North America Oilfield Equipment Rental Market by Drilling Equipment (Pressure & Flow Control Equipment, Fishing Equipment, Other Equipment), by Application (Onshore, Offshore), by Country - Analysis and Forecast to 2019

Oilfield equipment is required by the drilling operators for oil & gas exploration and production activities. Increase in offshore drilling activities that has resulted from rise in energy demand is considered as one of the most significant drivers of the North America oilfield equipment rental market. Other factors influencing its market growth are exploration activities at deep and ultra-deep offshore drilling areas of U.S., and Gulf of Mexico.

Renting oilfield equipment becomes a cost-effective alternative to purchasing such tools, as it helps in minimizing cost of inventory. It further reduces costs by eliminating the need for large equipment storage area and infrastructure, and enables operators to pick the right type and size of equipment for a particular operation. It also reduces downtime, thereby providing an opportunity to utilize the saved capital for more profitable ventures. All these factors have equally contributed to the increasing adoption of rented oilfield equipment by the oil & gas companies.

This market research report offers a deep dive analysis of the market segmentation, which is based on equipment type, application, and geography. According to equipment type, the market is classified into drilling equipment, pressure & flow control equipment, fishing equipment, and other equipment. With respect to geographical segmentation, the market is categorized into U.S. and Canada.

North American oilfield equipment rental (OER) market is estimated to reach $11,383 million by 2019, at a CAGR of 3.1% from 2014 to 2019. This growth is mainly attributed to the rise in the exploration and production of shale gas in countries such as U.S., and Canada. Among all countries in this region, U.S. has accounted for the largest market share of 77% in 2014.

In this study, major market players are identified through secondary and primary research, and their market shares are evaluated. To provide an in-depth understanding of the competitive landscape, the report includes profiles of major oilfield equipment rental participants, which combines manufacturers as well as service providers, such as Schlumberger (U.S.), Superior Energy Services (U.S.), and Weatherford (Ireland).

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Integrated Ecosystem of Oilfield Rental Equipment Market

2.2 Arriving at Oilfield Equipment Rental Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 25)

4 Market Overview (Page No. - 27)

4.1 Introduction

4.2 Oilfield Equipment Rental Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 Oilfield Equipment Rental Market, By Application (Page No. - 34)

5.1 Introduction

5.2 Oilfield Equipment Rental in Onshore , By Geography

5.3 Oilfield Equipment Rental in Offshore, By Geography

6 Oilfield Equipment Rental Market, By Equipment Type (Page No. - 39)

6.1 Introduction

6.2 North America Oilfield Equipment Rental Market, Type Comparison With Oilfield Services Market

6.3 North America Drilling Equipment Rental Market,By Type, 2014-2019

6.4 North America Drilling Equipment Rental Market, By Geography

6.5 North America Pressure & Flow Control Equipment Rental Market, By Type, 2014-2019 (USD MN)

6.6 North America Pressure and Flow Control Equipment Market, By Geography

6.7 North America Fishing Equipment Market, By Geography

7 Oilfield Equipment Rental Market, By Geography (Page No. - 50)

7.1 Introduction

7.2 U.S. Oilfield Equipment Rental Market

7.2.1 U.S. Oilfield Equipment Rental Market, By Application

7.2.2 U.S. Oilfield Equipment Rental Market, By Type

7.3 Canada Oilfield Equipment Rental Market

7.3.1 Canada Oilfield Equipment Rental Market, By Application

7.3.2 Canada Oilfield Equipment Rental Market, By Type

8 Oilfield Equipment Rental Market: Competitive Landscape (Page No. - 63)

8.1 Oilfield Equipment Rental Market: Company Share Analysis

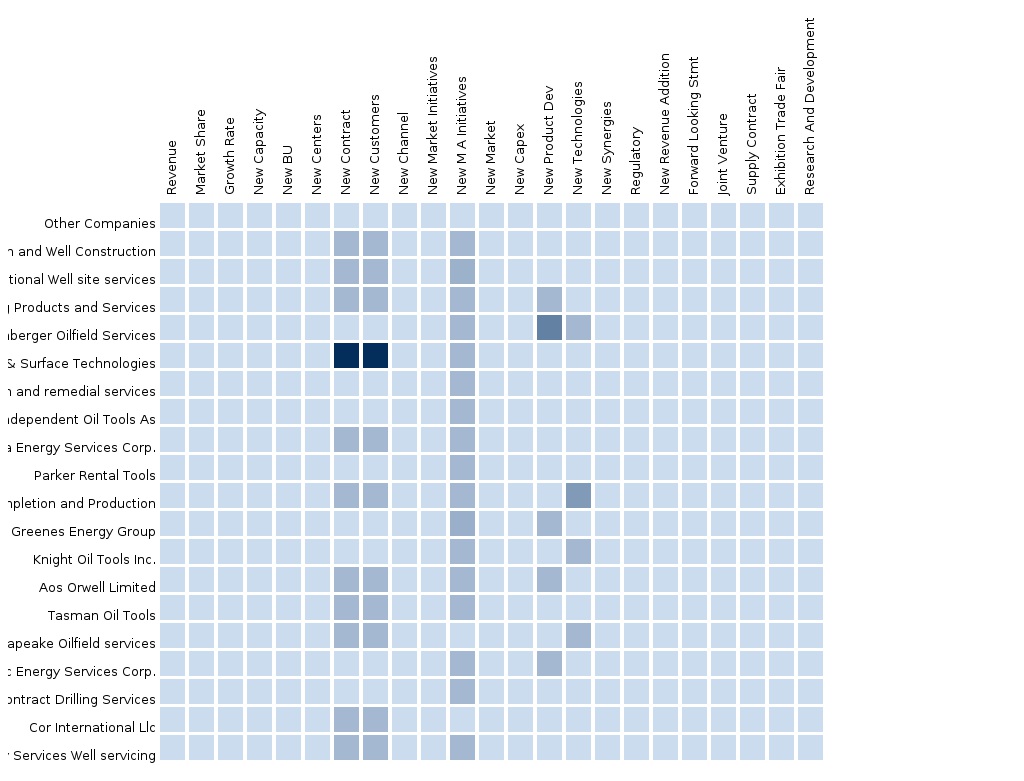

8.2 Company Presence in Oilfield Equipment Rental Market, By Type

8.3 Mergers & Acquisitions

8.4 Expansions

8.5 New Product Launch

9 Oilfield Equipment Rental Market, By Company (Page No. - 71)

9.1 Basic Energy Services

9.1.1 Overview

9.1.2 Key Financials

9.1.3 Product and Service Offerings

9.1.4 Related Developments

9.1.5 MMM View

9.2 Seventy Seven Energy Services

9.2.1 Overview

9.2.2 Key Operations Data

9.2.3 Key Financials

9.2.4 Product and Service Offerings

9.2.5 Related Developments

9.2.6 MMM View

9.3 Schlumberger Ltd.

9.3.1 Overview

9.3.2 Key Operations Data

9.3.3 Key Financials

9.3.4 Product and Service Offerings

9.3.5 Related Developments

9.3.6 MMM View

9.4 Halliburton

9.4.1 Overview

9.4.2 Key Financials

9.4.3 Product and Service Offerings

9.4.4 Related Developments

9.5 Weatherford International

9.5.1 Overview

9.5.2 Key Financials

9.5.3 Related Developments

9.5.4 MMM View

9.6 Oil States International Inc.

9.6.1 Overview

9.6.2 Key Financials

9.6.3 Product and Service Offerings

9.6.4 Related Developments

9.6.5 MMM View

9.7 Parker Drilling Company

9.7.1 Overview

9.7.2 Product and Service Offerings

9.7.3 Key Financials

9.7.4 Related Developments

9.7.5 MMM View

9.8 Superior Energy Services

9.8.1 Overview

9.8.2 Key Financials

9.8.3 Product and Service Offerings

9.8.4 Company Related Developments

10 Appendix (Page No. - 106)

10.1 Related Reports

10.2 Introducing RT: Real Time Market Intelligence

10.2.1 RT Snapshots

List of Tables (49 Tables)

Table 1 Global Oilfield Equipment Rental Peer Market Size, 2013 (USD MN)

Table 2 North America Oilfield Equipment Rental Market: Macro Indicators, By Geography, 2013

Table 3 North America Oilfield Equipment Rental Market: Comparison With Parent Market, 2013– 2019 (USD MN)

Table 4 North America Oilfield Equipment Rental Market: Drivers and Inhibitors

Table 5 North America Oilfield Equipment Rental Market, By Application, 2013 - 2019 (USD MN)

Table 6 North America Oilfield Equipment Rental Market, By Type, 2013 - 2019 (USD MN)

Table 7 North America Oilfield Equipment Rental Market, By Geography, 2013 - 2019(USD MN)

Table 8 North America Oilfield Equipment Rental Market: Comparison With Application Markets, 2013 - 2019 (USD MN)

Table 9 North America Oilfield Equipment Rental Market, By Application, 2013 - 2019 (USD MN)

Table 10 North America Oilfield Equipment Market in Onshore, By Geography, 2013 - 2019 (USD MN)

Table 11 North America Oilfield Equipment Rental in Offshore, By Geography, 2013 - 2019 (USD MN)

Table 12 North America Oilfield Equipment Rental, By Equipment Type, 2013 - 2019 (USD MN)

Table 13 North America Oilfield Equipment Rental Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 14 North America Drilling Equipment Rental Market, By Type, 2014 - 2019 (USD MN)

Table 15 North America Drilling Equipment Rental , By Geography, 2013–2019 (USD MN)

Table 16 North America Pressure & Flow Control Equipment Rental Market,By Type, 2013-2019 (USD MN)

Table 17 North America Pressure and Flow Control Market, By Geography, 2014 - 2019 (USD MN)

Table 18 North America Fishing Equipment Market, By Geography, 2013 - 2019 (USD MN)

Table 19 North America Oilfield Equipment Rental Market, By Geography, 2013 - 2019 (USD MN)

Table 20 U.S. Oilfield Equipment Rental Market, By Application, 2014-2019 (USD MN)

Table 21 U.S. Oilfield Equipment Rental Market, By Type, 2014- 2019 (USD MN)

Table 22 Canada Oilfield Equipment Rental, By Application, 2014 - 2019 (USD MN)

Table 23 Canada Oilfield Equipment Rental Market, By Type, 2014 - 2019 (USD MN)

Table 24 Oilfield Equipment Rental Market: Company Share Analysis, 2014 (%)

Table 25 North America Oilfield Equipment Market: Mergers & Acquisitions

Table 26 North America Oilfield Equipment Rental Market: Expansions

Table 27 North America Oilfield Equipment Rental Market: New Product Launch

Table 28 Contract North America Oilfield Equipment Rental Market: New Contract

Table 30 Basic Energy Services: Key Financials, 2009 - 2013 (USD MN)

Table 31 Basic Energy Services: Business Segment, 2009 - 2013 (USD MN)

Table 32 Seventy Seven Energy: Business Segment, 2011 - 2013 (USD MN)

Table 33 Seventy Seven Energy Services Key Financials, 2010 - 2013 (USD MN)

Table 34 Schlumberger Ltd.: Key Financials, 2009 - 2013 (USD MN)

Table 35 Schlumberger Ltd : Net Sales By Geographical Regions (USD Million)

Table 36 Schlumberger : Net Sales By Business Segment 2009 - 2013 (USD MN)

Table 37 Halliburton : Key Financials, 2009 - 2013 (USD MN)

Table 38 Halliburton Net Sales By Geographical Regions (USD Million)

Table 39 Weatherford International:Key Financials (USD Million)

Table 40 Weatherford Key Data Geographic Segments 2009 - 2013 (USD MN)

Table 41 Weatherford Market Revenue, By Business Segments 2009 - 2013 ($USD)

Table 42 Product and Service Offerings

Table 43 Oil States International Inc.: Business Segment, 2009 - 2013 (USD MN)

Table 44 Oil States International Inc. Geographic Segment,2009-2013

Table 45 Parker Drilling Business Segment, 2009-2013 (USD MN)

Table 46 Parker Drilling Geographic Segment, 2009-2013 (USD MN)

Table 47 Superior Energy Services .: Market Revenue, By Business Segments 2009 - 2013 (USD MN)

Table 48 Superior Energy Services.: Market Revenue, By Geographic Segments 2009 - 2013 (USD MN)

Table 49 Superior Energy Services.: Key Operations, 2009 - 2013 (USD MN)

List of Figures (41 Figures)

Figure 1 North America Oilfield Equipment Rental Market: Segmentation & Coverage

Figure 2 Oilfield Rental Equipment Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Approach

Figure 8 North America Oilfield Equipment Rental Market Snapshot

Figure 9 North America Oilfield Equipment Rental Types, By Geography, 2014 (USD MN)

Figure 10 North America Oilfiled Equipment Rental Market, By Application, 2014 - 2019 (USD MN)

Figure 11 North America Oilfield Equipment Market in Onshore, By Geography, 2013 - 2019 (USD MN)

Figure 12 North America Oilfield Equipment Rental Market in Offshore, By Geography, 2013 - 2019 (USD MN)

Figure 13 North America Oilfield Equipment Rental Market, By Type, 2014 - 2019 (USD MN)

Figure 14 North America Oilfield Equipment Rental Market: Type Comparison With Oilfield Services Market, 2014–2019 (USD MN)

Figure 15 North America Drilling Equipment Rental Market, By Type, 2014 - 2019 (USD MN)

Figure 16 North America Drilling Equipment Rental Market, By Geography, 2013–2019 (USD MN)

Figure 17 North America Pressure & Flow Control Equipment Rental Market, By Type, 2014 - 2019 (USD MN)

Figure 18 North America Pressure and Flow Control Equipment Market, By Geography, 2013 - 2019 (USD MN)

Figure 19 North America Fishing Equipment Market, By Geography, 2013 - 2019 (USD MN)

Figure 20 North America Oilfield Equipment Rental Market: Growth Analysis, By Geography, 2014-2019 (USD MN)

Figure 21 U.S. Oilfield Equipment Market Overview, 2014 & 2019 (%)

Figure 22 U.S. Oilfield Equipment Rental Market, By Application, 2014-2019 (USD MN)

Figure 23 U.S. Oilfield Equipment Rental Market: Application Snapshot

Figure 24 U.S. Oilfield Equipment Rental Market, By Type, 2014 - 2019 (USD MN)

Figure 25 U.S. Oilfield Equipment Rental Market Share, By Type, 2014-2019 (%)

Figure 26 Canada Oilfield Equipment Market Overview, 2014 & 2019 (%)

Figure 27 Canada Oilfield Equipment Rental Market, By Application, 2014-2019 (USD MN)

Figure 28 Canada Oilfield Equipment Rental Market: Application Snapshot (USD MN)

Figure 29 Canada Oilfield Equipment Rental Market, By Type, 2014 - 2019 (USD MN)

Figure 30 Canada Oilfield Market Share, By Type, 2013-2018 (%)

Figure 31 Oilfield Equipment Rental Market: Company Share Analysis, 2014 (%)

Figure 32 Oilfield Equipment Rental: Company Product Coverage, By Type, 2013

Figure 33 Basic Energy Services: Reveue Mix, 2013 (%)

Figure 35 Seventy Seven Energy Revenue Mix, 2013 (%)

Figure 36 Schlumberger Ltd. Revenue Mix, 2013 (%)

Figure 37 Halliburton Revenue Mix, 2013 (%)

Figure 38 Weatherford International, Revenue Mix, 2013 (%)

Figure 39 Oil States International Inc.: Revenue Mix 2013 (%)

Figure 40 Parker Drilling Revenue Mix (%)

Figure 41 Superior Energy Services : Revenue Mix, 2013(%)

North America oilfield rental equipment (OER) market is progressing on account of increased shale gas production in the U.S. and Canada, along with technological advancements made in the field of oilfield equipment. U.S. holds a major market share, followed by Canada. The U.S. oilfield equipment market is leading in comparison to other countries, owing to the thriving production activities of shale gas and tight oil.

Technological developments have enabled the emergence of non-conventional oil & gas fields, which were earlier considered unviable. Oil & gas companies are optimizing the proficiency of extraction from maturing oilfields. This has provided a renewed impetus to the drilling industry, which is the main driver of oilfield rental equipment market.

Renting oilfield equipment becomes a cost-effective alternative to purchasing such tools, as it helps in minimizing cost of inventory. It further reduces costs by eliminating the need for large equipment storage area and infrastructure, and enables operators to pick the right type and size of equipment for a particular operation. It also reduces downtime, thereby providing an opportunity to utilize the saved capital for more profitable ventures. All these factors have equally contributed to the increasing adoption of rented oilfield equipment by the oil & gas companies.

The oilfield equipment rental market in North America was valued at $9,765 million in 2014, and is projected to reach $11,383 million by 2019, at a CAGR of 3.1% from 2014 to 2019. The market segment in U.S. commanded the largest share of 77.4% in this market in 2014, and is expected to reach $8,806 million by 2019, at a CAGR of 3.1% during the forecast period.

An in-depth market share analysis, by revenue, of the top companies is included in the report. These numbers are arrived at, based on key facts, annual financial information from annual reports and interviews with industry experts and key opinion leaders, such as CEOs, directors, and marketing executives. The top five companies in the rental business include Halliburton Co. (U.S.), Oil States International, Inc. (U.S.), Schlumberger Limited (U.S.), Superior Energy Services, Inc. (U.S.), and Weatherford International Ltd. (Ireland).

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

South America Oilfield Services The oilfield services market in South America was valued around $14.04 billion in 2013, with a market share of 9.3% globally. Projected to grow at a CAGR of 17% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Apr 2015 |

|

Asia-Pacific Oilfield Services The oilfield services market in Asia Pacific was valued around $31598 million in 2013, with a market share of almost 20% globally. Projected to grow at a CAGR of 14% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries in the region. |

Apr 2015 |

|

Middle East Oilfield Services Middle East oilfield services market was valued at $73,405.6 million in 2014 and is projected to grow at a CAGR of 4.2% from 2014 to 2019 to reach a market size of $90,150.1 by 2019. The large share is attributed to the rise in exploration of new reserves which requires increased drilling activities. |

May 2015 |

|

Africa Oilfield Services The oilfield services market in Africa was valued around $7642 million in 2013, with a market share of 5% globally. Projected to grow at a CAGR of 14.4% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Apr 2015 |

|

Europe Oilfield Services The European oilfield services market was valued at $45,592.5 million in 2014, and is projected to reach $60,017.5 million by 2019, at a CAGR of 5.7% from 2014 to 2019. The growth of this market can be attributed to the rise in exploration activities of new reserves, which requires increased drilling activities. The drilling services segment accounted for the largest share of 59.2% of the European oilfield services market in 2014. |

Apr 2015 |

|

North America Oilfield Services The oilfield services market in North America was valued around $76.85 billion in 2013, with a market share of 50.8% globally. Projected to grow at a CAGR of 9.8% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Upcoming |