Europe Laboratory Information System (LIS) Market by Product (Integrated Laboratory Information System), by Type (Clinical Pathology Laboratory Information System, Anatomic Pathology Laboratory Information System) - Forecast to 2019

A Laboratory Information System (LIS) is a class of software, which takes care of receiving, processing, and storing information generated by medical laboratory processes. These systems are interfaced with instruments and other information systems, such as hospital information systems (HIS), Electronic Medical Record (EMR), and Computerized Physician Order Entry (CPOE). An LIS is a highly configurable application, which is customized to enable a wide variety of laboratory workflow models. The selection of an LIS vendor is a major undertaking for all laboratories.

The European laboratory information systems market is estimated to grow at a CAGR of 7.6% from 2014 to 2019. The rising demand for molecular diagnostic tests, the growing need to integrate different healthcare systems, governmental support for adoption of healthcare IT tools, continuous advancements in LIS products, and the rising incidences of chronic diseases are among the key factors driving the market growth. On the other hand, the high cost of LIS solutions, high maintenance and service expenses, and lack of skilled healthcare IT professionals are likely to restrain market growth in the coming years.

Germany dominates the European market for laboratory information system, having accounted for a 28.2% market share in 2014, followed by France. The U.K is expected to become a major market for laboratory information system (LIS) in the coming years.

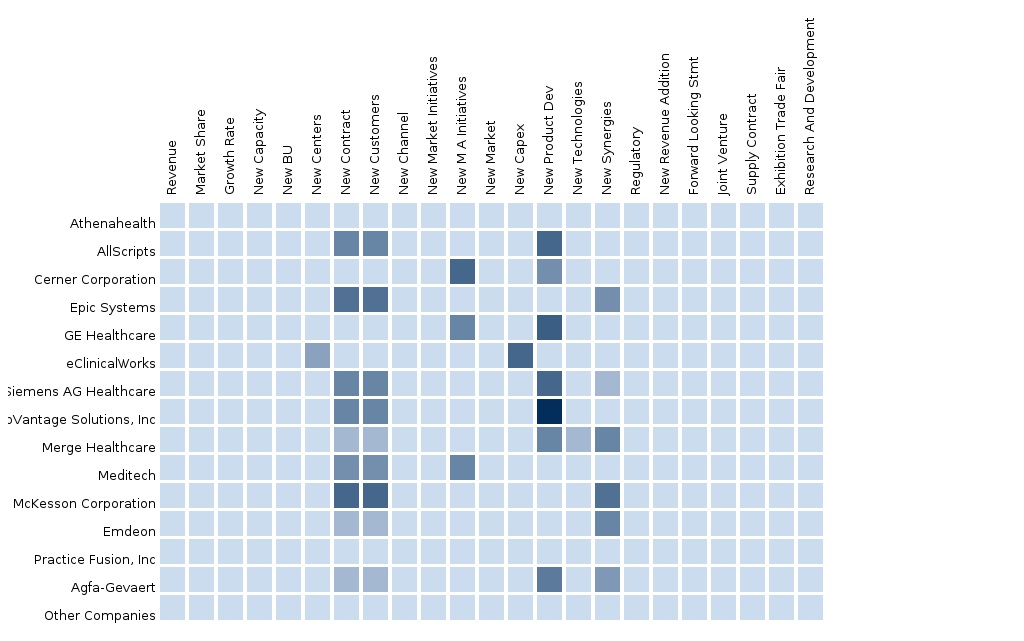

An in-depth market share analysis, in terms of revenue, of the top companies is also included in the report. These numbers are arrived at based on key facts, annual financial information from SEC filings, annual reports, and interviews with industry experts, key opinion leaders such as CEOs, directors, and marketing executives. A detailed market share analysis of the major players in the European laboratory information systems market has been covered in this report. The major companies in this market include Sunquest Information Systems (U.S.), Cerner Corporation (U.S.), SSC Soft Computer (U.S.), CompuGroup Medical AG (Germany), McKesson Corporation (U.S.), Epic Systems Corporation (U.S.), Medical Information Technology (U.S.), Orchard Software Corporation (U.S.), Allscripts (U.S.), Quest Diagnostics Incorporated (U.S.), Computer Programs and Systems (CPSI) (U.S.), and Merge Healthcare (U.S.). Other players in this market include Comp Pro Med (U.S.), Psyche Systems (U.S.), Technidata America (U.S.), and Siemens Medical Solutions (U.S.), among others.

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Integrated Ecosystem of Laboratory Information System (LIS) Market

2.2 Arriving at the Laboratory Information System (LIS) Market Size

2.2.1 Top-Down Approach

2.2.2 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 23)

4 Market Overview (Page No. - 26)

4.1 Introduction

4.2 Laboratory Information System (LIS) Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

5 European Laboratory Information System (LIS) Market, By Product (Page No. - 35)

5.1 Introduction

5.1.1 European Standalone Laboratory Information System (LIS) Market,By Geography

5.1.2 European Integrated Laboratory Information System (LIS) Market,By Geography

5.2 European Laboratory Information System (LIS) Market: Product Comparison With Clinical Information System (CIS) Market

6 European Laboratory Information System (LIS) Market, By Type (Page No. - 42)

6.1 Introduction

6.1.1 European Clinical Pathology LIS Market, By Geography

6.1.2 European Anatomic Pathology LIS Market, By Geography

6.2 European Laboratory Information System (LIS) Market: Type Comparison With Clinical Information System (CIS) Market

7 European Laboratory Information System (LIS) Market, By Component (Page No. - 48)

7.1 Introduction

7.1.1 European Laboratory Information System (LIS) Services Market, By Geography

7.1.2 European Laboratory Information System (LIS) Software Market, By Geography

7.2 European Laboratory Information System (LIS) Market: Component Comparison With Clinical Information System (CIS) Market

8 European Laboratory Information System (LIS) Market, By Delivery Mode (Page No. - 55)

8.1 Introduction

8.1.1 European Laboratory Information System (LIS) On-Premise Market, By Geography

8.1.2 European Laboratory Information System (LIS) Remotely Hosted Market, By Geography

8.1.3 European Laboratory Information System (LIS) Cloud-Based Market, By Geography

8.2 European Laboratory Information System (LIS) Market: Delivery Mode Comparison With Clinical Information System (CIS) Market

9 European Laboratory Information System (LIS) Market, By End-User (Page No. - 63)

9.1 Introduction

9.1.1 Laboratory Information System (LIS) in Clinical Diagnostic Laboratories, By Geography

9.1.2 Laboratory Information System (LIS) in Hospitals, By Geography

9.1.3 Laboratory Information System (LIS) in Anatomic Pathology Laboratories, By Geography

9.1.4 Laboratory Information System (LIS) in Blood Banks, By Geography

9.1.5 Laboratory Information System (LIS) in Molecular Diagnostic Laboratories, By Geography

9.2 European Laboratory Information System (LIS) Market: End-User Comparison With Clinical Information System (CIS) Market

10 European Laboratory Information System (LIS) Market, By Geography (Page No. - 73)

10.1 Introduction

10.2 Germany Laboratory Information System (LIS) Market

10.2.1 Germany Laboratory Information System (LIS) Market, By Product

10.2.2 Germany Laboratory Information System (LIS) Market, By Type

10.2.3 Germany Laboratory Information System (LIS) Market, By Component

10.2.4 Germany Laboratory Information System (LIS) Market, By Delivery Mode

10.2.5 Germany Laboratory Information System (LIS) Market, By End-User

10.3 France Laboratory Information System (LIS) Market

10.3.1 France Laboratory Information System (LIS) Market, By Product

10.3.2 France Laboratory Information System (LIS) Market, By Type

10.3.3 France Laboratory Information System (LIS) Market, By Component

10.3.4 France Laboratory Information System (LIS) Market, By Delivery Mode

10.3.5 France Laboratory Information System (LIS) Market, By End-User

10.4 U.K. Laboratory Information System (LIS) Market

10.4.1 U.K. Laboratory Information System (LIS) Market, By Product

10.4.2 U.K. Laboratory Information System (LIS) Market, By Type

10.4.3 U.K. Laboratory Information System (LIS) Market, By Component

10.4.4 U.K. Laboratory Information System (LIS) Market, By Delivery Mode

10.4.5 U.K. Laboratory Information System (LIS) Market, By End-User

10.5 Italian Laboratory Information System (LIS) Market

10.5.1 Italian Laboratory Information System (LIS) Market, By Product

10.5.2 Italian Laboratory Information System (LIS) Market, By Type

10.5.3 Italian Laboratory Information System (LIS) Market, By Component

10.5.4 Italian Laboratory Information System (LIS) Market, By Delivery Mode

10.5.5 Italian Laboratory Information System (LIS) Market, By End-User

10.6 Spain Laboratory Information System (LIS) Market

10.6.1 Spain Laboratory Information System (LIS) Market, By Product

10.6.2 Spain Laboratory Information System (LIS) Market, By Type

10.6.3 Spain Laboratory Information System (LIS) Market, By Component

10.6.4 Spain Laboratory Information System (LIS) Market, By Delivery Mode

10.6.5 Spain Laboratory Information System (LIS) Market, By End-User

10.7 Rest of Europe (Roe) Laboratory Information System (LIS) Market

10.7.1 Rest of Europe (Roe) Laboratory Information System (LIS) Market, By Product

10.7.2 Rest of Europe (Roe) Laboratory Information System (LIS) Market, By Type

10.7.3 Rest of Europe (Roe) Laboratory Information System (LIS) Market, By Component

10.7.4 Rest of Europe (Roe) Laboratory Information System (LIS) Market, By Delivery Mode

10.7.5 Rest of Europe (Roe) Laboratory Information System (LIS) Market, By End-User

11 European Laboratory Information System (LIS) Market: Competitive Landscape (Page No. - 113)

11.1 European Laboratory Information System (LIS) Market: Company Share Analysis

11.2 Company Presence in Laboratory Information System (LIS) Market

11.3 Mergers & Acquisitions

11.4 Expansions

11.5 Agreements

11.6 Joint Ventures

11.7 Collaborations

11.8 Partnerships

11.9 New Product Launches

12 Laboratory Information Systems Market, By Company (Page No. - 122)

(Overview, Financials, Products & Services, Strategy, and Developments)*

12.1 Epic Systems Corporation

12.2 Mckesson Corporation

12.3 Medical Information Technology, Inc.

12.4 Scc Soft Computer

12.5 Compugroup Medical Ag

12.6 Computer Programs and Systems, Inc.

12.7 Merge Healthcare Incorporated

12.8 Orchard Software Corporation

12.9 Comp Pro Med

12.10 Cerner Corporation

12.11 Sunquest Information Systems, Inc. (Subsidiary of Roper Industries)

12.12 Allscripts

12.13 Quest Diagnostics Incorporated.

12.14 Siemens Healthcare (A Subsidiary of Siemens Ag)

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Company

13 Appendix (Page No. - 161)

13.1 Customization Options

13.1.1 Porter Five Force Analysis

13.2 Related Reports

13.3 Introducing RT: Real Time Market Intelligence

13.3.1 RT Snapshots

List of Tables (86 Tables)

Table 1 Global Laboratory Information System (LIS) Peer Market Size, 2014 (USD MN)

Table 2 European Laboratory Information System (LIS) Market: Healthcare Expenditure, By Country, 2014 (USD Bn)

Table 3 European Laboratory Information System (LIS) Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 4 European Laboratory Information System (LIS) Market: Drivers and Inhibitors

Table 5 European Laboratory Information System (LIS) Market, By Geography, 2013-2019 (USD MN)

Table 6 European Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Table 7 European Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Table 8 European Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Table 9 European Laboratory Information System (LIS) Market, By Delivery Mode, 2013-2019 (USD MN)

Table 10 European Laboratory Information System (LIS) Market, By End-User, 2013-2019 (USD MN)

Table 11 European Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Table 12 European Laboratory Information System (LIS) Market, By Geography, 2013-2019 (USD MN)

Table 13 European Standalone Laboratory Information System (LIS) Market, By Geography, 2013-2019 (USD MN)

Table 14 European Integrated Laboratory Information System (LIS) Market, By Geography, 2013-2019 (USD MN)

Table 15 European Laboratory Information System: Product Comparison With Clinical Information System (CIS) Market, 2013–2019 (USD MN)

Table 16 European Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Table 17 European Clinical Pathology LIS Market, By Geography, 2013-2019 (USD MN)

Table 18 European Anatomic Pathology LIS Market, By Geography, 2013-2019 (USD MN)

Table 19 European Laboratory Information System: Type Comparison With Clinical Information System (CIS) Market, 2013–2019 (USD MN)

Table 20 European Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Table 21 European Laboratory Information System (LIS) Services Market, By Geography, 2013-2019 (USD MN)

Table 22 European Laboratory Information System (LIS) Software Market, By Geography, 2013-2019 (USD MN)

Table 23 European Laboratory Information System: Component Comparison With Clinical Information System (CIS) Market, 2013–2019 (USD MN)

Table 24 European Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Table 25 European Laboratory Information System (LIS) On-Premise Market, By Geography, 2013-2019 (USD MN)

Table 26 European Laboratory Information System (LIS) Remotely Hosted Market, By Geography, 2013-2019 (USD MN)

Table 27 European Laboratory Information System (LIS) Cloud-Based Market, By Geography, 2013-2019 (USD MN)

Table 28 European Laboratory Information System: Delivery Mode Comparison With Clinical Information System (CIS) Market, 2013–2019 (USD MN)

Table 29 European Laboratory Information System (LIS) Market, By End User, 2013-2019 (USD MN)

Table 30 Laboratory Information System (LIS) in Clinical Diagnostic Laboratories, By Geography, 2013-2019 (USD MN)

Table 31 Laboratory Information System (LIS) in Hospitals, By Geography, 2013-2019 (USD MN)

Table 32 Laboratory Information System (LIS) in Anatomic Pathology Laboratories, By Geography, 2013-2019 (USD MN)

Table 33 Laboratory Information System (LIS) in Blood Banks, By Geography, 2013-2019 (USD MN)

Table 34 Laboratory Information System (LIS) in Molecular Diagnostic Laboratories, By Geography, 2013-2019 (USD MN)

Table 35 European Laboratory Information System: End-User Comparison With Clinical Information System (CIS) Market, 2013–2019 (USD MN)

Table 36 European Laboratory Information System (LIS) Market, By Geography, 2013-2019 (USD MN)

Table 37 Germany Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Table 38 Germany Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Table 39 Germany Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Table 40 Germany Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Table 41 Germany Laboratory Information System (LIS) Market, By End-User, 2013-2019 (USD MN)

Table 42 France Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Table 43 France Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Table 44 France Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Table 45 France Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Table 46 France Laboratory Information System (LIS) Market, By End-User, 2013-2019 (USD MN)

Table 47 U.K. Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Table 48 U.K. Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Table 49 U.K. Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Table 50 U.K. Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Table 51 U.K. Laboratory Information System (LIS) Market, By End-User, 2013-2019 (USD MN)

Table 52 Italian Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Table 53 Italian Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Table 54 Italian Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Table 55 Italian Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Table 56 Italian Laboratory Information System (LIS) Market, By End-User, 2013-2019 (USD MN)

Table 57 Spain Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Table 58 Spain Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Table 59 Spain Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Table 60 Spain Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Table 61 Spanish Laboratory Information System (LIS) Market, By End-User, 2013-2019 (USD MN)

Table 62 Rest of Europe (Roe) Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Table 63 Rest of Europe (Roe) Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Table 64 Rest of Europe (Roe) Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Table 65 Rest of Europe (Roe) Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Table 66 Rest of Europe (Roe) Laboratory Information System (LIS) Market, By End-User, 2013-2019 (USD MN)

Table 67 European Laboratory Information System (LIS) Market: Company Share Analysis, 2013 (%)

Table 68 European Laboratory Information System (LIS) Market: Mergers & Acquisitions

Table 69 European Laboratory Information System (LIS) Market: Expansions

Table 70 European Laboratory Information System (LIS) Market: Investments

Table 71 European Laboratory Information System (LIS) Market: Joint Ventures

Table 72 European Laboratory Information System (LIS) Market: Collaborations

Table 73 European Laboratory Information System (LIS) Market: Partnerships

Table 74 European Laboratory Information System (LIS) Market: New Product Launches

Table 75 Mckesson Corporation: Key Financials, 2009 - 2014 (USD MN)

Table 76 Contribution of Technology Solutions Segment Towards Company Revenue, 2009-2014 (USD MN)

Table 77 Medical Information Technology, Inc.: Key Financials, 2008 - 2013 (USD MN)

Table 78 Compugroup Medical Ag: Key Financials, 2008 - 2013 (USD MN)

Table 79 Computer Programs and Systems, Inc.: Key Financials, 2008 - 2013 (USD MN)

Table 80 Contribution of System Sales Segment Towards Company Revenue, 2008-2013 (USD MN)

Table 81 Merge Healthcare Incorporated: Key Financials, 2008 - 2013 (USD MN)

Table 82 Cerner Corporation : Key Financials, 2008 - 2013 (USD MN)

Table 83 Sunquest Information Systems, Inc. (Roper Industries.) : Key Financials, 2008 - 2013 (USD MN)

Table 84 Allscripts: Key Financials, 2008 - 2013 (USD MN)

Table 85 Quest Diagnostics Incorporated.: Key Financials, 2008 - 2013 (USD MN)

Table 86 Siemens Healthcare: Key Financials, 2011 - 2013 (USD MN)

List of Figures (100 Figures)

Figure 1 European Laboratory Information System (LIS) Market: Segmentation & Coverage

Figure 2 Laboratory Information System (LIS) Market: Integrated Ecosystem

Figure 3 Top-Down Approach

Figure 4 European Laboratory Information System (LIS) Market: Healthcare Expenditure, By Geography, 2014 (USD Bn)

Figure 5 European Laboratory Information System Market Snapshot (Top Markets), 2014

Figure 6 European Laboratory Information System (LIS) Market, By Geography, 2013-2019 (USD MN)

Figure 7 European Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Figure 8 European Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Figure 9 European Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Figure 10 European Laboratory Information System (LIS) Market, By Delivery Mode, 2013-2019 (USD MN)

Figure 11 European Laboratory Information System (LIS) Market, By End-User, 2013-2019 (USD MN)

Figure 12 European Laboratory Information System (LIS) Market, By Product, 2014

Figure 13 European Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Figure 14 European Laboratory Information System (LIS) Market, By Country, 2013-2019 (USD MN)

Figure 15 European Standalone Laboratory Information System (LIS) Market, By Geography, 2013 - 2019 (USD MN)

Figure 16 European Integrated Laboratory Information System (LIS) Market, By Geography, 2013-2019 (USD MN)

Figure 17 European Laboratory Information System: Product Comparison With Clinical Information System (CIS) Market, 2013–2019 (USD MN)

Figure 18 European Laboratory Information System (LIS) Market, By Type, 2014

Figure 19 European Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Figure 20 European Clinical Pathology LIS Market, By Geography, 2013-2019 (USD MN)

Figure 21 European Anatomic Pathology LIS Market, By Geography, 2013-2019 (USD MN)

Figure 22 European Laboratory Information System: Type Comparison With Clinical Information System (CIS) Market, 2013–2019 (USD MN)

Figure 23 European Laboratory Information System (LIS) Market, By Component, 2014

Figure 24 European Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Figure 25 European Laboratory Information System (LIS) Services Market, By Geography, 2013-2019 (USD MN)

Figure 26 European Laboratory Information System (LIS) Software Market, By Geography, 2013-2019 (USD MN)

Figure 27 European Laboratory Information System: Component Comparison With Clinical Information System (CIS) Market, 2013–2019 (USD MN)

Figure 28 European Laboratory Information System (LIS) Market, By Delivery Mode, 2014

Figure 29 European Laboratory Information System (LIS) Market, By Delivery Mode, 2013-2019 (USD MN)

Figure 30 European Laboratory Information System (LIS) On-Premise Market, By Geography, 2013-2019 (USD MN)

Figure 31 European Laboratory Information System (LIS) Remotely Hosted Market, By Geography, 2013-2019 (USD MN)

Figure 32 European Laboratory Information System (LIS) Cloud-Based Market, By Geography, 2013-2019 (USD MN)

Figure 33 European Laboratory Information System: Delivery Mode Comparison With Clinical Information System (CIS) Market, 2013–2019 (USD MN)

Figure 34 European Laboratory Information System (LIS) Market, By End User, 2014

Figure 35 European Laboratory Information System (LIS) Market, By End-User, 2013-2019 (USD MN)

Figure 36 Laboratory Information System (LIS) in Clinical Diagnostic Laboratories, By Geography, 2013-2019 (USD MN)

Figure 37 Laboratory Information System (LIS) in Hospitals, By Geography, 2013-2019 (USD MN)

Figure 38 Laboratory Information System (LIS) in Anatomic Pathology Laboratories, By Geography, 2013-2019 (USD MN)

Figure 39 Laboratory Information System (LIS) in Blood Banks, By Geography, 2013-2019 (USD MN)

Figure 40 Laboratory Information System (LIS) in Molecular Diagnostic Laboratories, By Geography, 2013-2019 (USD MN)

Figure 41 European Laboratory Information System: End-User Comparison With Clinical Information System (CIS) Market, 2013–2019 (USD MN)

Figure 42 European Laboratory Information System (LIS) Market, By Geography, 2014

Figure 43 European Laboratory Information System (LIS) Market: Growth Analysis, By Geography, 2012-2018 (USD MN)

Figure 44 Germany Laboratory Information System (LIS) Segment-Based Market Share, 2014 & 2019 (%)

Figure 45 Germany Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Figure 46 Germany Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Figure 47 Germany Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Figure 48 Germany Laboratory Information System (LIS) Market, By Delivery Mode, 2013-2019 (USD MN)

Figure 49 Germany Laboratory Information System (LIS) Market, By End-User, 2013-2019 (USD MN)

Figure 50 France Laboratory Information System (LIS) Segment-Based Market Share, 2014 & 2019 (%)

Figure 51 France Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Figure 52 France Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Figure 53 France Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Figure 54 France Laboratory Information System (LIS) Market, By Delivery Mode, 2013-2019 (USD MN)

Figure 55 France Laboratory Information System (LIS) Market, By End-User, 2013-2019 (USD MN)

Figure 56 U.K. Laboratory Information System (LIS) Segment-Based Market Share, 2014 & 2019 (%)

Figure 57 U.K. Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Figure 58 U.K. Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Figure 59 U.K. Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Figure 60 U.K. Laboratory Information System (LIS) Market, By Delivery Mode, 2013-2019 (USD MN)

Figure 61 U.K. Laboratory Information System (LIS) Market, By End-User, 2013-2019 (USD MN)

Figure 62 Italian Laboratory Information System (LIS) Segment-Based Market Share, 2014 & 2019 (%)

Figure 63 Italian Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Figure 64 Italian Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Figure 65 Italian Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Figure 66 Italian Laboratory Information System (LIS) Market, By Delivery Mode, 2013-2019 (USD MN)

Figure 67 Italian Laboratory Information System (LIS) Market, By End-User, 2013-2019 (USD MN)

Figure 68 Spain Laboratory Information System (LIS) Segment-Based Market Share, 2014 & 2019 (%)

Figure 69 Spain Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Figure 70 Spain Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Figure 71 Spain Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Figure 72 Spain Laboratory Information System (LIS) Market, By Delivery Mode, 2013-2019 (USD MN)

Figure 73 Spanish Laboratory Information System (LIS) Market, By End-User, 2013-2019 (USD MN)

Figure 74 Rest of Europe (Roe) Laboratory Information System (LIS) Segment-Based Market Share, 2014 & 2019 (%)

Figure 75 Rest of Europe (Roe) Laboratory Information System (LIS) Market, By Product, 2013-2019 (USD MN)

Figure 76 Rest of Europe (Roe) Laboratory Information System (LIS) Market, By Type, 2013-2019 (USD MN)

Figure 77 Rest of Europe (Roe) Laboratory Information System (LIS) Market, By Component, 2013-2019 (USD MN)

Figure 78 Rest of Europe (Roe) Laboratory Information System (LIS) Market, By Delivery Mode, 2013-2019 (USD MN)

Figure 79 Rest of Europe (Roe) Laboratory Information System (LIS) Market, By End-User, 2013-2019 (USD MN)

Figure 80 European Laboratory Information System (LIS) Market: Company Share Analysis, 2013 (%)

Figure 81 European Laboratory Information System (LIS) Market: Company Coverage, By Product, 2013

Figure 82 European Laboratory Information System (LIS) Market: Company Coverage, By Type, 2013

Figure 83 Mckesson Corporation: Revenue Mix, 2014 (%)

Figure 84 Medical Information Technology, Inc.: Revenue Mix, 2013 (%)

Figure 85 Contribution of Product Segment Towards Company Revenue, 2008-2013 (USD MN)

Figure 86 Compugroup Medical Ag: Revenue Mix, 2013 (%)

Figure 87 Contribution of Hps 1 Segment Towards Company Revenue, 2008-2013 (USD MN)

Figure 88 Computer Programs and Systems, Inc.: Revenue Mix, 2013 (%)

Figure 89 Merge Healthcare Incorporated: Revenue Mix, 2013 (%)

Figure 90 Contribution of Software and Other Segments Towards Company Revenue, 2008-2013 (USD MN)

Figure 91 Cerner Corporation: Revenue Mix, 2013 (%)

Figure 92 Contribution of Services Segment Towards Company Revenue, 2008-2013 (USD MN)

Figure 93 Sunquest Information Systems, Inc. (Roper Industries.): Revenue Mix, 2013 (%)

Figure 94 Contribution of Medical & Scientific Imaging Segment Towards Company Revenue, 2008-2013 (USD MN)

Figure 95 Allscripts: Revenue Mix, 2013 (%)

Figure 96 Contribution of Clinical and Financial Solutions Segment Towards Company Revenues, 2011-2013 (USD MN)

Figure 97 Quest Diagnostics Incorporated: Revenue Mix, 2013 (%)

Figure 98 Contribution of Diagnostic Information Services Segment Towards Company Revenue, 2008-2013 (USD MN)

Figure 99 Siemens Healthcare: Revenue Mix, 2013 (%)

Figure 100 Contribution of Healthcare Segment Towards Company Revenue, 2011-2013 (USD MN)

Laboratory Information Systems (LIS) facilitate the generation of simple laboratory reports, as well as track entire laboratory workflows throughout all phases of testing.

The adoption of IT solutions streamlines laboratory workflow, integrates multiple laboratory tasks, and ensures easy adoption of technological changes in LIS as well as laboratory testing methods. The best-of-breed segment encompasses dedicated LIS systems focusing on improving all aspects of laboratory workflow (such as the Sunquest Laboratory from Sunquest Information Systems, Inc.), while enterprise LIS comprises LIS modules as well as other hospital IT modules (for instance, the Beaker LIS from Epic). Healthcare facilities may choose either of these systems based on their needs. Since most of the LIS systems available in the market have similar features, the key players are increasingly focusing on offering the best implementation and aftersales services in order to gain a competitive advantage.

The European LIS market, in terms of value, is projected to reach $582.5 million by 2019 from $403.3 million in 2014, at a CAGR of 7.6% from 2014 to 2019. The rising demand for molecular diagnostic tests; the growing need to integrate different healthcare systems; governmental support for adoption of healthcare IT tools; continuous advancements in LIS products; and the rising prevalence of chronic diseases are some of the key factors driving the market growth. On the other hand, the high cost of LIS solutions, high maintenance and service expenses, and lack of skilled healthcare IT professionals are expected to restrain the market growth in the coming years.

Based on product, the LIS market has been segmented into integrated LIS and standalone LIS. The standalone LIS segment held the largest market share of 59.1% in 2014. This segment would continue to dominate the market, although the integrated LIS segment is projected to grow at a faster CAGR during the forecast period, 2014 to 2019. The ability of the standalone LIS to work offline, along with better affordability, enhanced data security, and user-friendly nature, as compared to an integrated LIS, are the factors responsible for its extensive implementation in the European region.

Based on type, the LIS market is segmented into clinical pathology LIS and anatomic pathology LIS. The clinical pathology LIS segment accounted for 68.2% share of the total LIS market in 2014. An exponential increase in the incidence of chronic diseases has led to an elevated number of tests. It is easier to generate fast, organized, and feasible results with the help of LIS systems. Thus, it is estimated that the clinical pathology LIS segment would continue to lead the European LIS market in the coming years.

The key players in the Europe LIS market include Sunquest Information Systems (U.S.), Cerner Corporation (U.S.), SSC Soft Computer (U.S.), CompuGroup Medical AG (Germany), McKesson Corporation (U.S.), Epic Systems Corporation (U.S.), Medical Information Technology (U.S.), Orchard Software Corporation (U.S.), Allscripts (U.S.), Quest Diagnostics Incorporated (U.S.), Computer Programs and Systems (CPSI) (U.S.), and Merge Healthcare (U.S.).

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North American Clinical Cardiovascular Information And Imaging Solution The North American Clinical CVIS market is anticipated to boom due to the inherent advantages it offers in the field of interventional cardiology. This report encompasses the market share, value chain analysis, and market metrics along with the market drivers and restraints. A DeepDive analysis of the top players of this domain have also been considered in the report. |

Upcoming |

|

European Clinical Cardiovascular Information And Imaging Solution market Globally, Europe is the second largest Clinical Information Systems market, which is expected to reach a CAGR value of 6.35%, from 2012 to 2018. The European chromatography market is segmented into geography, sub-market, application, component, deployment, and end-user. A DeepDive analysis of the top players of this domain have also been considered in the report. |

Upcoming |

|

Asia Clinical Information Systems Market The Asian clinical CVIS market report includes the market share, value chain analysis, and market metrics that include drivers, restraints, and upcoming opportunities. The market is segmented into geography, sub-market, application, component, deployment, and end-user. A DeepDive analysis of the top players of this domain have also been considered in this report. |

Upcoming |