The European disc brake market was valued at $2.78 billion in 2013, and is expected to grow at a CAGR of 5.8%. It is projected to reach $3.68 billion by 2018.

Europe is the second-largest market in terms of vehicle production across the globe, and this has strengthened its position in the disc brake market as well. The production level of vehicles dropped in this region due to the financial crisis of 2009, which affected the major industries, like the automotive. However, owing to the improving economic conditions, the region is anticipated to witness substantial growth in the coming years. The disposable income of the consumers has led to an increase in the demand for vehicles in the region. This demand, coupled with high volume of performance vehicles and road safety norms which has reduced the stopping distance for vehicles, has increased the scope of the disc brake market in the region.

In the European region, Germany, which is the largest automobile market, is also the leader in the disc brake market followed by Russia and France. The Russian market is the fastest-growing market, owing to increasing demand and the enhanced performance of cars manufactured.

The passenger cars segment is the largest segment in this region, due to high demand for these types of cars in the recent times, whereas the growth of the LCVs segment is higher as compared to other vehicle segments. The growth of disc brakes in HCVs is second to that of LCVs, due to growing trade in the region with the improved economic conditions.

1 Introduction

1.1 Objective of the study

1.2 Market Definitions

1.3 Market Segmentation & Aspects Covered

1.4 Research Methodology

1.4.1 Assumptions (Market Size, Forecast, etc)

2 Executive Summary

3 Market Overview

4 Europe Disc Brake, By Applications

4.1 Split By Geography

4.2 DB-Europe-Passenger-Cars

4.2.1 By Geographies

4.2.1.1 France

4.2.1.2 Germany

4.2.1.3 Russia

4.3 DB-Europe-HCV

4.3.1 By Companies

4.3.1.1 DB-HCV-Meritor Commercial Truck & Industrial-Europe

4.3.2 By Geographies

4.3.2.1 France

4.3.2.2 Germany

4.3.2.3 Europe

4.4 DB-Europe-LCV

4.4.1 By Companies

4.4.1.1 DB-LCV-Meritor Commercial Truck & Industrial-Europe

4.4.2 By Geographies

4.4.2.1 France

4.4.2.2 Germany

4.4.2.3 Russia

5 Europe Disc Brake, By Geographies

5.1 Disc Brake-France

5.1.1 By Applications

5.1.1.1 Passenger-Cars

5.1.1.2 HCV

5.1.1.3 LCV

5.1.2 By Companies

5.1.2.1 DB-France-Akebono Brake Industry Co. Ltd

5.2 DB-Germany

5.2.1 By Applications

5.2.1.1 Passenger-Cars

5.2.1.2 HCV

5.2.1.3 LCV

5.3 DB-Europe - Russia

5.3.1 By Applications

5.3.1.1 Passenger-Cars

5.3.1.2 HCV

5.3.1.3 LCV

5.4 DB-United Kingdom

5.4.1 By Companies

5.4.1.1 DB-Meritor Commercial Truck -United Kingdom

5.5 Disc Brake-Italy

5.5.1 By Companies

5.5.1.1 DB-Italy-Knorr-Bremse Commercial vehicle systems

5.6 DB-Europe - Other Geographies

5.6.1 By Applications

5.6.1.1 Passenger Cars

5.6.1.2 Europe

5.6.1.3 Europe

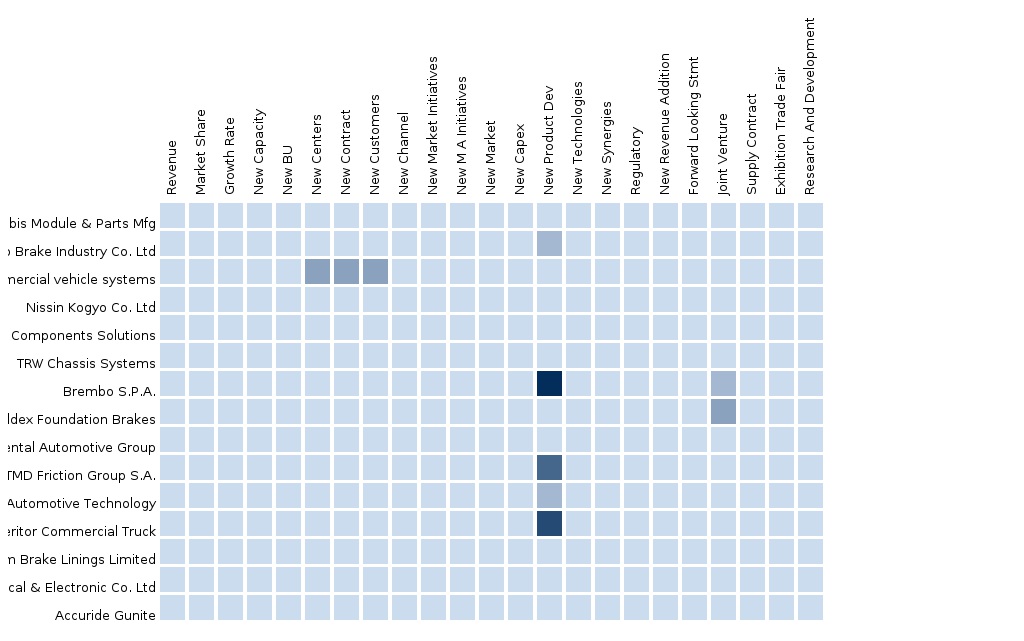

6 Europe Disc Brake, By Companies

6.1 Split By Geography

6.2 Disc Brake-Europe-Federal-Mogul Vehicle Components Solutions

6.3 DB-Europe-Brembo S.P.A.

6.4 DB-Europe-Knorr-Bremse Commercial vehicle systems

6.4.1 DB-Europe-Knorr-Bremse Commercial vehicle systems, By Geographies

6.4.1.1 DB-Italy-Knorr-Bremse Commercial vehicle systems

6.5 DB-Europe-Hyundai Mobis Module & Parts Mfg

6.6 DB-Europe-TRW Chassis Systems

6.7 DB-Europe-Nissin Kogyo Co. Ltd

6.8 DB-Akebono Brake Industry Co. Ltd-Europe

6.9 DB-Europe-Haldex Foundation Brakes

6.10 DB-Meritor Commercial Truck -Europe

6.10.1 DB-Meritor Commercial Truck -Europe, By Geographies

6.10.1.1 DB-Meritor Commercial Truck -United Kingdom

6.11 DB-Europe-Sundaram Brake Linings Limited

6.12 DB-Europe-Zhejiang Asia-Pacific Mechanical & Electronic Co. Ltd

6.13 DB-Europe-Accuride Gunite

6.14 DB-Europe-Robert Bosch Gmbh Automotive Technology

List Of Figures

1 Top Growing DB-Europe Markets By Revenue 2013 - 2018

2 DB-Europe BCG Matrix 2013

3 Top Growing DB-Europe-Passenger-Cars Markets By Revenue 2013 - 2018

4 DB-Europe-Passenger-Cars BCG Matrix 2013

5 DB-Europe Market Share 2013

6 Top Growing DB-Europe-HCV Markets By Revenue 2013 - 2018

7 DB-Europe-HCV BCG Matrix 2013

8 DB-Europe Market Share 2013

9 Top Growing DB-Europe-LCV Markets By Revenue 2013 - 2018

10 DB-Europe-LCV BCG Matrix 2013

11 DB-Europe Market Share 2013

12 DB-Europe Market Share 2013

13 DB-Europe Market Share 2013

14 DB-Europe Market Share 2013

List Of Tables

1 DB-Europe market values, by Applications, 2013 - 2018

2 DB-Europe market volume, by Applications, 2013 - 2018

3 DB-Europe market values, by Geographies, 2013 - 2018

4 DB-Europe market volume, by Geographies, 2013 - 2018

5 DB-Europe-Passenger-Cars by Geographies

6 DB-Europe-Passenger-Cars by Geographies

7 DB-Europe-HCV by Geographies

8 DB-Europe-HCV by Geographies

9 DB-Europe-LCV by Geographies

10 DB-Europe-LCV by Geographies

11 DB-France by Applications

12 DB-France by Applications

13 DB-Germany by Applications

14 DB-Germany by Applications

15 DB-Europe - Russia by Applications

16 DB-Europe - Russia by Applications

17 DB-Europe - Other Geographies by Applications

18 DB-Europe - Other Geographies by Applications

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Asia-Pacific Brake The Asia-Pacific Brake market was valued at $10.44 billion in 2013, and expected to grow at 7.8% annually. It is projected to reach $15.21 billion by the end of 2018. The Asia-Pacific region is the leader in the drum brakes market across all the regions with China being the leader in the Asia-Pacific region followed by Japan. The growing demand for higher performing vehicles & longer service interval are some of the other factors that drive the market for Disc Brakes in the Asia-Pacific region, while the market being concentrated with smaller and cheaper vehicles using drum brakes acts as a restraining factor. |

Upcoming |

|

Europe Brake The European Brake market was valued at $5.02 billion in 2013, to grow at 5.5% annually. It is projected to reach $6.57 billion by the end of 2018. The increasing demand for small and cheaper cars in the major countries in the region like Germany, Russia and France has boosted the drum brakes market. Also since price of the disc brakes is much higher than the drum brakes, the consumers tend to go for cheaper drum brakes even though they are not as efficient as disc brakes. Germany is the leader in the European disc brake market and also holds its leadership for being the largest automobile market in the region. It is followed by Russia and France which holds the second and third position respectively in terms of disc brake market in the region. |

Upcoming |

|

North America Brake The North American Brake market was valued at $3.69 billion in 2013, to grow at 7.5% annually. It is projected to reach $5.30 billion by the end of 2018. The U.S and Mexico are the major market for drum brakes in the North American region due to its growing vehicle production and the increasing demand for cheaper cars. Another reason for the growth of drum brake sin the North American region is mainly due to the increasing cost of disc brakes which has pushed the cost-centric buyers’ to opt for the cheaper drum brakes. The North American disc brake market is driven by factors such as—fast growth in luxury and sports vehicle segment and stringent emission norms. The low end vehicles in the region refrain from using the disc brakes due to its initial cost. |

Upcoming |