Middle East and Africa Image Sensor Market by Technology (CMOS Image Sensor, CCD Image Sensor, and Contact Image Sensor) and by Application (Consumer, Healthcare, Industrial, Surveillance, Automotive, and Aerospace and Defense) Forecasts till 2019

The Middle Eastern & African image sensor market, mainly driven by the increasing demand of high quality cameras in smartphones and tablets and the increasing application of image sensors in medical diagnostic, was valued at a market size of $407.1 million in 2014 and expected to reach $676.6 million by 2019, growing at a CAGR of 10.7% from 2014 to 2019.

The report “Middle East & Africa Image Sensor Market Forecast, 2014-2019“ analyzes the Middle Eastern and African image sensor market and the factors driving the market of image sensor in the region. Of all the geographies, the Middle Eastern and African region has shown a positive growth in the image sensor market till 2019, and is expected to reach a total market size of $676.6 million in 2015. The major factor driving the Middle Eastern and African image sensor market is the large consumer base for smartphone’s and tablets, and other consumer electronics.

CMOS, CCD, and contact image sensor (CIS) are the technologies used in image sensors. Attributes of the CMOS technology such as low cost and low power consumption, have helped CMOS image sensors gradually overtake CCD image sensors in the market. CMOS image sensors had the highest revenue of $358.9 million in 2014, in the Middle Eastern and African image sensor market, segmented by technology. It is expected to reach a total market size of $628.7 million in 2019.

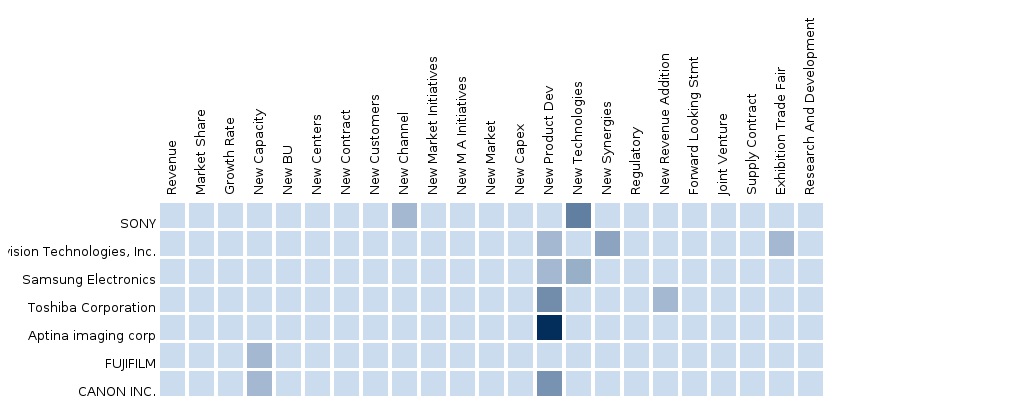

The report also provides an extensive competitive landscaping of companies operating in this market. The main companies operating in the image sensor market and extensively covered in this report are OmniVision Technologies Ltd., Aptina Imaging Corporation, Samsung Electronics, Toshiba Corporation, and Sony Corporation.

Segment and country specific company shares, news and deals, mergers and acquisitions, segment specific pipeline products, product approvals, and product recalls of the major companies have been detailed.

Customization Options:

With Market data, you can also customize MMM assessments that meet your company’s specific needs. Customize to get comprehensive industry standard and deep dive analysis of the following parameters:

Technological Data

- Region wise end-user adoption rate analysis of the technology (CMOS, CCD, contact image sensors)

- Technology matrix which gives a detailed comparison of technologies (CMOS, CCD, contact image sensors) mapped at country and sub-segment level

- Upcoming development in the technology (company and country-wise)

- Technology matrix which gives detailed comparison of technology mapped with different manufacturing types (FSI and BSI) and operating spectrums (visible, IR, and X-ray)

Price Trend Analysis

- Average selling price (ASP) analysis of image sensors with respect to different applications at country-level

- Analysis of material cost, processing cost, and assembly cost incurred in making an image sensor

Data from Key Players

- Key revenue pockets for the manufacturing and supplying firms

- Various firms’ opinions about upcoming market and trends

- Qualitative inputs on macro-economic indicators, mergers and acquisitions

Shipment Data

- Shipment of image sensors as per the requirement in different application

Country-Level Data Analysis

- Country-level data for top countries in the image sensor market

- Country specific data showing opportunities in different regions

Trend Analysis of Applications

- Application matrix which gives a detailed comparison of application portfolio of each company in the Middle East and Africa

- Application matrix which gives a detailed comparison of application portfolio using different technology

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition and Scope

1.3 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Integrated Ecosystem of Image Sensor Market

2.2 Arriving at the Image Sensor: Middle East and Africa Market Size

2.3 Top-Down Approach

2.4 Bottom-Up Approach

2.5 Demand-Side Approach

2.6 Macroindicator-Based Approach

2.6.1 Research and Development Expenditure

2.7 Assumptions

3 Executive Summary (Page No. - 22)

4 Market Overview (Page No. - 24)

4.1 Introduction

4.2 Image Sensor Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand-Side Analysis

4.6 Vendor-Side Analysis

5 Middle East and Africa Image Sensor Market, By Technology (Page No. - 31)

5.1 Introduction

5.2 Middle East and Africa Image Sensor, Type Comparison With Parent Market

5.3 Middle East and Africa Cmos Image Sensor Technology, By Geography

5.4 Middle East and Africa Ccd Technology Market, By Geography

5.5 Middle East and Africa Contact Image Sensor Market, By Geography

5.6 Sneak View: Middle East and Africa Image Sensor Market, By Technology

6 Image Sensor Market, By Application (Page No. - 38)

6.1 Introduction

6.2 Image Sensor Market in Medical Sector, By Geography

6.3 Image Sensor Market in Medical Sector, By Application

6.4 Image Sensor Market in Endoscopy, By Geography

6.5 Image Sensor in Endoscopy, By Application

6.6 Middle East and Africa Image Sensor Market in Rigid Endoscopy,By Application

6.7 Middle East and Africa Image Sensor Market in Flexible Endoscopy,By Application

6.8 Middle East and Africa Image Sensor Market in Digital Radiology,By Geography

6.9 Middle East and Africa Image Sensor Market in Digital Radiology,By Application

6.10 Middle East and Africa Image Sensor Market in Ophthalmology,By Geography

6.11 Middle East and Africa Image Sensor Market in Ophthalmology,By Application

6.12 Middle East and Africa Image Sensor Market in Automotive Sector,By Geography

6.13 Middle East and Africa Image Sensor Market in Automotive Sectory,By Application

6.14 Middle East and Africa Image Sensor Market in Defense and Aerospace Application Sector, By Geography

6.15 Middle East and Africa Image Sensor Market in Defense and Aerospace Application Sector, By Application

6.16 Middle East and Africa Image Sensor Market in Global Visible Spectrum Image Sensors By Defense Equipment, By Application

6.17 Middle East and Africa Image Sensor Market in Consumer Sector,By Geography

6.18 Middle East and Africa Image Sensor Market in Consumer Sector,By Application

6.19 Middle East and Africa Image Sensor Market in Surveillance Sector,By Geography

6.20 Middle East and Africa Image Sensor Market in Industrial Sector,By Geography

6.21 Middle East and Africa Image Sensor Market in Industrial Sector,By Application

6.22 Middle East and Africa Image Sensor Market in Industrial Sector (Scan Types), By Application

7 Image Sensor, By Geography (Page No. - 61)

7.1 Introduction

7.2 Middle East Image Sensor Market

7.2.1 Middle East Image Sensor Market, By Application

7.2.2 Middle East Image Sensor Market, By Technology

7.3 Africa Image Sensor Market

7.3.1 Africa Image Sensor Market, By Application

7.3.2 Africa Image Sensor Market, By Type

8 Image Sensor Market Competitive Landscape (Page No. - 70)

8.1 Image Sensor Market: Company Share Analysis

8.2 Company Presence in Image Sensor Market, By Technology

8.3 New Product Development and New Launches

8.4 Mergers & Acquisitions

8.5 Agreements, Partnerships, Joint Ventures, and Collaborations

9 Company Profiles (Page No. - 77)

9.1 Omnivision Technologies Ltd.

9.2 Aptina Imaging Corporation

9.3 Samsung Electronics

9.4 Sony Corporation

9.5 Toshiba Corporation

10 Appendix (Page No. - 91)

10.1 Customization Options

10.1.1 Product Portfolio Analysis

10.1.2 Country Level Data Analysis

10.1.3 Product Comparison of Various Competitors

10.1.4 Trade Analysis

10.2 Introducing RT: Real-Time Market Intelligence

10.2.1 RT Snapshots

List of Tables (51 Tables)

Table 1 Global Image Sensor Market Size, By Technology, 2014 (USD MN)

Table 2 Middle East and Africa Image Sensor Market Size, By Application,2014 (USD MN)

Table 3 Middle East and Africa Image Sensor Market: Comparison With Parent Market, 2013 - 2019 (USD MN)

Table 4 Table 6 Middle East and Africa Image Sensor Market: Drivers and Inhibitors

Table 5 Middle East and Africa Image Sensor Market: By Application,2013 - 2019 (USD MN)

Table 6 Middle East and Africa Image Sensor Market: By Technology,2014 (USD MN)

Table 7 Middle East and Africa Image Sensor Market, By Application,2013 - 2019 (USD MN)

Table 8 Middle East and Africa Image Sensor Market, By Technology,2013 - 2019 (USD MN)

Table 9 Middle East and Africa Image Sensor Market: Type Comparison With Parent Market, 2014 - 2019 (USD MN)

Table 10 Middle East and Africa Cmos Image Sensor Technology Market,By Geography, 2013 - 2019 (USD MN)

Table 11 Middle East and Africa Ccd Technology Market, By Geography,2013 - 2019 (USD MN)

Table 12 Middle East and Africa Contact Image Sensor Technology Market,By Geography, 2013- 2019 (USD MN)

Table 13 Middle East and Africa Image Sensor Market, By Application,2013 - 2019 (USD MN)

Table 14 Middle East and Africa Image Sensor Market in Medical Sector,By Geography, 2013 - 2019 (USD MN)

Table 15 Middle East and Africa Image Sensor Market, By Medical Sector Application, 2013 - 2019 (USD MN)

Table 16 Middle East and Africa Image Sensor Market in Endoscopy, By Geography, 2013 - 2019 (USD MN)

Table 17 Middle East Image Sensor Market in Endoscopy, By Application,2013 - 2019 (USD MN)

Table 18 Middle East and Africa Image Sensor Market in Rigid Endoscopy,By Application, 2013 - 2019 (USD Thousand)

Table 19 Middle East and Africa Image Sensor Market in Flexible Endoscopy,By Application, 2013 - 2019 (USD Thousand)

Table 20 Middle East and Africa Image Sensor Market in Digital Radiology,By Geography, 2013 - 2019 (USD MN)

Table 21 Middle East and Africa Image Sensor Market in Digital Radiology,By Application, 2013 - 2019 (USD MN)

Table 22 Middle East and Africa Image Sensor Market in Ophthalmology,By Geography, 2013 - 2019 (USD Thousand)

Table 23 Middle East and Africa Image Sensor Market in Ophthalmology,By Application, 2013 - 2019 (USD Thousand)

Table 24 Middle East and Africa Image Sensor Market in Automotive,By Application, 2013 - 2019 (USD MN)

Table 25 Middle East and Africa Image Sensor Market in Defense and Aerospace Application Sector, By Geography, 2013 - 2019 (USD MN)

Table 26 Middle East and Africa Image Sensor Market in Defense and Aerospace Application Sector, By Application, 2013 - 2019 (USD MN)

Table 27 Middle East and Africa Image Sensor Market in Global Visible Spectrum Image Sensors By Defense Equipment, By Application, 2013 - 2019 (USD MN)

Table 28 Middle East and Africa Image Sensor Market in Consumer Sector,By Geography, 2013 - 2019 (USD MN)

Table 29 Middle East and Africa Image Sensor Market in Consumer Sector,By Application, 2013 - 2019 (USD Thousand)

Table 30 Middle East and Africa Image Sensor Market in Surveillance Sector,By Geography, 2013 - 2019 (USD MN)

Table 31 Middle East and Africa Image Sensor Market in Industrial Sector,By Geography, 2013 - 2019 (USD MN)

Table 32 Middle East and Africa Image Sensor Market in Industrial Sector,By Application, 2013 - 2019 (USD MN)

Table 33 Middle East and Africa Image Sensor Market in Industrial Sector (Scan Types), By Application, 2013 - 2019 (USD MN)

Table 34 Middle East and Africa Image Sensor Market, By Geography,2013 - 2019 (USD MN)

Table 35 Middle East Image Sensor Market, By Application, 2013 - 2019 (USD MN)

Table 36 Middle East Image Sensor Market, By Technology, 2013 - 2019 (USD MN)

Table 37 Africa Image Sensor Market, By Application, 2013 - 2019 (USD MN)

Table 38 Africa Image Sensor Market, By Technology, 2013 - 2019 (USD MN)

Table 39 Image Sensor Market: Company Share Analysis, 2013 (%)

Table 40 Image Sensor Market: New Product Developments and New Launches

Table 41 Image Sensor Market: Mergers & Acquisitions

Table 42 Image Sensor Market: Agreements, Partnerships, Joint Ventures, and Collaborations

Table 43 Omnivision Technologies, Ltd.: Operating Data (USD MN)

Table 44 Samsung Electronics: Annual Revenue, By Business Segments,2009 - 2013 (USD MN)

Table 45 Samsung Electronics: Annual Revenue, By Geographic Segments,2009 - 2013 (USD MN)

Table 46 Samsung Electronics: Operating Data (USD MN)

Table 47 Sony Corporation: Annual Revenue, By Business Segments,2009 - 2013 (USD MN)

Table 48 Sony Corporations: Annual Revenue, By Geography, 2009 - 2013 (USD MN)

Table 49 Sony Corporations: Operating Data (USD MN)

Table 50 Toshiba Corporation: Annual Revenue, By Business Segments,2009 - 2013 (USD MN)

Table 51 Toshiba Corporations: Operating Data (USD MN)

List of Figures (51 Figures)

Figure 1 Figure 1 Middle East and Africa Image Sensor Market: Segmentation & Coverage

Figure 2 Figure 2 Image Sensor Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand-Side Approach

Figure 7 Research and Development Expenditure

Figure 8 Middle East and Africa Image Sensor Market Snapshot

Figure 9 Figure 9 Image Sensor Market: Growth Aspects

Figure 10 Middle East and Africa Image Sensor Market, By Application, 2014 -2019

Figure 11 Middle East and Africa Image Sensor Market, By Geography, 2014 (USD MN)

Figure 12 Middle East and Africa Image Sensor Market, By Technology,2014 - 2019 (USD MN)

Figure 13 Middle East Image Sensor Market: Type Comparison With Sensor Market, 2013 - 2019 (USD MN)

Figure 14 Middle East and Africa Cmos Image Sensor Technology Market,By Geography, 2013 - 2019 (USD MN)

Figure 15 Middle East and Africa Ccd Technology Market, By Geography,2013 - 2019 (USD MN)

Figure 16 Middle East and Africa Contact Image Sensor Market, By Geography,2013 - 2019 (USD MN)

Figure 17 Sneak View: Middle East and Africa Image Sensor Market

Figure 18 Middle East and Africa Image Sensor Market, By Application,2014 - 2019 (USD MN)

Figure 19 Middle East and Africa Image Sensor Market in Medical Sector,By Geography, 2013 - 2019 (USD MN)

Figure 20 Middle East and Africa Image Sensor Market in Medical Sector,By Application, 2014 - 2019 (USD MN)

Figure 21 Middle East and Africa Image Sensor Market in Endoscopy, By Geography, 2013 - 2019 (USD MN)

Figure 22 Middle East and Africa Image Sensor Market in Endoscopy,By Application, 2014 - 2019 (USD MN)

Figure 23 Middle East and Africa Image Sensor Market in Rigid Endoscopy,By Application, 2014 - 2019 (USD Thousand)

Figure 24 Middle East and Africa Image Sensor Market in Flexible Endoscopy,By Application, 2014 - 2019 (USD Thousand)

Figure 25 Middle East and Africa Image Sensor Market in Digital Radiology,By Geography, 2013 - 2019 (USD MN)

Figure 26 the Middle East and Africa Image Sensor Market in Digital Radiology,By Application, 2014 - 2019 (USD MN)

Figure 27 Middle East and Africa Image Sensor Market in Ophthalmology,By Geography, 2013 - 2019 (USD Thousand)

Figure 28 Middle East and Africa Image Sensor Market in Ophthalmology,By Application, 2014 - 2019 (USD Thousand)

Figure 29 Middle East and Africa Image Sensor Market in Automotive Sector,By Geography, 2013 - 2019 (USD MN)

Figure 30 Middle East and Africa Image Sensor Market in Automotive Sector,By Geography, 2013 - 2019 (USD MN)

Figure 31 Middle East and Africa Image Sensor Market in Automotive Sector,By Application, 2014 - 2019 (USD MN)

Figure 32 Middle East and Africa Image Sensor Market in Defense and Aerospace Application Sector, By Geography, 2013 - 2019 (USD MN)

Figure 33 Middle East and Africa Image Sensor Market in Defense and Aerospace Application Sector, By Application, 2014 - 2019 (USD MN)

Figure 34 the Middle East and Africa Image Sensor Market in Global Visible Spectrum Image Sensors By Defense Equipment, By Application,

2014 - 2019 (USD MN) 54

Figure 35 Middle East and Africa Image Sensor Market in Consumer Application,By Geography, 2013 - 2019 (USD MN)

Figure 36 Middle East and Africa Image Sensor Market in Consumer Sector,By Application, 2014 - 2019 (USD MN)

Figure 37 Middle East and Africa Image Sensor Market Surveillance Sector,By Geography, 2013 - 2019 (USD MN)

Figure 38 Middle East and Africa Image Sensor Market in Industrial Sector,By Geography, 2013 - 2019 (USD MN)

Figure 39 Middle East and Africa Image Sensor Market in Industrial Sector,By Application, 2014 - 2019 (USD MN)

Figure 40 Middle East and Africa Image Sensor Market in Industrial Sector (Scan Types), By Application, 2014 - 2019 (USD MN)

Figure 41 Middle East and Africa Image Sensor Market: Growth Analysis,By Geography, 2014 - 2019 (USD MN)

Figure 42 Middle East Image Sensor Market Overview, 2014 and 2019 (%)

Figure 43 Middle East Image Sensor Market, By Application, 2013 - 2019 (USD MN)

Figure 44 Middle East Image Sensor Market: Application Snapshot

Figure 45 Middle East Image Sensor Market, By Technology, 2013 - 2019 (USD MN)

Figure 46 Africa Image Sensor Market Overview, 2014 and 2019 (%)

Figure 47 Africa Image Sensor Market, By Application, 2013 - 2019 (USD MN)

Figure 48 Africa Image Sensor Market: Application Snapshot

Figure 49 Africa Image Sensor, By Type, 2013 - 2019 (USD MN)

Figure 50 Image Sensor Market: Company Share Analysis, 2013 (%)

Figure 51 Image Sensor Market: Company Product Coverage, By Technology, 2013

The Middle Eastern and African image sensor market was valued at $407.1 million in 2014 and is expected to reach $676.6 million by 2019 at a CAGR of 10.7%. An image sensor is an electronic photosensitive device which is used to convert an optical image into an electronic signal. It consists of millions of photodiodes and acts as an image receiver in digital imaging equipment. It is widely used in digital cameras, camera modules, and other imaging devices.

The image sensor market in Middle East & Africa is growing due to the automotive & consumer market available in the region. The potential applications of image sensors in vehicles are growing, with estimates that in the future there are likely to be five to twenty cameras installed in cars, used in a mix of machine and human vision applications. Thus, image sensors carry a great scope in the field of automotive sector of this region.

The mobile phone camera market is based almost entirely on CMOS sensors and the large consumer market has pushed CMOS technology to the edge, including development of advanced pixels with low noise. Since the consumer electronics market holds a major share in image sensing, there will be an increase in the demand for mobile phones and other consumer electronics in the coming years in the Middle Eastern and African market.

Previously, there used to be analog sensors such as video tubes that have been replaced by mostly charge-coupled device (CCD) and complementary metal-oxide-semiconductor (CMOS) image sensors. The increasing popularity of photography among the youth is also fuelling the growth of the image sensor market.

This study has been undertaken to understand the market dynamics in the area of image sensors, the current revenue generated, and its revenue forecast. The study has been conducted to identify the key applications and geographies where huge opportunities can be expected in the coming future. Total image sensor shipments and its average selling prices have been analyzed to arrive at the final market size of the image sensor. Furthermore, image sensor revenue has also been analyzed by clubbing the revenue of the top market players involved in the development of image sensor. This is further verified after discussing with key market players.

The image sensor type market is broadly classified into CCD sensors, CMOS sensors, and Contact image sensors. CMOS image sensors accounted for the largest share of the image sensor market in 2014. The market for CMOS image sensors is expected to grow at a high rate from 2014 to 2019. This is mainly because of an increased use of CMOS sensors in consumer electronics, automotive and transportation, security and surveillance, and the industrial segment, as it is able to offer features such as low power consumption, low manufacturing cost, ease of integration, and higher frame rate. In addition, with the use of BSI technology, CMOS image sensors are able to produce better quality of images even in low light conditions and the implementation of global shutter made it possible to capture images of fast moving objects without any distortion. This results in an increased market share for CMOS image sensors.

The image sensor application market is broadly segmented into consumer electronics, automotive and transportation, aerospace and defence, healthcare, industrial, and security & surveillance. Consumer electronics held the largest share in the Middle Eastern and African image sensor market with the market size of $280.4 million in 2013 and is expected to reach $496.6 million by 2019, growing at a CAGR of 10.9% from 2014 to 2019.

Healthcare, industrial, and automotive and transportation applications are the fastest growing segments for the Middle Eastern and African image sensor market. Image sensors are becoming more popular in a wide range of industrial automation applications. Machine vision systems, robots, wafer inspections, quality checks and printed circuit boards are the key application areas which make use of image sensors. Hence, increased industrial automation will be able to drive the image sensor market in Middle East and Africa.

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement