North America Dermatology Diagnostic Devices Market by Diagnostic Device (Dermatoscope, Microscope, Imaging Techniques), by Treatment Device (Liposuction, Microdermabrasion, Lasers), by Application - Forecast to 2019

The global healthcare industry is witnessing a major transformation towards non-invasive diagnostics, which helps in easy and painless diagnosis. Dermatology diagnostic devices aid in the easy detection of various skin disorders such as melanoma. There are various kinds of diagnostic devices, of which the most widely used devices by dermatologists are digital photography tools and dermatoscopes. By projecting light on to the skin and thereby magnifying the skin structure, dermatoscopes help in better diagnosis. Digital photography, on the other hand, involves the total cutaneous imaging of skin lesions, with serial images that are recorded over a period of time, which are then further analyzed.

The dermatology diagnostic devices market is segmented based on type, which includes dermatoscopes, imaging techniques, and microscopes. The dermatology diagnostic devices market is dominated by imaging techniques, which commands over 83.1% of the market in the North American region, and is expected to grow at a CAGR of 8.0% during the forecast period (2014 to 2019). This large share is primarily due to device’s ability to detect advanced stages of melanoma. The microscopes market, on the other hand, is the fastest-growing market, at a CAGR of 9.1% during the forecast period. The dermatoscopes market is further divided into traditional and digital dermatoscopes, of which traditional dermatoscopes command the largest share of over 58.0%. On the other hand, imaging techniques are further classified into ultrasound, CT, MRI, and OCT, of which the ultrasound market has the largest market share of over 48.5%.

In the North American region, the U.S. dominated the dermatology diagnostic devices market, registering around 89.3% in 2014, followed by Europe. Mexico is the fastest-growing region and is expected to grow at a CAGR of 9.8% during the forecast. This is due to the increasing demand for dermatologists and growing awareness of skin disorders in this region.

In-depth market share analysis, by revenue, of the top companies is also included in the report. These numbers are arrived at based on key facts; annual financial information from SEC filings and annual reports; and interviews with industry experts and key opinion leaders such as CEOs, directors, and marketing executives. A detailed market share analysis of the major players in the North American dermatology diagnostic devices market is also covered in this report. The major companies in this market include GE Healthcare (U.K.), Siemens Healthcare (Germany), Philips Healthcare (Netherlands), Toshiba Medical Systems (Japan), Heine Optotechnik (Germany), Carl Zeiss Meditec AG (Germany), Bruker Corporation (U.S.), Welch Allyn (U.S.), Nikon Corporation (Japan), and Leica Microsystems (Germany).

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of Dermatology Diagnostic Devices Market

2.2 Arriving at the Dermatology Diagnostics Devices Market:Market Size

2.2.1 Top-Down Approach

2.2.2 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 17)

4 Market Overview (Page No. - 19)

4.1 Introduction

4.2 North American Dermatology Diagnostic Devices Market: Comparison With Parent Market (Dermatology Devices)

4.3 Market Drivers and Inhibitors

5 North American Dermatology Diagnostic Devices Market, By Type (Page No. - 22)

5.1 Diagnostic Devices

5.1.1 Introduction

5.1.2 Dermatoscopes

5.1.3 Microscopes

5.1.4 Imaging Techniques

6 North American Dermatology Diagnostic Devices Market, By Geography (Page No. - 29)

6.1 Introduction

6.2 U.S. Dermatology Diagnostic Devices Market

6.2.1 U.S. Dermatology Diagnostic Devices Market, By Type

6.2.2 U.S. Dermatology Imaging Techniques Market, By Type

6.2.3 U.S. Dermatoscopes Market, By Type

6.3 Canada Dermatology Diagnostic Devices Market

6.3.1 Canada Dermatology Diagnostic Devices Market, By Type

6.3.2 Canada Dermatology Imaging Techniques Market, By Type

6.3.3 Canada Dermatoscopes Market, By Type

6.4 Mexico Dermatology Dianostic Devices Market

6.4.1 Mexico Dermatology Imaging Techniques Market, By Type

6.4.2 Mexico Dermatoscopes Market, By Type

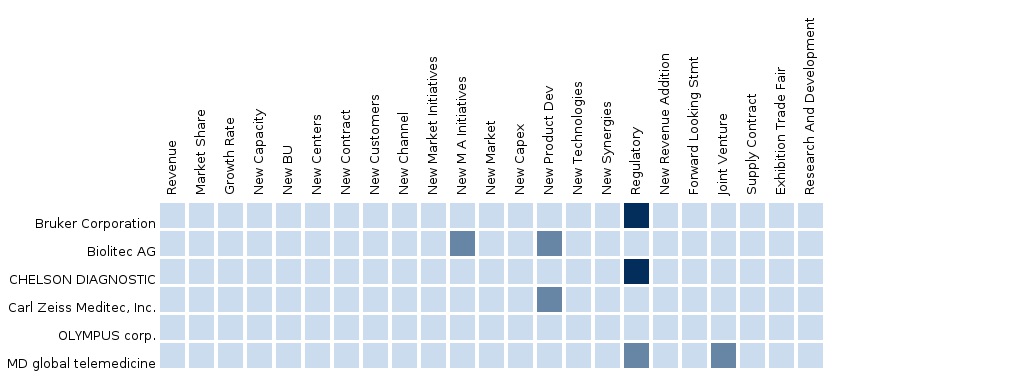

7 Dermatology Diagnostic Devices Market: Competitive Landscape (Page No. - 42)

7.1 Dermatology Diagnostic Devices Market: By Company

7.2 Mergers & Acquisitions

7.3 Expansions

7.4 Agreements

7.5 Approvals

7.6 New Technology/Product Launches

8 Dermatology Diagnostic Devices Market, By Company (Page No. - 47)

(Overview, Financials, Products & Services, Strategy, and Developments)*

8.1 Amd Global Telemedicine Inc.

8.2 Carl Zeiss Meditec AG

8.3 Fei Company

8.4 Fotofinder Systems GMBH

8.5 Leica Microsystems

8.6 Michelson Diagnostics Ltd.

8.7 Nikon Corporation

8.8 Mela Sciences, Inc.

8.9 Verisante Technology, Inc.

8.10 Solta Medical

8.11 GE Healthcare

8.12 Bruker Corporation

8.13 Philips Healthcare

8.14 Heine Optotechnik

8.15 Siemens Healthcare

8.16 Toshiba Medical Systems

8.17 Welch Allyn

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

9 Appendix (Page No. - 79)

9.1 Customization Options

9.1.1 Product Analysis

9.1.2 Epidemiology Data

9.1.3 Surgeons/Physicians Perception Analysis

9.1.4 Regulatory Framework

9.1.5 Competitive Intelligence

9.2 Related Reports

9.3 Introducing RT: Real Time Market Intelligence

9.3.1 RT Snapshots

List of Tables (31 Figures)

Table 1 North American Dermatology Diagnostic Devices Peer Market Size, 2014 (USD MN)

Table 2 North America: Dermatology Diagnostic Devices Market Size, By Type 2013- 2019 (USD MN)

Table 3 North America: Dermatology Diagnostic Devices Market: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 4 North American Dermatology Diagnostic Devices Market: Drivers and Inhibitors

Table 5 North America: Dermatology Diagnostic Devices Market Size, By Type, 2013 – 2019 (USD MN)

Table 6 North America: Dermatoscopes Market Size, By Type, 2013 – 2019 (USD MN)

Table 7 North America: Imaging Techniques Market Size, By Type, 2013 – 2019 (USD MN)

Table 8 U.S.: Dermatology Diagnostic Devices Market Size, By Type, 2013 – 2019 (USD MN)

Table 9 U.S.: Dermatology Imaging Techniques Market Size, By Type, 2013 – 2019 (USD MN)

Table 10 U.S. Dermatoscopes Market Size, By Type, 2013 – 2019 (USD MN)

Table 11 Canada: Dermatology Diagnostic Devices Market Size, By Type, 2013 - 2019 (USD MN)

Table 12 Canada: Dermatology Imaging Techniques Market Size, By Type, 2013 - 2019 (USD MN)

Table 13 Canada: Dermatoscopes Market Size, By Type, 2013 – 2019 (USD MN)

Table 14 Mexico: Dermatology Diagnostic Devices Market Size, By Type, 2013 - 2019 (USD MN)

Table 15 Mexico: Dermatology Imaging Techniques Market Size, By Type, 2013 - 2019 (USD MN)

Table 16 Mexico: Dermatoscopes Market, By Type, 2013 – 2019 (USD MN)

Table 17 Dermatology Diagnostic Devices Market Shares, By Company

Table 18 Dermatology Devices Market: Mergers & Acquisitions

Table 19 Dermatology Devices Market: Expansions

Table 20 Dermatology Devices Market: Agreements

Table 21 Dermatology Devices Market: Approvals

Table 22 Dermatology Devices Market: New Product Launches

Table 23 Carl Zeiss: Key Financials, 2011 – 2013 (USD MN)

Table 24 Leica Microsystems: Key Financials, 2011 – 2013 (USD MN)

Table 25 Nikon Corporation: Key Financials, 2012 – 2014 (USD MN)

Table 26 Mela Sciences, Inc.: Key Financials, 2012 – 2013 (USD MN)

Table 27 Verisante Technology: Key Financials, 2011 - 2013 (USD MN)

Table 28 Solta Medical: Key Financials, 2011 - 2013 (USD MN)

Table 29 GE Healthcare: Key Financials, 2011–2013 (Usd MN)

Table 30 Bruker Corporation: Key Financials, 2011–2013 (USD MN)

Table 31 Philips Healthcare: Key Financials, 2011–2013 (USD MN)

List of Figures (23 Figures)

Figure 1 North American Dermatology Diagnostic Devices Market: Segmentation & Coverage

Figure 2 Dermatology Diagnostic Devices Market: Integrated Ecosystem

Figure 3 Top-Down Approach

Figure 4 North American Dermatology Diagnostic Devices Market: New Cases of Melanoma of Skin (Males and Females), By Geography, 2014

Figure 5 North American Dermatology Diagnostic Devices Market:Market Snapshot

Figure 6 North American Dermatology Diagnostic Devices Market: Comparison With Parent Market

Figure 7 North American Dermatology Diagnostic Devices Market, By Type, 2014 vs. 2019 (USD MN)

Figure 8 North American Dermatoscopes Market, By Type, 2013 – 2019 (USD MN)

Figure 9 North American Imaging Techniques Market, By Type, 2013 – 2019 (USD MN)

Figure 10 North American Dermatology Diagnosis Devices Market: Growth Analysis, By Geography, 2014 – 2019 (USD MN)

Figure 11 U.S. Dermatology Diagnostic Devices Market: Type Snapshot

Figure 12 U.S. Dermatology Diagnostic Devices Market: Type , 2013 – 2019 (USD MN)

Figure 13 U.S. Dermatology Imaging Techniques Market: Type 2013 – 2019 (USD MN)

Figure 14 U.S. Dermatoscopes Market: Type 2013 - 2019 (USD MN)

Figure 15 Canada Dermatology Diagnostic Devices Market: Type Snapshot

Figure 16 Canada Dermatology Diagnostic Devices Market: Type 2013 - 2019 (USD MN)

Figure 17 Canada Dermatology Imaging Techniques Market: Type 2013 - 2019 (USD MN)

Figure 18 Canada Dermatoscopes Market: Type 2013 - 2019 (USD MN)

Figure 19 Mexico Dermatology Diagnostic Devices Market: Type Snapshot

Figure 20 Mexico Dermatology Diagnostic Devices Market: Type, 2013 - 2019 (USD MN)

Figure 21 Mexico Dermatology Imaging Techniques Market: Type, 2013 - 2019 (USD MN)

Figure 22 Mexico Dermatoscopes Market: Type, 2013 - 2019 (USD MN)

Figure 23 Dermatology Diagnostic Devices: Company Share Analysis, 201

This market research report categorizes the dermatology diagnostic devices market into submarkets, namely, dermatoscopes, imaging techniques, and microscopes. On the basis of geography, the North American market is segmented into the U.S, Canada, and Mexico. The study, which analyzes the market based on product sales and competitive scenario, is based on primary and secondary research. The trends and opportunities in the market are also analyzed in the report.

There has been a rise in the incidences of various skin disorders such as melanoma, psoriasis, vascular lesions, and acne. Among these disorders, melanoma is a type of skin cancer that predominantly develops on the skin and is easily visible to the naked eye. However, the challenge lies in recognizing early symptoms so that the appropriate treatment can be initiated before the tumor reaches a thickness of 0.76 mm, which can be fatal for the patient. In recent years, there has been a significant increase in the demand for various procedures and surgeries for the treatment of skin ailments. Among all cancers, the incidence of melanoma is increasing at a high rate in the U.S., with a current lifetime risk of 1 in 55.

Various sophisticated diagnostic instruments such as dermatoscopes, OCT scanners, and handheld scanners allow early detection of melanoma, thereby improving survival rates and reducing the number of biopsies in future, associated morbidity, and cost of healthcare. Advancements in technology have enabled the development of new, accurate, sensitive, and quantitative diagnostic instruments that have the potential to treat a number of skin disorders. Quantitative Thermographic Imaging (QTI), Confocal Microscopy, and Optical Coherence Tomography (OCT) have revolutionized diagnostic procedures. White-light and polarized-light imaging, spatial and spectroscopic multispectral methods, and Terahertz (THZ) imaging methods have also been applied in certain cases to effectively treat patients.

The North American dermatology diagnostic devices market was valued at $138.2 million in 2014 and is poised to reach $202.4 million by 2019, at a CAGR of 7.9% during the forecast period. The dermatology diagnostic devices market in the U.S. was valued at $127.7 millionin 2014 and is expected to reach $127.7 million in 2019, at a CAGR of 7.9% during the forecast.

The skin care products and devices industry is experiencing dynamic changes. Changing trends in 3D printing and stringent norms by regulatory authorities are projected to create various innovations in the dermatology diagnostic devices market, which will help improve the quality of care, while simultaneously reduce costs. The major players in the North American dermatology diagnostic devices market include GE Healthcare (U.K.), Siemens Healthcare (Germany), Philips Healthcare (Netherlands), Toshiba Medical Systems (Japan), Heine Optotechnik (Germany), Carl Zeiss Meditec AG (Germany), Bruker Corporation (U.S.), Welch Allyn (U.S.), Nikon Corporation (Japan), and Leica Microsystems (Germany).

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Asia Dermatology Devices The report also provides the strategic analysis of the key players in this market. Based on product types, the Asian dermatology devices market has been segmented into dermatology treatment devices and dermatology diagnostic devices, wherein the dermatology treatment devices segment dominates the market, having accounted for a 94.6% of the overall market share in 2014. On the basis of end-users, the dermatology devices market is categorized into hospitals and clinics. |

Feb 2015 |

|

North America Dermatology Devices The major factors driving the demand for dermatological devices in the U.S. are the desire for youthful appearance, increasing incidence rates of skin diseases, increasing trend towards non-invasive aesthetic procedures, and technological advancements. People are becoming more conscious about their appearance and are aware of the skin disorders caused due to exposure to the sun. |

Feb 2015 |