North America Dermatology Treatment Devices Market by Types (Liposuction, Microdermabrasion, Lasers) & by Application (Cancer Diagnosis, Psoriasis, Hair Removal) - Forecast to 2019

The global healthcare industry is witnessing a shift in paradigm towards non-invasive diagnostics, which help in easy and painless diagnosis. Dermatology treatment devices aid in the treatment of various skin disorders such as skin pigmentation. Various kinds of treatment devices such as LED light therapy devices, and lasers are used by dermatologists. The LED light therapy and laser devices segments have been witnessing tremendous growth since 2011 due to its advantages such as less incision, better results, and quick recovery.

Based on type, the treatment devices market is segmented into LED light therapy devices, lasers, electrosurgical equipment, liposuction devices, microdermabrasion, and cryotherapy. The dermatology treatment devices market is dominated by laser devices which comprises over 39.4% of the market share in the North American region and is also expected to grow at the highest CAGR of 12.3% during the forecasted period. The lasers market is further divided carbon dioxide lasers, ND-YAG lasers, pulsed dye lasers, diode lasers, argon lasers, ruby lasers, erbium-YAG lasers, and intense pulse light (IPL), where intense pulse light (IPL) holds the highest market share.

In North America, the U.S dominates the dermatology treatment devices market, with a share of around 86.0% in 2013, followed by Canada. The Canadian market is expected to grow at the highest CAGR of 11.5% during the forecast period.

In-depth market share analysis, by revenue, of top companies is also included in the report. These numbers are arrived at, based on key facts, annual financial information from SEC filings, annual reports, and interviews with industry experts and key opinion leaders such as CEOs, directors, and marketing executives. Detailed market share analysis of the major players in the North American dermatology treatment devices market is covered in this report.

The major companies in this market include Photomedex, Inc., Verisante Technology, Inc., MELA Sciences, Inc., Michelson Diagnostics Ltd., Leica Microsystems, Fotofinder Systems GMBH, FEI Company, Solta Medical, Syneron Medical Ltd., Lumenis Ltd., Cutera, Inc., Cynosure, Inc., AMD Global Telemedicine Inc, Ambicare Health Ltd., and ALMA Lasers, Ltd.

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Integrated Ecosystem of Dermatology Treatment Devices Market

2.2 Arriving at the Dermatology Treatment Devices Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand-Side Approach

2.2.4 Macroindicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 22)

4 Market Overview (Page No. - 23)

4.1 Introduction

4.2 North American Dermatology Treatment Devices Market: Comparison With Parent Market (Dermatology Devices)

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

5 North American Dermatology Treatment Devices Market, By Product (Page No. - 29)

5.1 Dermatology Treatment Devices Market

5.1.1 Electrosurgical Equipment

5.1.2 Microdermabrasion Devices

5.1.3 Cryotherapy Devices

5.1.4 Led Light Therapy Devices

5.1.5 Lasers

5.1.5.1 North American Lasers Market, By Technology

5.1.5.1.1 Carbon Dioxide Lasers

5.1.5.1.2 ND-YAG Lasers

5.1.5.1.3 Pulsed Dye Lasers

5.1.5.1.4 Diode Lasers

5.1.5.1.5 Argon Lasers

5.1.5.1.6 Ruby Lasers

5.1.5.1.7 Erbium-YAG Lasers

5.1.5.1.8 Intense Pulse Light

5.1.5.2 North American Dermatology Lasers Market, By Application

5.1.5.2.1 Hair Removal

5.1.5.2.2 Skin Rejuvenation

5.1.5.2.3 Pigmented Lesions

5.1.5.2.4 Acne

5.1.5.2.5 Vascular Lesions

5.1.5.2.6 Wrinkle Removal

5.1.5.2.7 Skin Resurfacing

5.1.5.2.8 Psoriasis

5.1.5.2.9 Tattoo Removal

6 North American Dermatology Treatment Devices Market, By End User (Page No. - 46)

6.1 North American Dermatology Treatment Devices End-Users Market: Overview

6.2 North American Dermatology Treatment Devices Hospitals Market

6.3 North American Dermatology Treatment Devices Clinics Market

7 North American Dermatology Treatment Devices Market, By Country (Page No. - 50)

7.1 Introduction

7.2 U.S. Dermatology Treatment Devices Market

7.2.1 U.S. Dermatology Treatment Devices Market, By Type

7.3 Canada Dermatology Treatment Devices Market

7.3.1 Canada Dermatology Treatment Devices Market, By Type

7.4 Mexico Dermatology Treatment Devices Market

7.4.1 Mexico Dermatology Treatment Devices Market, By Type

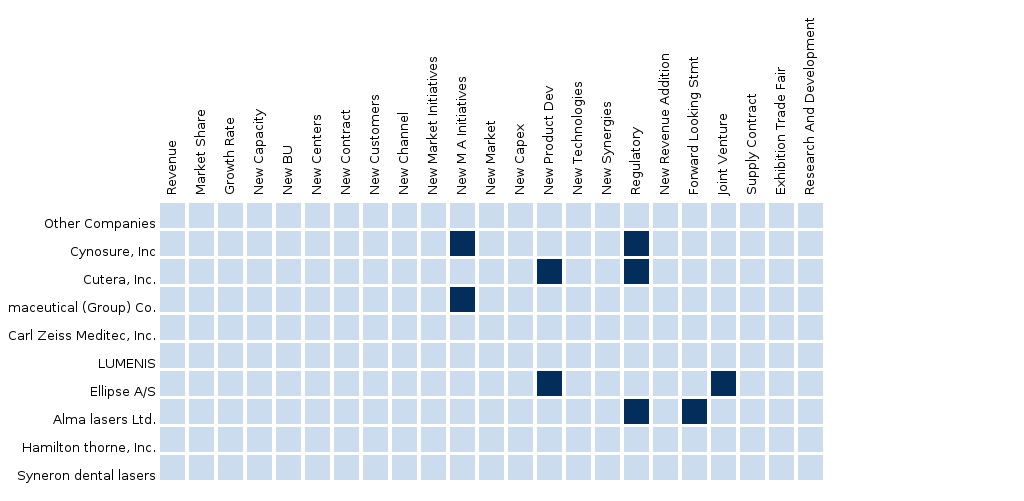

8 Dermatology Treatment Devices Market: Competitive Landscape (Page No. - 65)

8.1 Dermatology Treatment Devices Market: By Company

8.2 Mergers & Acquisitions

8.3 Agreements

8.4 Approvals

8.5 New Technology/Product Launches

8.6 Joint Ventures

9 Dermatology Treatment Devices Market, By Company (Page No. - 71)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 ALMA Lasers, Ltd.

9.2 Ambicare Health Ltd

9.3 AMD Global Telemedicine Inc.

9.4 Cynosure, Inc.

9.5 Cutera, Inc.

9.6 Lumenis Ltd.

9.7 Syneron Medical Ltd.

9.8 SOLTA Medical

9.9 FEI Company

9.10 Fotofinder Systems GMBH

9.11 LEICA Microsystems

9.12 Michelson Diagnostics Ltd.

9.13 MELA Sciences, Inc.

9.14 Verisante Technology, Inc.

9.15 Photomedex, Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

10 Appendix (Page No. - 100)

10.1 Customization Options

10.1.1 Product Analysis

10.1.2 Epidemiology Data

10.1.3 Surgeons/Physicians Perception Analysis

10.1.4 Regulatory Framework

10.1.5 Competitive Intelligence:

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (40 Tables)

Table 1 North America: Dermatology Treatment Devices Peer Market Size,2014 (USD MN)

Table 2 North America: Dermatology Treatment Devices: Macroindicators,By Country, 2014 (Usd Bn)

Table 3 North America: Dermatology Treatment Devices Market Size, Byproduct, 2013 - 2019 (USD MN)

Table 4 North American Dermatology Treatment Devices Market: Comparison With Parent Market, 2013 - 2019 (USD MN)

Table 5 North American Dermatology Treatment Devices Market: Drivers and Inhibitors

Table 6 North America: Dermatology Treatment Devices Market Size, By Product, 2013 - 2019 (USD MN)

Table 7 North America: Dermatology Treatment Devices Market Size, By Country, 2013 - 2019 (USD MN)

Table 8 North America: Dermatology Treatment Devices Market Size, By Product, 2013 - 2019 (USD MN)

Table 9 North America: Dermatology Lasers Market Size, By Technology,2013 - 2019 (USD MN)

Table 10 North American Dermatology Lasers Market Size, By Application,2013 - 2019 (USD MN)

Table 11 North America: Dermatology Treatment Devices Market Size, By End User, 2013 - 2019 (USD MN)

Table 12 North America: Dermatology Treatment Devices Market Size for Hospitals, By Country, 2013 - 2019 (USD MN)

Table 13 North America: Dermatology Treatment Devices Market Size for Clinics, By Country, 2013 - 2019 (USD MN)

Table 14 North America: Dermatology Treatment Devices Market Size, By Country, 2013 - 2019 (USD MN)

Table 15 U.S.: Dermatology Treatment Devices Market Size, By Type,2013 - 2019 (USD MN)

Table 16 U.S.: Dermatology Lasers Market Size, By Technology, 2013 - 2019 (USD MN)

Table 17 U.S.: Dermatology Lasers Market Size, By Application, 2013 - 2019 (USD MN)

Table 18 U.S.: Dermatology Treatment Devices Market Size, By End User,2013 - 2019 (USD MN)

Table 19 Canada: Dermatology Treatment Devices Market Size, By Type,2013 - 2019 (USD MN)

Table 20 Canada: Dermatology Lasers Market Size, By Technology,2013 - 2019 (USD MN)

Table 21 Canada: Dermatology Lasers Market Size, By Application,2013 - 2019 (USD MN)

Table 22 Canada: Dermatology Treatment Devices Market Size, By End User,2013 - 2019 (USD MN)

Table 23 Mexico: Dermatology Treatment Devices Market Size, By Type,2013 - 2019 (USD MN)

Table 24 Mexico: Dermatology Lasers Market Size, By Technology,2013 - 2019 (USD MN)

Table 25 Mexico: Dermatology Lasers Market Size, By Application,2013 - 2019 (USD MN)

Table 26 Mexico: Dermatology Treatment Devices Market Size, By End User,2013 - 2019 (USD MN)

Table 27 Dermatology Treatment Devices Market: By Company

Table 28 Dermatology Treatment Devices Market: Mergers & Acquisitions

Table 29 Dermatology Treatment Devices Market: Agreements

Table 30 Dermatology Treatment Devices Market: Approvals

Table 31 Dermatology Treatment Devices Market: New Technology/Product Launches

Table 32 North Americadermatology Treatment Devices Market: Joint Ventures

Table 33 Cynosure, Inc.: Key Financials, 2011 - 2013 (USD MN)

Table 34 Cutera, Inc.: Key Financials, 2011 - 2013 (USD MN)

Table 35 Lumenis Ltd.: Key Financials, 2011 - 2013 (USD MN)

Table 36 Syneron Medical Ltd.: Key Financials, 2011 - 2013 (USD MN)

Table 37 SOLTA Medical, LLC. Key Financials, 2011 - 2013 (USD MN)

Table 38 MELA Sciences, Inc.: Key Financials (USD MN)

Table 39 Verisante Technology, Inc.: Key Financials (USD MN)

Table 40 Photomedex, Inc.: Key Financials (USD MN)

List of Figures (40 Figures)

Figure 1 North American Dermatology Treatment Devices Market: Segmentation & Coverage

Figure 2 Dermatology Treatment Devices Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand-Side Approach

Figure 7 Macroindicator-Based Approach

Figure 8 North American Dermatology Treatment Devices Market Snapshot

Figure 9 North America Dermatology Treatment Devices Market: Comparison With Parent Market, 2013 - 2019 (USD MN)

Figure 10 North American Dermatology Treatment Devices Market, By Product, 2014 Vs. 2019, (USD MN)

Figure 11 North American Dermatology Treatment Devices Market Size, By Product, 2013 - 2019 (USD MN)

Figure 12 North American Dermatology Treatment Devices Market, By Country, 2014 Vs. 2019 (USD MN)

Figure 13 North American Dermatology Treatment Devices Market, By Country, 2013 - 2019 (USD MN)

Figure 14 North American Dermatology Treatment Devices Market, By Product, 2014 Vs. 2019 (USD MN)

Figure 15 Dermatology Cosmetic Procedures, U.S., 2013

Figure 16 Top 5 Surgical Cosmetic Procedures, U.S., 2013

Figure 17 Top 5 Nonsurgical Cosmetic Procedures, U.S., 2013

Figure 18 North American Dermatology Treatment Devices Market, By Type,2013 - 2019 (USD MN)

Figure 19 North American Dermatology Lasers Market Size, By Technology,2013 - 2019 (USD MN)

Figure 20 North American Dermatology Lasers Market, By Application,2013 - 2019 (USD MN)

Figure 21 North American Dermatology Treatment Devices Market, Comparison With Hospitals and Clinics, 2014 Vs. 2019 (USD MN)

Figure 22 North American Dermatology Treatment Devices Market for Hospitals, By Country, 2013 - 2019 (USD MN)

Figure 23 North American Dermatology Treatment Devices Market for Clinics, By Country, 2013 - 2019 (USD MN)

Figure 24 North American Dermatology Treatment Devices Market: Growth Analysis, By Country, 2014-2019 (USD MN)

Figure 25 U.S. Dermatology Treatment Devices Market, By Type, 2014 Vs. 2019 (USD MN)

Figure 26 U.S. Dermatology Treatment Devices Market, By Type, 2013 - 2019 (USD MN)

Figure 27 U.S. Dermatology Lasers Market, By Technology, 2013 - 2019 (USD MN)

Figure 28 U.S. Dermatology Lasers Market, By Application, 2013 - 2019 (USD MN)

Figure 29 U.S. Dermatology Treatment Devices Market, By End User,2013 - 2019 (USD MN)

Figure 30 Canada: Dermatology Treatment Devices Market, By Type,2014 Vs. 2019 (USD MN)

Figure 31 Canada: Dermatology Treatment Devices Market, By Type,2013 - 2019 (USD MN)

Figure 32 Canada: Dermatology Lasers Market, By Type, 2013 - 2019 (USD MN)

Figure 33 Canada: Dermatology Lasers Market, By Application, 2013 - 2019 (USD MN)

Figure 34 Canada: Dermatology Treatment Devices Market, By End User,2013 - 2019 (USD MN)

Figure 35 Mexico: Dermatology Treatment Devices Market, By Type,2014 Vs. 2019 (USD MN)

Figure 36 Mexico: Dermatology Treatment Devices Market, By Type,2013 - 2019 (USD MN)

Figure 37 Mexico: Dermatology Lasers Market, By Type, 2013 - 2019 (USD MN)

Figure 38 Mexico: Dermatology Treatment Lasers Market, By Application,2013 - 2019 (USD MN)

Figure 39 Mexico Dermatology Treatment Devices Market, By End User,2013 - 2019 (USD MN)

Figure 40 Dermatology Treatment Devices: Company Share Analysis, 2014 (%)

This market research report categorizes the dermatology treatment devices market into to submarkets, namely products, end users, and geographies. The study is based on primary and secondary research, and analyzes the market based on product sales and competitive scenario. It also studies and analyzes the trends and opportunities in the market.

In this report, the North American dermatology treatment devices have been segmented into electrosurgical equipment, cryotherapy devices, LED devices, liposuction devices, lasers, and microdermabrasion devices. The North American dermatology treatment devices market was valued at $3,102.0 million in 2014 and is expected to reach $5,016.2 million by 2019, at a CAGR of 10.1% during the forecast period of 2014 to 2019.

The major players in the dermatology treatment devices market include Heine Optotechnik (Germany), Optomed Oy (Finland), FotoFinder Systems (Germany), Michelson Diagnostics (UK), Genesis Biosystems (U.S.), Ellipse A/S (Denmark), Alma Lasers (Israel), Palomar Technologies (U.S.), GE Healthcare (U.K.), and Philips Healthcare (Netherlands), Verisante Technology, Inc. (Canada), HEINE Optotechnik (Germany), 3Gen LLC (U.S.), Welch Allyn (U.S.), Carl Zeiss Meditec, Inc. (U.S.), Hitachi (Japan), Leica Microsystems (Germany), Olympus (Japan), GE Healthcare (U.K.), Phillips Healthcare (Netherlands), Toshiba Medical Systems (Japan), and Siemens Medical Systems (Germany).

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Asia Dermatology Devices The report also provides the strategic analysis of the key players in this market. Based on product types, the Asian dermatology devices market has been segmented into dermatology treatment devices and dermatology diagnostic devices, wherein the dermatology treatment devices segment dominates the market, having accounted for a 94.6% of the overall market share in 2014. On the basis of end-users, the dermatology devices market is categorized into hospitals and clinics. |

Feb 2015 |

|

North America Dermatology Devices The major factors driving the demand for dermatological devices in the U.S. are the desire for youthful appearance, increasing incidence rates of skin diseases, increasing trend towards non-invasive aesthetic procedures, and technological advancements. People are becoming more conscious about their appearance and are aware of the skin disorders caused due to exposure to the sun. |

Feb 2015 |