ($Million)

Table 38 APAC Market, By Equipment And Services, 2013 – 2019, Y-O-Y (%)

Table 39 APAC Market Size, By Equipment Types, 2013 – 2019 ($Million)

Table 40 APAC Market, By Equipment, 2013 – 2019, Y-O-Y (%)

Table 41 APAC Market Size, By Services Types, 2013 – 2019 ($Million)

Table 42 APAC Market, By Services, 2013 – 2019, Y-O-Y (%)

Table 43 APAC Small Cells: Market Size, 2013 – 2019 ($Million, Y-O-Y %)

Table 44 Alcatel-Lucent: Revenue By Business Segments, 2012 – 2013 ($Million)

Table 45 Broadcom Corporation: Revenues By Business Segment, 2012 – 2013 ($Million)

Table 46 Brocade Communications Systems: Revenues, By Business Segment, 2012 – 2013 ($Million)

Table 47 Cisco Systems Inc.: Revenues By Business Segment, 2012 – 2013 ($Million)

Table 48 Cisco Systems Inc.: Revenue By Countries, 2012 – 2013 ($Million)

Table 49 Ericsson: Revenue By Business Segments, 2012 – 2013 ($Million)

Table 50 Ericsson: Revenue By Countries, 2012 – 2013 ($Million)

Table 51 Fujitsu: Revenue By Business Segments, 2013 – 2013 ($Million)

Table 52 Huawei: Revenue By Segments, 2012-2013 ($Million)

Table 53 Jdsu: Revenue By Business Segments, 2013–2013 ($Million)

Table 54 NEC: Revenue By Business Segments, 2012 – 2013 ($Million)

Table 55 NSN: Revenue By Business Segments, 2012 – 2013 ($Million)

Table 56 Orange: Revenues, 2012 – 2013 ($Million)

Table 57 Tellabs: Revenue By Business Segments, 2013–2013 ($Million)

Table 58 Vitesse Semiconductor: Revenue By Business Segments, 2012–2013 ($Million)

Table 59 ZTE: Revenue By Business Segments, 2012-2013 ($Million)

Table 60 APAC Mobile And Wireless Backhaul New Product Development

Table 61 APAC Mobile And Wireless Backhaul Acquisitions

Table 62 APAC Mobile And Wireless Backhaul Ventures And Collaboration

Table 63 APAC Mobile And Wireless Backhaul Venture Funding

List Of Figures

Figure 1 APAC Mobile And Wireless Backhaul: Stakeholders

Figure 2 Research Methodology

Figure 3 APAC Market, 2013 – 2019 ($Billion, Y-O-Y %)

Figure 4 APAC Market, By Equipment And Services, 2013 – 2019 ($ Million, Y-O-Y %)

Figure 5 APAC Market Evolution

Figure 6 APAC Market Segmentation

Figure 7 Impact Analysis Of Dro, 2013 – 2019

Figure 8 APAC Mobile And Wireless Backhaul: Value Chain

Figure 9 APAC Mobile And Wireless Backhaul: Technologies

Figure 10 APAC Equipment Market, 2013 – 2019, Y-O-Y (%)

Figure 11 APAC Equipment Market, By Types, 2013 – 2019, Y-O-Y (%)

Figure 12 APAC Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 13 APAC Microwave Equipment Market, 2013 – 2019, Y-O-Y (%)

Figure 14 APAC Microwave Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 15 APAC Millimeter Wave Equipment Market, 2013 – 2019, Y-O-Y (%)

Figure 16 APAC Millimeter Wave Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 17 APAC Sub-6 Ghz Equipment Market, 2013 – 2019, Y-O-Y (%)

Figure 18 APAC Sub-6 Ghz Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 19 APAC Test And Measurement Equipment Market, 2013 – 2019, Y-O-Y (%)

Figure 20 APAC Test And Measurement Equipment Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 21 APAC Service Market, 2013 - 2019, Y-O-Y (%)

Figure 22 APAC Service Market, By Types, 2013 – 2019, Y-O-Y (%)

Figure 23 APAC Service Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 24 APAC Network Service Market, 2013 – 2019, Y-O-Y (%)

Figure 25 APAC Network Service Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 26 APAC System Integration Market, 2013 – 2019, Y-O-Y (%)

Figure 27 APAC System Integration Market, By Countries, 2013 – 2019, Y-O-Y %)

Figure 28 APAC Professional Services Market, 2013 – 2019, Y-O-Y (%)

Figure 29 APAC Professional Services Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 30 APAC Market, By Countries, 2013 – 2019, Y-O-Y (%)

Figure 31 APAC Mobile And Wireless Backhaul: Parfait Chart

Figure 32 APAC Market, 2013 – 2019 ($Million, Y-O-Y (%)

Figure 33 APAC Market, By Equipment And Services, 2013 – 2019, Y-O-Y (%)

Figure 34 APAC Market, By Equipment, 2013 – 2019, Y-O-Y (%)

Figure 35 APAC Market, By Services, 2013 – 2019, Y-O-Y (%)

Figure 36 APAC Mobile And Wireless Backhaul: Ecosystem

Figure 37 APAC Mobile And Wireless Backhaul: Roles Of Ecosystem Players

Figure 38 APAC Mobile And Wireless Backhaul: Product Category Mapping

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Europe Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-Europe markets are doing well and which are not? |

Upcoming |

|

North America Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-North America markets are doing well and which are not? |

Upcoming |

|

Asia-Pacific Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-Asia-Pacific markets are doing well and which are not? |

Upcoming |

|

Middle East and Africa Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered What are market estimates and forecasts; which of Wireless Infrastructure-Middle East and Africa markets are doing well and which are not? ... |

Upcoming |

|

Latin America Wireless Infrastructure Solutions of this market are Communication Test and Measurement. Key Questions Answered ... What are market estimates and forecasts; which of Wireless Infrastructure-Latin America markets are doing well and which are not? |

Upcoming |