North America Biostimulants Market by Modes of Application (Foliar, Seed, Soil) by Active Ingredient (Extracts, Acids, Others) by End-User (Row Crops, Fruits & Vegetables, Turfs & Ornamentals) by Geography -Analysis & Forecast To 2019

The North American biostimulants market is estimated to grow at a CAGR of 14.1% during the forecast period of 2014 to 2019. Plant biostimulants contain substance(s) and/or micro-organisms whose function when applied to plants or the rhizosphere is to stimulate natural processes to enhance/benefit nutrient uptake, nutrient efficiency, tolerance to abiotic stress, and crop quality. Biostimulants have no direct action against pests, and therefore do not fall within the regulatory framework of pesticides.

The North American biostimulants market has evolved into a major agricultural input for sustainable crop production. Humic acids, fulvic acids, amino acids, and so on are the different types of commonly used biostimulants. Cost to produce biostimulants depends on the technology used and amount of R&D expenditure in it.

The North American biostimulants market is dominated by the U.S., followed by Canada. The requirement for crops of high yield and quality, and evolving agricultural practices and precision farming are driving the consumption of biostimulants in the U.S. market. The increase in the cost of synthetic fungicides and pesticides, along with the rising awareness regarding balanced nutrition of plants, is expected to have positive impacts on the U.S. biostimulants market. The U.S. is slowly adopting biostimulants as seed treatments to strengthen the crop’s vigor at an early stage of development.

The North American biostimulants market is a competitive market, with many firms such as Taminco Corp. (Belgium), Isagro S.p.A (Italy), Valagro S.p.A (Italy), Koppert B.V. (Netherlands), and Italopolina S.p.A (Italy), among others, expanding their market shares in the North American region. To gain a significant market share, these companies are adopting numerous market strategies including innovative product developments, partnerships, mergers & acquisitions, and expansion of existing facilities. Apart from these companies, there are a large numbers of small firms present in the North American biostimulants market.

Scope of the Report

This research report categorizes the North American biostimulants market into the following segments and sub segments:

North American Biostimulants Market, By Active Ingredient

- Acids

- Humic acids

- Fulvic acids

- Amino Acids

- Extracts

- Seaweed

- Other Plant Extracts

North American Biostimulants Market, By Crop Type

- Turf & Ornamental Crops

- Row Crops

- Fruits & Vegetables

- Others

North America Biostimulants Market, By Geography

- U.S.

- Canada

- Mexico

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Integrated Ecosystem of Biostimulants Market

2.2 Arriving at the Biostimulants Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 21)

4 Market Overview (Page No. - 23)

4.1 Introduction

4.2 Biostimulant Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

4.6 Vendor Side Analysis

5 North America Biostimulants Market, By Mode of Application (Page No. - 33)

5.1 Introduction

5.2 Biostimulants in Foliar Function, By Geography

5.3 Biostimulants in Soil Function, By Geography

5.4 Biostimulants in Seed Function, By Geography

6 North America Biostimulants Market, By End-User (Page No. - 41)

6.1 Introduction

6.2 Demand Side Analysis

6.3 Biostimulants in RoW Crops, By Geography

6.4 Biostimulants in Fruits and Vegetables, By Geography

6.5 Biostimulants in Turfs and Ornamentals, By Geography

7 North America Biostimulants Market, By Active Ingredients (Page No. - 49)

7.1 Introduction

7.2 North America Biostimulants Market: Active Ingredients Comparison With Agricultural Biologicals Market

7.3 North America Acid Based Biostimulants Market, By Geography

7.4 North America Extract Based Biostimulants Market, By Geography

7.5 Sneak View: North America Agricultural Biologicals Market, By Active Ingredient

8 North America Biostimulants Market, By Geography (Page No. - 57)

8.1 Introduction

8.2 U.S. Biostimulants Market

8.2.1 U.S. Biostimulants Market, By Mode of Application

8.2.2 U.S. Biostimulants Market, By End-User

8.2.3 U.S. Biostimulants Market, By Active Ingredients

8.3 Canada Biostimulants Market

8.3.1 Canada Biostimulants Market, By Mode of Application

8.3.2 Canada Biostimulants Market, By End-User

8.3.3 Canada Biostimulants Market, By Active Ingredient

8.4 Mexico Biostimulants Market

8.4.1 Mexico Biostimulants Market, By Mode of Application

8.4.2 Mexico Biostimulants Market, By End-User

8.4.3 Mexico Biostimulants Market, By Active Ingredient

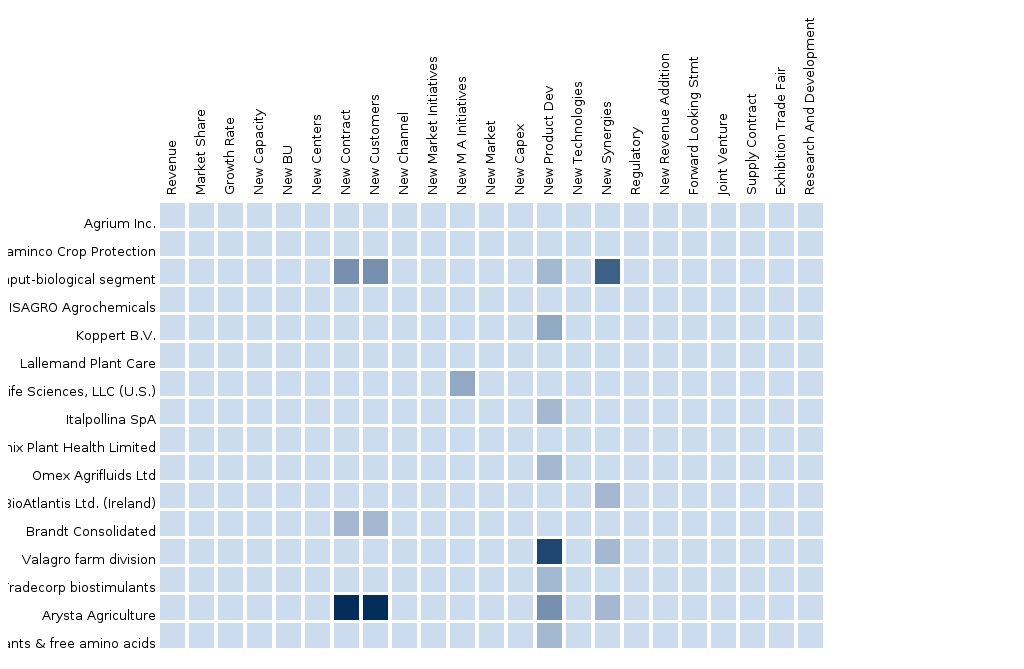

9 North America Biostimulants Market: Competitive Landscape (Page No. - 81)

9.1 North America Biostimulants Market: Company Share Analysis

9.2 Company Presence in Biostimulants Market, By Type

9.3 Mergers & Acquisitions

9.4 Expansions

9.5 Investments

9.6 Joint Ventures

10 North America Biostimulants Market, By Company (Page No. - 87)

(Overview, Financials, Products & Services, Strategy, and Developments)*

10.1 Isagro S.P.A

10.2 Taminco Corporation

10.3 Valagro S.P.A

10.4 Koppert B.V.

10.5 Biostadt India Limited

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

11 Appendix (Page No. - 100)

11.1 Customization Options

11.1.1 Technical Analysis

11.1.2 Low-Cost Sourcing Locations

11.1.3 Regulatory Framework

11.1.4 Biostimulants Usage Data

11.1.5 Impact Analysis

11.1.6 Trade Analysis

11.1.7 Historical Data and Trends

11.2 Related Reports

11.3 Introducing RT: Real Time Market Intelligence

11.3.1 RT Snapshots

List of Tables (66 Tables)

Table 1 Global Biostimulants Peer Market Size, 2014 (USD MN)

Table 2 North America Biostimulants End-User Markets, 2014 (USD MN)

Table 3 North America Biostimulants Market: Macroindicator,By Geography, 2014 (MN HA)

Table 4 North America Biostimulants Market: Comparison With Parent Market, 2013–2019 (USD MN)

Table 5 North America Biostimulants Market: Comparison With Parent Market, 2013–2019 (000’HA)

Table 6 North America Biostimulants Market: Drivers and Inhibitors

Table 7 North America Biostimulants Market, By Mode of Application,2013-2019 (USD MN)

Table 8 North America Biostimulants Market, By Mode of Application,2013-2019 (000’HA)

Table 9 North America Biostimulants Market, By Active Ingredients,2013-2019 (USD MN)

Table 10 North America Biostimulants Market, By Active Ingredients,2013-2019 (000’HA)

Table 11 North America Biostimulants Market, By Geography, 2013-2019 (USD MN)

Table 12 North America Biostimulants Market, By Geography, 2013-2019 (000’HA)

Table 13 North America Biostimulants Market: Comparison With End-User Markets, 2013-2019 (USD MN)

Table 14 North America Biostimulants Market, By Mode of Application,2013-2019 (USD MN)

Table 15 North America Biostimulants: Market, By Mode of Application,2013-2019 (000’HA)

Table 16 North America Biostimulants in Foliar Function, By Geography,2013-2019 (USD MN)

Table 17 North America Biostimulants in Foliar Function, By Geography,2013-2019 (000’HA)

Table 18 North America Biostimulants in Soil Function, By Geography,2013-2019 (USD MN)

Table 19 North America Biostimulants in Soil Function, By Geography,2013-2019 (000’HA)

Table 20 North America Biostimulants in Seed Function, By Geography,2013-2019 (USD MN)

Table 21 North America Biostimulants in Seed Function, By Geography,2013-2019 (000’HA)

Table 22 North America Biostimulants Market, By End-User, 2013-2019 (USD MN)

Table 23 North America Biostimulants: Market, By End-User, 2013-2019 (000’HA)

Table 24 North America Biostimulants in RoW Crops, By Geography,2013-2019 (USD MN)

Table 25 North America Biostimulants in RoW Crops, By Geography,2013-2019 (000’HA)

Table 26 North America Biostimulants in Fruits and Vegetables, By Geography, 2013-2019 (USD MN)

Table 27 North America Biostimulants in Fruits and Vegetables, By Geography, 2013-2019 (000’HA)

Table 28 North America Biostimulants in Turfs and Ornamentals, By Geography, 2013-2019 (USD MN)

Table 29 North America Biostimulants in Turfs and Ornamentals, By Geography, 2013-2019 (000’HA)

Table 30 North America Biostimulants Market, By Active Ingredient,2013-2019 (USD MN)

Table 31 North America Biostimulants Market, By Active Ingredient,2013-2019 (000’HA)

Table 32 North America Biostimulants Market: Active Ingredients Comparison With Agricultural Biologicals Market, 2013–2019 (USD MN)

Table 33 North America Acid Based Biostimulants Market, By Geography,2013–2019 (USD MN)

Table 34 North America Acid Based Biostimulants Market, By Geography,2013–2019 (000’HA)

Table 35 North America Extract Based Biostimulants Market, By Geography,2013-2019 (USD MN)

Table 36 North America Extract Based Biostimulants Market, By Geography,2013-2019 (000’HA)

Table 37 North America Biostimulants Market, By Geography, 2013-2019 (USD MN)

Table 38 North America Biostimulants Market, By Geography, 2013-2019 (000’HA)

Table 39 U.S. Biostimulants Market, By Mode of Application, 2013-2019 (USD MN)

Table 40 U.S. Biostimulants Market, By Mode of Application, 2013-2019 (000’HA)

Table 41 U.S. Biostimulants Market, By End-User, 2013-2019 (USD MN)

Table 42 U.S. Biostimulants Market, By End-User, 2013-2019 (000’HA)

Table 43 U.S. Biostimulants Market, By Active Ingredient, 2013-2019 (USD MN)

Table 44 U.S. Biostimulants Market, By Active Ingredient, 2013-2019 (000’HA)

Table 45 Canada Biostimulants Market, By Mode of Application, 2013-2019 (USD MN)

Table 46 Canada Biostimulants Market, By Mode of Application, 2013-2019 (000’HA)

Table 47 Canada Biostimulants Market, By End-User, 2013-2019 (USD MN)

Table 48 Canada Biostimulants Market, By End-User, 2013-2019 (000’HA)

Table 49 Canada Biostimulants Market, By Active Ingredient, 2013-2019 (USD MN)

Table 50 Canada Biostimulants Market, By Active Ingredient, 2013-2019 (000’HA)

Table 51 Mexico Biostimulants Market, By Mode of Application, 2013-2019 (USD MN)

Table 52 Mexico Biostimulants Market, By Mode of Application, 2013-2019 (000’HA)

Table 53 Mexico Biostimulants Market, By End-User, 2013-2019 (USD MN)

Table 54 Mexico Biostimulants Market, By End-User, 2013-2019 (000’HA)

Table 55 Mexico Biostimulants Market, By Active Ingredient, 2013-2019 (USD MN)

Table 56 Mexico Biostimulants Market, By Active Ingredient, 2013-2019 (000’HA)

Table 57 North America Biostimulants Market: Company Share Analysis, 2014 (%)

Table 58 North America Biostimulants Market: Mergers & Acquisitions

Table 59 North America Biostimulants Market: Expansions

Table 60 North America Biostimulants Market: Investments

Table 61 North America Biostimulants Market: Joint Ventures

Table 62 Isagro S.P.A: Annual Revenue, By Geography, 2009–2013 (USD MN)

Table 63 Isagro S.P.A: Annual Revenue, 2009–2013 (USD MN)

Table 64 Taminco Corporation: Key Operations Data, 2010-2014 (USD MN)

Table 65 Taminco Corporation: Key Financials, By Business Segment,2010-2014 (USD MN)

Table 66 Taminco Corporation: Key Financials, By Geographical Segment,2010-2014 (USD MN)

List of Figures (55 Figures)

Figure 1 North America Biostimulants Market: Segmentation & Coverage

Figure 2 Biostimulants Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macroindicator-Based Approach

Figure 8 North America Biostimulants Market: Snapshot

Figure 9 Biostimulants Market: Growth Aspects

Figure 10 North America Biostimulants Market, By Mode of Application, 2014 vs 2019

Figure 11 North America Biostimulants Active Ingredients, By Geography,2014 (USD MN)

Figure 12 North America Biostimulants Market: Growth Analysis, By Active Ingredients, 2014–2019 (%)

Figure 13 Biostimulants: Mode of Application Market Scenario

Figure 14 North America Biostimulants Market, By Mode of Application,2014-2019 (USD MN)

Figure 15 North America Biostimulants Market, By Mode of Application,2014-2019 (000’HA)

Figure 16 North America Biostimulants Market in Foliar Function, By Geography, 2013-2019 (USD MN)

Figure 17 North America Biostimulants Market in Soil Function, By Geography, 2013-2019 (USD MN)

Figure 18 North America Biostimulants Market in Seed Function, By Geography, 2013-2019 (USD MN)

Figure 19 North America Biostimulants Market, By End-User, 2014-2019 (USD MN)

Figure 20 North America Biostimulants Market, By End-User, 2014-2019 (000’HA)

Figure 21 North America Biostimulants Market in RoW Crops, By Geography,2013-2019 (USD MN)

Figure 22 North America Biostimulants Market in Fruits and Vegetables,By Geography, 2013-2019 (USD MN)

Figure 23 North America Biostimulants Market in Turfs and Ornamentals,By Geography, 2013-2019 (USD MN)

Figure 24 North America Biostimulants Market, By Active Ingredient,2013-2019 (USD MN)

Figure 25 North America Biostimulants Market, By Active Ingredient,2014 & 2019 (000’HA)

Figure 26 North America Biostimulants Market: Active Ingredients Comparison With Agricultural Biologicals Market, 2013–2019 (USD MN)

Figure 27 North America Acid Based Biostimulants Market, By Geography,2013–2019 (USD MN)

Figure 28 North America Extract Based Biostimulants Market, By Geography,2013-2019 (USD MN)

Figure 29 North America Biostimulants Market: Growth Analysis, By Geography, 2014-2019 (USD MN)

Figure 30 North America Biostimulants Market: Growth Analysis, By Geography, 2014-2019 (000’HA)

Figure 31 U.S. Biostimulants Market Overview, 2014 & 2019 (%)

Figure 32 U.S. Biostimulants Market, By Mode of Application, 2013-2019 (USD MN)

Figure 33 U.S. Biostimulants Market: Mode of Application Snapshot

Figure 34 U.S. Biostimulants Market, By End-User, 2013-2019 (USD MN)

Figure 35 U.S. Biostimulants Market: End-User Snapshot

Figure 36 U.S. Biostimulants Market, By Active Ingredients, 2013-2019 (USD MN)

Figure 37 U.S. Biostimulants Market Share, By Active Ingredients, 2014-2019 (%)

Figure 38 Canada Biostimulants Market Overview, 2014 & 2019 (%)

Figure 39 Canada Biostimulants Market, By Mode of Application, 2013-2019 (USD MN)

Figure 40 Canada Biostimulants Market: Mode of Application Snapshot

Figure 41 Canada Biostimulants Market, By End User, 2013-2019 (USD MN)

Figure 42 Canada Biostimulants Market: End-User Snapshot

Figure 43 Canada Biostimulants Market, By Active Ingredient, 2013-2019 (USD MN)

Figure 44 Canada Biostimulants Market Share, By Active Ingredients, 2013-2019 (%)

Figure 45 Mexico Biostimulants Market Overview, 2014 & 2019 (%)

Figure 46 Mexico Biostimulants Market, By Mode of Application, 2013-2019 (USD MN)

Figure 47 Mexico Biostimulants Market: Mode of Application Snapshot

Figure 48 Mexico Biostimulants Market, By End-User, 2013-2019 (USD MN)

Figure 49 Mexico Biostimulants Market: End-User Snapshot

Figure 50 Mexico Biostimulants Market, By Active Ingredient, 2013-2019 (USD MN)

Figure 51 Mexico Biostimulants Market Share, By Active Ingredient, 2014-2019 (%)

Figure 52 North America Biostimulants Market: Company Share Analysis, 2014(%)

Figure 53 Biostimulants: Company Product Coverage, By Type, 2014

Figure 54 Isagro S.P.A Revenue Mix, By Geography 2013 (%)

Figure 55 Taminco Corporation Revenue Mix, 2014 (%)

The growth of the biostimulants market in North America has been driven by the strong initiatives to support organic farming and enhanced product vitality through innovative production technologies. The North American biostimulants market is projected to continue its steady growth in the coming years. Factors such as toxicity of agrochemicals increase the need for environment-friendly and innovative production methods; moreover, the advent of agriculture modernization has turned the market’s attention towards biostimulants. The positive growth rate of the market is induced by the discovery and development of natural active ingredients.

The purpose of this study is to analyze the North American biostimulants market. This report includes revenue forecasts, market trends, and opportunities for the period from 2014 to 2019. The analysis has been conducted on the various market segments derived on the basis of end-use applications of biostimulants and biostimulants types. The major active ingredients considered in the analysis are acids and extracts. The major end-users of biostimulants include row crops, fruits & vegetables, and turfs & ornamentals, among others.

The North American biostimulants market was valued at $313.0 million in 2014 and is projected to reach $605.1 million by 2019, at a CAGR of 14.1% from 2014 to 2019. The market, by active ingredients, was led by the acid-based biostimulants segment in 2014, with a share of 54.4% in 2014.

The major companies profiled in the market report include Taminco Corp. (Brazil), Isagro S.p.A (Italy), Valagro S.p.A (Italy), Koppert NV (Netherlands), and Biostadt India Ltd. (India). These companies have adopted the strategies of mergers & acquisitions, partnerships, and collaborations to strengthen and sustain their positions in the North American biostimulants market.

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Europe Agriculture Biologicals Market Biologicals-Europe and Agriculture Biopesticides Market, Bio... |

Upcoming |

|

Asia-Pacific Agriculture Biologicals Market Biologicals-Asia and Agriculture Biopesticides Market, Bio... |

Upcoming |

|

Latin America Agriculture Biologicals Market Biologicals-Latin America and Agriculture Biopesticides Market, Bio... |

Apr 2015 |

|

North America Agriculture Biologicals Market The North America agriculture biologicals market was valued at $1,409.07 million in 2014 and is projected to reach $2,758.24 million by 2019 at a CAGR of 14.4% during the forecast period. The market, by application is led by cereals and grains in 2014. In North America, U.S. has the largest share in the agriculture biologicals market. It constitutes of 72.47% of North America agriculture biologicals market. The biopesticides are mostly consumed in North America than other biological types. |

May 2015 |