Asia Pacific Phosphatic Fertilizers Market, By Type (DAP, MAP, Super Phosphate, Others), By Application (Grains & Oilseeds, Fruits & Vegetables, Rest (Crops)), By Country - Analysis and Forecast to 2019

The Asia Pacific Phosphatic Fertilizers Market is estimated to grow at CAGR of 2.2 %, in the period of 2014 to 2019. Phosphorus is the 11th most abundant element in the earth’s crust. However, the soil from which plants obtain phosphorus contains only small amounts of it. There is no other substitute for phosphorus in agriculture. If soils are deficient in phosphorus, food production is restricted, unless the nutrient is added in the form of fertilizers. Hence, to increase food production, an adequate amount of phosphorus is required.

Commercial phosphate fertilizers are manufactured using phosphate rock. Approximately two- third of the world phosphate resources are derived from sedimentary and marine phosphate rock deposits. About 90% of the global phosphate rock demand is used to produce food. Phosphorus is scarce and phosphate rock is a non-renewable resource. Market forces and political regulations can have a profound impact on the availability of Phosphatic fertilizers in Asia Pacific.

Asia-Pacific Phosphatic Fertilizer Market is dominated by China, followed by India and other Asia Pacific Countries. The China has largest population on the earth and to feed these increasing numbers it needs to increase its food production by cultivating on barren lands enriched with the use of fertilizers.

The Asia-Pacific Phosphatic Fertilizer market is competitive market, with firms such as Yara International ASA (Norway), EuroChem (Russia), Agrium Inc. (Canada), Israel Chemical Ltd.(Israel) and Coromandal International (India) among others, which are expanding their market share in Asia Pacific region. To gain the market share these companies are adapting numours market strategies including innovative product development, partnerships, mergers and acquisions and exoansion of exiting facilities. Apart from these companies there are large numbers of small firms present in Asia Pacific Market.

Table of Contents

1 Introduction (Page No. - 8)

1.1 Objectives Of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 10)

2.1 Integrated Ecosystem Of Phosphatic Fertilizers Market

2.2 Arriving at the Phosphatic Fertilizers Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 19)

4 Market Overview (Page No. - 21)

4.1 Introduction

4.2 Phosphatic Fertilizers Market : Comparison With Parent Market

4.3 Market Drivers And Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

4.6 Vendor Side Analysis

5 Asia-Pacific Phosphatic Fertilizer Market, By Application (Page No. - 32)

5.1 Introduction

5.2 Vendor Side Analysis

5.3 Phosphatic Fertilizers in Grains & Oilseeds, By Geography

5.4 Phosphatic Fertilizers in Fruits & Vegetables, By Geography

5.5 Sneak View: Asia-Pacific Fertilizers Market, By Application

6 Asia-Pacific Phosphatic Fertilizer Market, By Type (Page No. - 42)

6.1 Introduction

6.2 Asia Phosphatic Fertilizers Market Type Comparison With Fertilizers Market

6.3 Asia Diammonium Phosphate Fertilizers Market, By Geography

6.4 Asia Monoammonium Phosphate Fertilizers Market, By Geography

6.5 Asia Superphosphate Fertilizers Market, By Geography

6.7 Sneak View: Asia-Pacific Fertilizers Market, By Type

7 Asia-Pacific Phosphatic Fertilizer Market, By Geography (Page No. - 54)

7.1 Introduction

7.2 Vendor Side Analysis

7.3 China Phosphatic Fertilizers Market

7.3.1 China Phosphatic Fertilizers Market, By Application

7.3.2 China Phosphatic Fertilizers Market, By Type

7.4 India Phosphatic Fertilizers Market

7.4.1 India Phosphatic Fertilizers Market, By Application

7.4.2 India Phosphatic Fertilizers Market, By Type

7.5 Japan Phosphatic Fertilizers Market

7.5.1 Japan Phosphatic Fertilizers Market, By Application

7.5.2 Japan Phosphatic Fertilizers Market, By Type

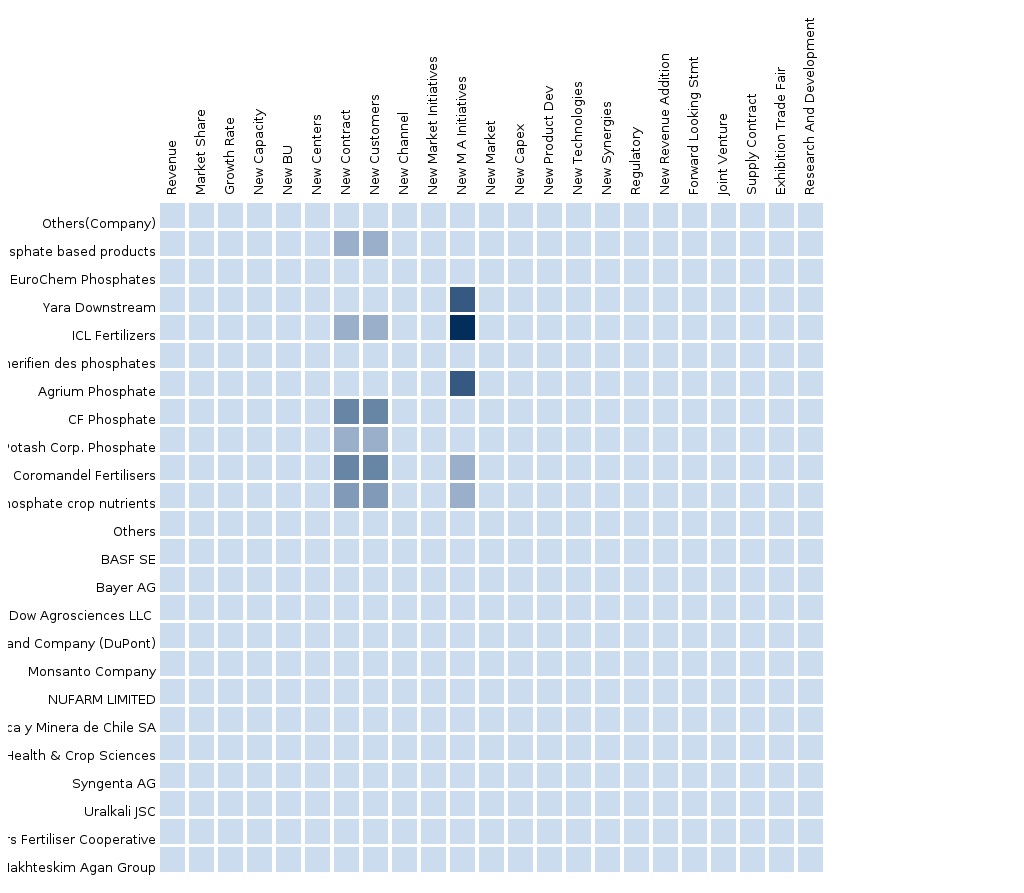

8 Asia-Pacific Phosphatic Fertilizer Market: Competitive Landscape (Page No. - 76)

8.1 Phosphatic Fertilizers Market: Company Share Analysis

8.2 Company Presence in Phosphatic Fertilizers Market, By Type

8.3 Mergers & Acquisitions

8.4 Expansions

8.5 Joint Ventures

8.6 Agreements

8.7 Strategic Alliances And Contracts

9 Asia-Pacific Phosphatic Fertilizer Market, By Company (Page No. - 83)

9.1 Agrium Inc.

9.1.1 Overview

9.1.2 Key Operations Data

9.1.3 Key Financials

9.1.4 Product And Service Offerings

9.1.5 Related Developments

9.1.6 Mmm Analysis

9.2 Eurochem Group

9.2.1 Overview

9.2.2 Key Financials

9.2.3 Product And Service Offerings

9.2.4 Related Developments

9.2.5 Mmm Analysis

9.3 Office Chérifien Des Phosphates (Ocp)

9.3.1 Overview

9.3.2 Product And Service Offerings

9.3.3 Related Developments

9.3.4 Mmm Analysis

9.4 Yara International ASA

9.4.1 Overview

9.4.2 Key Financials

9.4.3 Product And Service Offerings

9.4.4 Related Developments

9.4.5 Mmm Analysis

9.5 Coromandel International Limited

9.5.1 Overview

9.5.2 Product And Service Offerings

9.5.3 Related Developments

9.5.4 Mmm Analysis

9.6 the Mosaic Company

9.6.1 Overview

9.6.2 Product And Service Offerings

9.6.3 Related Developments

9.6.4 Mmm Analysis

9.7 OJSC Phosagro

9.7.1 Overview

9.7.2 Product And Service Offerings

9.7.3 Related Developments

9.7.4 Mmm Analysis

9.8 Israel Chemical Limited

9.8.1 Overview

9.8.2 Product And Service Offerings

9.8.3 Related Developments

9.8.4 Mmm Analysis

10 Appendix (Page No. - 103)

10.1 Customization Options

10.1.1 Technical Analysis

10.1.2 Low-Cost Sourcing Locations

10.1.3 Regulatory Framework

10.1.4 Impact Analysis

10.1.5 Trade Analysis

10.1.6 Historical Data And Trends

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

10.3.1 RT Snapshots

List Of Tables (49 Tables)

Table 1 Global Phosphatic Fertilizers Peer Market Size, 2014 (USD MN)

Table 2 Asia-Pacific Phosphatic Fertilizer Application Market, 2014 (KT)

Table 3 Asia-Pacific Phosphatic Fertilizer Market: Macro Indicators, By Geography, 2014 (HA)

Table 4 Asia-Pacific Phosphatic Fertilizer Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 5 Asia-Pacific Phosphatic Fertilizer Market: Comparison With Parent Market, 2013 – 2019 (KT)

Table 6 Asia-Pacific Phosphatic Fertilizer Market: Drivers And Inhibitors

Table 7 Asia-Pacific Phosphatic Fertilizer Market, By Application, 2013 - 2019 (USD MN)

Table 8 Asia-Pacific Phosphatic Fertilizer Market, By Application, 2013 - 2019 (KT)

Table 9 Asia-Pacific Phosphatic Fertilizer Market, By Type, 2013 - 2019 (USD MN)

Table 10 Asia-Pacific Phosphatic Fertilizer Market, By Type, 2013 - 2019 (KT)

Table 11 Asia-Pacific Phosphatic Fertilizer Market, By Geography, 2013 - 2019 (USD MN)

Table 12 Asia-Pacific Phosphatic Fertilizer Market, By Geography, 2013 – 2019 (KT)

Table 13 Asia-Pacific Phosphatic Fertilizer Market: Comparison With Application Markets, 2013 - 2019 (USD MN)

Table 14 Asia-Pacific Phosphatic Fertilizer Market, By Application, 2013 - 2019 (USD MN)

Table 15 Asia-Pacific Fertilizer: Market, By Application, 2013 - 2019 (KT)

Table 16 Asia-Pacific Phosphatic Fertilizer in Grains & Oilseeds, By Geography, 2013 - 2019 (USD MN)

Table 17 Asia-Pacific Phosphatic Fertilizer in Grains & Oilseeds, By Geography, 2013 - 2019 (KT)

Table 18 Asia-Pacific Phosphatic Fertilizer in Fruits & Vegetables, By Geography, 2013 - 2019 (USD MN)

Table 19 Asia-Pacific Phosphatic Fertilizer in Fruits & Vegetables, By Geography, 2013 - 2019 (KT)

Table 20 Asia-Pacific Phosphatic Fertilizer Market, By Type, 2013 - 2019 (USD MN)

Table 21 Asia-Pacific Phosphatic Fertilizer Market, By Type, 2013 - 2019 (KT)

Table 22 Asia-Pacific Phosphatic Fertilizer Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 23 Asia-Pacific Diammonium Phosphate Fertilizers Market, By Geography, 2013–2019 (USD MN)

Table 24 Asia-Pacific Diammonium Phosphate Fertilizers Market, By Geography, 2013–2019 (KT)

Table 25 Asia-Pacific Monoammonium Phosphate Fertilizers Market, By Geography, 2013 - 2019 (USD MN)

Table 26 Asia-Pacific Monoammonium Phosphate Fertilizers Market, By Geography, 2013 - 2019 (KT)

Table 27 Asia-Pacific Superphosphate Fertilizers Market, By Geography, 2013 - 2019 (USD MN)

Table 28 Asia-Pacific Superphosphate Fertilizers Market, By Geography, 2013 - 2019 (KT)

Table 29 Asia-Pacific Phosphatic Fertilizers Market, By Geography, 2013 - 2019 (USD MN)

Table 30 Asia-Pacific Phosphatic Fertilizers Market, By Geography, 2013 - 2019 (KT)

Table 31 China Phosphatic Fertilizers Market, By Application, 2013-2019 (USD MN)

Table 32 China Phosphatic Fertilizers Market, By Application, 2013-2019 (KT)

Table 33 China Phosphatic Fertilizer Market, By Type, 2013 - 2019(USD MN) 61

Table 34 China Phosphatic Fertilizers Market, By Type, 2013 - 2019 (KT)

Table 35 India Phosphatic Fertilizers Market, By Application, 2013 - 2019 (USD MN)

Table 36 India Phosphatic Fertilizers Market, By Application, 2013 - 2019 (KT)

Table 37 India Phosphatic Fertilizers Market, By Type, 2013 - 2019 (USD MN)

Table 38 India Phosphatic Fertilizers Market, By Type, 2013 - 2019 (KT)

Table 39 Japan Phosphatic Fertilizers Market, By Application, 2013 - 2019 (USD MN)

Table 40 Japan Phosphatic Fertilizers Market, By Application, 2013 - 2019 (KT)

Table 41 Japan Phosphatic Fertilizers: Market, By Type, 2013 - 2019 (USD MN)

Table 42 Japan Phosphatic Fertilizers: Market, By Type, 2013 - 2019 (KT)

Table 43 Asia-Pacific Phosphatic Fertilizers Market: Mergers & Acquisitions

Table 44 Asia-Pacific Phosphatic Fertilizers Market: Expansions

Table 45 Asia-Pacific Phosphatic Fertilizers Market: Joint Ventures

Table 46 Agrium, Inc.: Key Operations Data, 2009 - 2013 (USD MN)

Table 47 Agrium Inc.: Key Financials, 2009 - 2013 (USD MN)

Table 48 Eurochem Group: Key Financials, 2009 - 2013 (USD MN)

Table 49 Yara International ASA: Key Financials, 2009 - 2013 (USD MN)

List Of Figures (52 Figures)

Figure 1 Asia Phosphatic Fertilizers Market: Segmentation & Coverage

Figure 2 Phosphatic Fertilizers Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Approach

Figure 8 Asia Phosphatic Fertilizers Market Snapshot

Figure 9 Phosphatic Fertilizers Market: Growth Aspects

Figure 10 Asia Phosphatic Fertilizers Market, By Application, 2014 vs 2019

Figure 11 Asia Phosphatic Fertilizers Types, By Geography, 2014 (USD MN)

Figure 12 Asia Phosphatic Fertilizers Market: Growth Analysis, By Type, 2014–2019 (%)

Figure 13 Phosphatic Fertilizers: Application Market Scenario

Figure 14 Asia Fertilizers Market, By Application, 2014 - 2019 (USD MN)

Figure 15 Asia Phosphatic Fertilizers Market, By Application, 2014 - 2019 (KT)

Figure 16 Asia Phosphatic Fertilizers Market: Vendor Side Analysis

Figure 17 Aisa Phosphatic Fertilizers Market in Grains & Oilseeds, By Geography, 2013 - 2019 (USD MN)

Figure 18 Asia Phosphatic Fertilizers Market in Fruits & Vegetables, By Geography, 2013- 2019 (USD MN)

Figure 19 Sneak View: Asia-Pacific Fertilizer Market

Figure 20 Asia-Pacific Phosphatic Fertilizers Market, By Type, 2014 - 2019 (USD MN)

Figure 21 Asia-Pacific Phosphatic Fertilizers Market, By Type, 2014 & 2019 (KT)

Figure 22 Asia-Pacific Phosphatic Fertilizers Market: Type Comparison With Fertilizers Market, 2013–2019 (USD MN)

Figure 23 Asia-Pacific Diammonium Phosphate Fertilizers Market, By Geography, 2013–2019 (USD MN)

Figure 24 Asia Pacifc Monoammonium Phosphate Market, By Geography, 2013 - 2019 (USD MN)

Figure 25 Asia-Pacific Superphosphate Fertilizers Market, By Geography, 2013 - 2019 (USD MN)

Figure 26 Asia-Pacific Phosphatic Fertilizers Market: Growth Analysis, By Geography, 2014-2019 (USD MN)

Figure 27 Asia-Pacific Phosphatic Fertilizers Market: Growth Analysis, By Geography, 2014-2019 (KT)

Figure 28 China Phosphatic Fertilizers Market Overview, 2014 & 2019 (%)

Figure 29 China Phosphatic Fertilizers Market, By Application, 2013 -2019 (USD MN)

Figure 30 China Phosphatic Fertilizers Market: Application Snapshot

Figure 31 China Phosphatic Fertilizers Market, By Type, 2013 - 2019 (USD MN)

Figure 32 China Phosphatic Fertilizers Market Share, By Type, 2014-2019 (%)

Figure 33 India Phosphatic Fertilizers Market Overview, 2014 & 2019 (%)

Figure 34 India Phosphatic Fertilizers Market, By Application, 2013-2019 (USD Mn)

Figure 35 India Phosphatic Fertilizers Market: Application Snapshot

Figure 36 India Phosphatic Fertilizers Market, By Type, 2013 - 2019 (USD MN)

Figure 37 India Phosphatic Fertilizers Market Share, By Type, 2014-2019 (%)

Figure 38 Japan Phosphatic Fertilizers Market Overview, 2014 & 2019 (%)

Figure 39 Japan Phosphatic Fertilizers Market, By Application, 2013 - 2019 (USD MN)

Figure 40 Japan Phosphatic Fertilizers Market: Application Snapshot

Figure 41 Japan Phosphatic Fertilizers Market, By Type, 2013 - 2019 (USD MN)

Figure 42 Japan Phosphatic Fertilizers Market: Type Snapshot

Figure 43 Phosphatic Fertilizers Market: Company Share Analysis, 2014 (%)

Figure 44 Phosphatic Fertilizers Market: Company Share Analysis, 2014 (%)

Figure 45 Phosphatic Fertilizers: Company Product Coverage, By Type, 2014

Figure 46 Agrium Inc. Revenue Mix, 2013 (%)

Figure 47 Eurochem Group Revenue Mix, 2013 (%)

Figure 48 OCP Group.: Revenue Mix, 2013 (%)

Figure 49 Yara International ASA Revenue Mix, 2013 (%)

Figure 50 the Mosaic Company: Reveue Mix, 2013 (%)

Figure 51 OJSC Phosagro: Reveue Mix, 2013 (%)

Figure 52 Israel Chemicals Limited: Reveue Mix, 2013 (%)

Fertilizers are chemical compounds that help crops to grow successfully. Phosphorous is one of the key three nutrients which help plants in growth, utilization of sugar & starch, photosynthesis, nucleus formation and cell division. Energy from photosynthesis and the metabolism of carbohydrate is stored in phosphate compound for future growth prospects. Phosphorus inputs are vital to crop production. Adequate phosphorus results in rapid growth and early maturity of plants, whereas excess phosphorous may act hazardous for aquatic animals. Phosphate fertilizer is a fertilizer that is high in phosphorous. Most phosphate fertilizer comes from phosphate rock, a mineral mined in massive quantities of millions of tons from locations around the world. Phosphate help plants more efficiently process applied phosphates while still allowing growers to achieve exceptional crop growth and yields. This translates to reduced costs for the grower and reduced impacts on health and the environment.

Phosphatic fertilizers market is growing in Asia-Pacific because the growth prospects of agriculture sector in this region are very huge. A large number of populations are dependent on agriculture that will lead to increase in demand of phosphate fertilizers to increase the efficiency of the land for better productivity. Increasing income level makes the population demand more for food which in turn increases the demand of Phosphatic fertilizers. On the other hand, adverse governmental policies in developing economies, declining phosphate reserve and new policy of World Trade Organization to stop the subsidies to farmer are resulting in threat to the growth of phosphatic fertilizers in Asia-Pacific region.

The Asia-Pacific phosphatic fertilizers market, by type, was valued at $33,590.27 million in 2014 and is projected to reach $37,505.47 million by 2019 at a CAGR of 2.2% during the forecast period. The market, by consumption, was led by Superphosphate in 2014, with a 39.55% share. It is projected to reach a volume of 29,849.4 KT at a CAGR of 2.7% through the forecasted period. The Mono-ammonium fertilizers market is estimated to grow at the highest CAGR of 3.1% through 2019. China is a key market for phosphatic fertilizers in the Asia-Pacific region. The grains & oilseeds segment held a greater share of the phosphatic fertilizers market, in terms of application, in 2014.

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement