North America Bromine Market By Application (Flame Retardants, Oil & Gas Drilling, Biocides, Medicinal, Hbr Flow Battery, Plasma Etching, PTA Synthesis), By Derivatives (Organobromines, Brine Fluids, and Hydrogen Bromide) & Country -Trends & Forecasts 2019

The North American bromine market, along with its end products, has witnessed linear growth in the past few years, which is estimated to increase in the near future. Bromine is a volatile and heavy liquid element at room temperature. Bromine and its derivatives are extracted from seawater, salt lakes, and brine wells. It is one of the basic organic chemical raw materials widely used in oil & gas, textile, automotive, construction, agricultural, electronics, water treatment, furnishing, and ship building.

The stringent fire safety regulations and growing demand of clear brine fluid are the major drivers for the demand of bromine in North America. The U.S. is the largest producer of natural gas in the world, with shale gas production also increasing at a brisk pace in the country. This will result in the increased demand for clear brine fluids in the country.

The bromine market is experiencing enormous growth, which is expected to continue in the near future and intense efforts at country level. The consumption of brine fluids is increasing in North America, as the region is witnessing increased oil & gas drilling activities that are expected to increase in the country owing to the growing demand for natural gas in North America.

Considerable amounts of investments are made by various market players to serve the end-user applications industry in future. The North American region of the bromine market accounted for about 30% of the market share of the total global demand in 2014. The demand for bromine is expected to be moderate in North America. This can be attributed to the increasing consumption of bromine derivatives in automotive, oil & gas, water treatment, electronics, and fine chemicals industries in the North American region.

The drivers of the industry are stringent fire safety regulations and the growing demand for clear brine fluid. The consumption of brine fluids is increasing in North America, as the region is witnessing increased oil & gas drilling activities. Flame retardants are very important chemicals in the manufacturing industries. The textile, plastic & rubber manufacturing, automotive, and furnishing industries uses flame retardants to minimize fire hazards in the commodities.

This study aims to estimate the North American market of bromine for 2014 and to project its demand by 2019. This market research study provides a detailed qualitative and quantitative analysis of the North America bromine market. We have used various secondary sources such as encyclopedia, directories, industry journals, and databases to identify and collect information useful for this extensive commercial study of the North America bromine market. The primary sources – experts from related industries and suppliers - have been interviewed to obtain and verify critical information as well as to assess the future prospects of the bromine market.

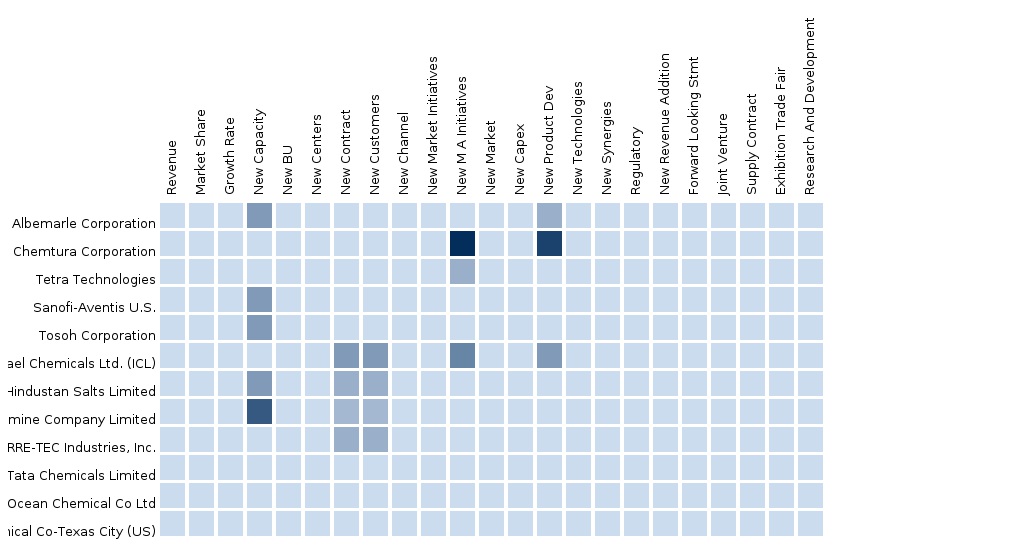

Competitive scenarios of top players in the North America bromine market have been discussed in detail. We have also profiled leading players of this industry with their recent developments and other strategic industry activities. These include key Bromine manufacturers such as Albemarle (U.S), Israel Chemical Ltd. (Israel), Chemtura Corporation (U.S), Tetra Technologies (Texas), Jordan Bromine Company (Amman, Jordan), and others.

Scope of the report:

This research report categorizes the global market for bromine on the basis of applications, end-user industries, and geography along with forecasting volume, value, and analyzing trends in each of the submarkets.

On the basis of derivatives:

- Organobromine

- Brine Fluids

- Hydrobromic Acid

On the basis of applications:

- Flame Retardants

- Biocides

- Oil & Gases

- Medicinals

- PTA synthesis

- Plasma Etching

- Others

Each application has been described in detail in the report with volume and revenue forecasts for each application.

On the basis of geography:

- U.S.

- Canada

- Mexico

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of Bromine Market

2.2 Arriving at the Bromine Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.3 Assumptions

3 Executive Summary (Page No. - 18)

4 Market Overview (Page No. - 20)

4.1 Introduction

4.2 Market Drivers and Inhibitors

4.3 Key Market Dynamics

4.4 Demand Side Analysis

5 Bromine Market, By Derivative (Page No. - 27)

5.1 Introduction

5.2 North America Organobromine Market, By Country

5.3 North America Organobromine Market, By Application

5.4 North America Brine Fluid Market, By Country

5.5 North America Brine Fluid Market, By Application

5.6 North America Hydrobromic Acid Market, By Country

5.7 North America Hydrobromic Acid Market, By Application

6 Bromine Market, By Country (Page No. - 40)

6.1 Introduction

6.2 U.S. Bromine & Derivatives Market

6.2.1 U.S. Bromine Market, By Derivative

6.3 Canada Bromine Market

6.3.1 Canada Bromine Market, By Derivative

6.4 Mexico Bromine Market

6.4.1 Mexico Bromine Market, By Derivative

7 Bromine Market: Competitive Landscape (Page No. - 49)

7.1 Bromine Market: Company Share Analysis

7.2 Company Presence in Bromine Market, By Derivative

7.3 Mergers & Acquisitions

7.4 Expansions

7.5 Joint Ventures

7.6 New Product Development

7.7 Others

8 Bromine Market, By Company (Page No. - 53)

8.1 Albemarle Corporation

8.2 Israel Chemical Ltd.

8.3 Chemtura Corporation.

8.4 Tetra Technologies

8.5 Jordan Bromine Company

9 Appendix (Page No. - 68)

9.1 Customization Options

9.1.1 Technical Analysis

9.1.2 Low-Cost Sourcing Locations

9.1.3 Regulatory Framework

9.1.4 Impact Analysis

9.1.5 Trade Analysis

9.2 Related Reports

9.3 Introducing RT: Real Time Market Intelligence

9.3.1 RT Snapshots

List of Tables (42 Tables)

Table 1 North America Bromine Market Size, 2014 (USD MN)

Table 2 North America Bromine Market, 2013 (KT)

Table 3 North America Bromine Market: Drivers and Inhibitors

Table 4 North America Bromine Market, By Derivatives, 2013 - 2019 (USD MN)

Table 5 North America Bromine Market, By Derivatives, 2013 - 2019 (KT)

Table 6 North America Bromine Market, By Derivative, 2013 - 2019 (USD MN)

Table 7 North America Bromine Market, By Derivative, 2013 - 2019 (KT)

Table 8 North America Bromine Market, By Country, 2013 - 2019 (USD MN)

Table 9 North America Bromine Market, By Country, 2013 - 2019 (KT)

Table 10 North America Bromine Market: Derivative Markets, 2013 - 2019 (USD MN)

Table 11 North America Brominemarket, By Derivative, 2013 - 2019 (USD MN)

Table 12 North America Bromine Market, By Derivative, 2013 - 2019 (KT)

Table 13 North America Organobromine Market, Bycountry, 2013–2019 (USD MN)

Table 14 North America Organobromine Market, Bycountry, 2013–2019 (KT)

Table 15 North America Organobromine Market,By Application, 2013 - 2019 (USD MN)

Table 16 North America Organobromine Market, By Application, 2013 - 2019 (KT)

Table 17 North America Brine Fluid Market, By Country, 2013 - 2019 (USD MN)

Table 18 North America Brine Fluid Market, Bycountry, 2013 - 2019 (KT)

Table 19 North America Brine Fluid Market, By Application, 2013 - 2019 (USD MN)

Table 20 North America Brine Fluid Market, By Application, 2013 - 2019 (KT)

Table 21 North America Hydrobromic Acid Market, Bycountry, 2013 - 2019 (USD MN)

Table 22 North America Hydrobromic Acid Market, Bycountry, 2013 – 2019 (KT)

Table 23 North America Hydrobromic Market, By Application, 2013 - 2019 (USD MN)

Table 24 North America Hydrobromic Market, By Application, 2013 - 2019 (KT)

Table 25 North America Bromine Market, By Country, 2013 - 2019 (USD MN)

Table 26 North America Bromine Market, By Country, 2013 - 2019 (KT)

Table 27 U.S. Bromine Market, By Derivative, 2013 - 2019(USD MN)

Table 28 U.S. Bromine Market, By Derivative, 2013 - 2019 (KT)

Table 29 Canada Bromine Market, By Derivative, 2013 - 2019 (USD MN)

Table 30 Canada Bromine Market, By Derivative, 2013 - 2019 (KT)

Table 31 Mexico Bromine Market, By Derivative, 2013-2019(USD MN)

Table 32 Mexico Bromine Market, By Derivative, 2013 - 2019 (KT)

Table 33 Bromine Market: Company Share Analysis, 2013 (%)

Table 34 North America Bromine Market: Mergers & Acquisitions

Table 35 North America Bromine Market: Expansions

Table 36 North America Bromine Market: Joint Ventures

Table 37 North America Bromine Market: New Product Development

Table 38 North America Bromine Market: Others

Table 39 Albemarle Corporation: Key Financials, 2009 - 2013 (USD MN)

Table 40 Israel Chemical Ltd.: Key Financials, 2009 - 2013 (USD MN)

Table 41 Chemtura Corporation of Saskatchewan, Inc.: Key Financials, 2009 - 2013 (USD MN)

Table 42 Tetra Technologies: Key Financials, 2009 - 2013 (USD MN)

List of Figures (40 Figures)

Figure 1 North America Bromine Market: Segmentation & Coverage

Figure 2 Bromine Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 North America Bromine Market Snapshot

Figure 8 Bromine Market: Growth Aspects

Figure 9 North America Bromine Market, By Application, 2014 Vs 2019

Figure 10 North America Bromine Market, By Country, 2014 (USD MN)

Figure 11 North America Bromine Market: Growth Analysis, By Derivatives, 2013 – 2019 (%)

Figure 12 North America Bromine, By Derivatives, 2014 - 2019 (USD MN)

Figure 13 North America Bromine Market, By Derivative, 2014 & 2019 (KT)

Figure 14 North America Organobromine Market, By Country, 2013–2019 (USD MN)

Figure 15 North America Organobromine Market,By Application, 2013 - 2019 (USD MN)

Figure 16 North American Organobromine Market: Application Snapshot

Figure 17 North America Brine Fluid, Bycountry, 2013 - 2019 (USD MN)

Figure 18 North America Brine Fluid Market, By, Application 2013 - 2019 (USD MN)

Figure 19 North American Brine Fluid Market: Application Snapshot

Figure 20 North America Hydrobromic Acid Market, By Country, 2013 - 2018 (USD MN)

Figure 21 North America Hydrobromic Acid Market,Byapplication, 2013 - 2019 (USD MN)

Figure 22 North American Hydrobromic Market: Application Snapshot

Figure 23 North America Bromine Market: Growth Analysis,By Country, 2014-2019 (USD MN)

Figure 24 North America Bromine Market: Growth Analysis,By Country, 2013-2019 (KT)

Figure 25 U.S. Bromine Market Overview, 2014 & 2019 (%)

Figure 26 U.S. Bromine Market, By Derivative, 2013 - 2019 (USD MN)

Figure 27 Canada Bromine Market Overview, 2014 & 2019 (%)

Figure 28 Canada Bromine Market, By Derivative, 2013 - 2019 (USD MN)

Figure 29 Mexico Bromine Market Overview, 2014 & 2019 (%)

Figure 30 Mexico Bromine Market, By Derivative, 2013 – 2019 (USD MN)

Figure 31 Bromine Market: Company Share Analysis, 2014 (%)

Figure 32 Bromine: Company Product Coverage, By Derivative, 2014

Figure 33 Albemarle Corporation: Reveue Mix, 2013 (%)

Figure 34 Contribution of Fine Chemistry Segment Towards Company Revenues, 2009-2013 (USD MN)

Figure 35 Israel Chemical Limited: Revenue Mix, 2013 (%)

Figure 36 Contribution of Industrial Product Segment Towards Company Revenues, 2009-2013 (USD MN)

Figure 37 Chemtura Corporation Revenue Mix, 2013 (%)

Figure 38 Contribution of Industrial Engineered Products Segment Towards Company Revenues, 2009-2013 (USD MN)

Figure 39 Tetra Technologies; Revenue Mix, 2013 (%)

Figure 40 Contribution of Fluids, Filtration, Tools & Services Segment Towards Company Revenues, 2008-2013 (USD MN)

Bromine is a volatile and heavy liquid element at room temperature. It is of brownish-red color and dissolves in water. Bromine is extracted from seawater, salt lakes, and brine wells.

There are three major derivatives of bromine, namely organobromine, clear brine fluid, and hydrogen bromide or hydrobromic acid. The market share of organobromines is the largest across all the regional bromine markets. The flame retardants segment is largest contributor in the North America bromine applications market. Bromine & its derivatives are mainly used for applications such as flame retardants, drilling fluids, biocides, pharmaceutical formulations, plasma etching, PTA synthesis, fumigants, HBr flow batteries, and disinfectants. The major end-user industries of bromine include oil & gas, textile, automotive, construction, agricultural, electronics, water treatment, furnishing, and ship building.

The North American bromine market, in terms of value, is projected to reach $1,995.5 million by 2019 from $1,193.5 million in 2014, at a CAGR of 10.8% from 2014 to 2019. The rising demand for clear brine fluid; the growing automotive industries; growing environmental and public health concerns; and continuous advancements in bromine products and are some of the key factors driving the market growth. On the other hand, the decline in the demand for methyl bromide, and the declining use of Penta-BDE, Octa-BDE, and Deca-BDE are expected to restrain the market growth in the coming years.

The North American region covers 30% of the global bromine market, in terms of value. The U.S. is a key market for bromine & its derivatives in the North American region. The organobromine segment held a larger share of 72% of the bromine derivatives market, in 2014. This segment would continue to dominate the market in the coming years, although the brine fluid segment is projected to grow at a faster CAGR during the forecast period of 2014 to 2019.

The key players in the North America bromine market include Albemarle (U.S), Israel Chemical Ltd. (Israel), Chemtura Corporation (U.S), Tetra Technologies (U.S.), and Jordan Bromine Company (Amman, Jordan), among others.

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement