South America Traction Transformer Market by Type (Tap changing, Tapped, and Rectifier), by Application (Electric Locomotive, Electrical multiple unit (EMU), and Trams) and by Voltage (AC Traction Transformer and DC Traction Transformer) Forecasts 2014 to 2019

The South American Traction Transformer market is estimated to grow at a CAGR of 4.4% in the forecast period, 2014 to 2019. The South American Traction Transformer market had a significant amount of market share of the global traction transformer market in the year 2014.

In this report, the South American traction transformer market has been fragmented on the basis of type, application, and voltage range. On the basis of types, traction transformers are segmented as tap changing, tapped, and rectifier. The rectifier transformers are growing fast at a CAGR of 8.0% for the forecast period of 2014 to 2019. They are used in industrial applications such as electrolysis process for aluminum or chemical ones for zinc, copper or chlorine.

Geographically, South America is estimated to command a market share of 4.1% of the traction transformer market. The factors driving the growth of traction transformer in Europe is the increasing requirement for electrification in rail transportation due to increasing environmental concern as traction transformers educe CO2 emissions by using bio-degradable coolants instead of mineral-based coolants and minimize the energy consumption during operation.

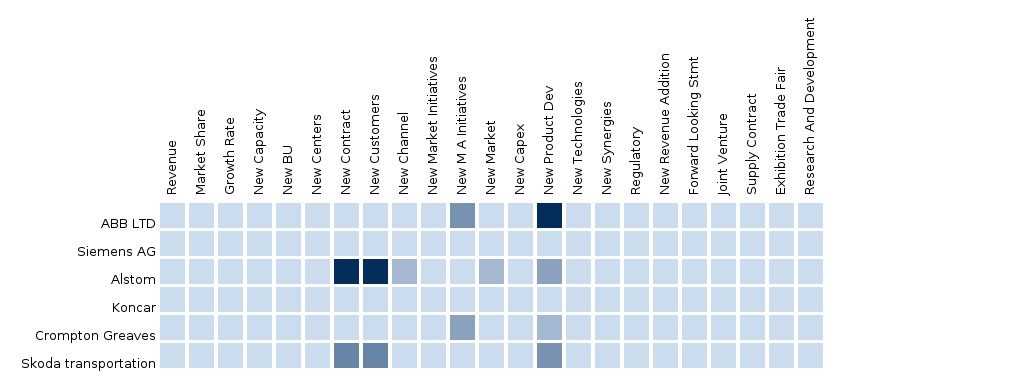

There are a number of players in South American region for traction transformer market which makes it competitive. The top players of South American traction transformer market are ABB (Switzerland), Siemens AG (Germany), and Alstom SA (France). New product launches and partnerships, agreements, collaborations, and joint ventures are the major strategies adopted by most market players to achieve growth in the traction transformer market.

Customization Options:

Along with the market data, you can also customize the MMM assessments that are in accordance to your company’s specific needs. Customize to get comprehensive industry standards and deep-dive analysis of the following parameters:

Product Analysis

- Usage pattern (in-depth trend analysis) of products (segment-wise)

- Product matrix, which gives a detailed comparison of product portfolio of each company mapped at country and sub-segment level

- End-user adoption rate analysis of the products (segment-wise and country-wise)

- Comprehensive coverage of product approvals, pipeline products, and product recalls

Data from Manufacturing Firms

- Fast turn-around analysis of manufacturing firms’ responses to recent market events and trends

- Various firms’ opinions about different applications where traction transformer can be used

- Qualitative inputs on macro-economic indicators, mergers & acquisitions in each geography

Comparative Analysis

- Market data and key developments of top companies

Shipment/Volume Data

- Tracking the value of components shipped annually in each geography

Trend analysis of Application

- Application matrix, which gives a detailed comparison of application portfolio of each company, mapped in each geography

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of Traction Transformers Market

2.2 Arriving at the Traction Transformers Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 20)

4 Market Overview (Page No. - 22)

4.1 Introduction

4.2 Traction Transformer Market: Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

4.5 Demand Side Analysis

4.6 Vendor Side Analysis

5 Traction Transformers Market, By Type (Page No. - 29)

5.1 Introduction

5.2 South American Traction Transformer Market, By Type

5.3 South American Traction Transformers Market, Type Comparison With Transformer Market

5.4 South American Tap Changing Market, By Geography

5.5 South American Tapped Market, By Geography

5.6 South American Rectifier Market, By Geography

6 Traction Transformers Market, By Voltage (Page No. - 37)

6.1 Introduction

6.2 South America Traction Transformer Market, By Voltage

6.3 South America Traction Transformers Market, Voltage Range Comparison With Transformer Market

6.4 South America AC Market, By Geography

6.5 South America DC Market, By Geography

7 Traction Transformer Market, By Application (Page No. - 43)

7.1 Introduction

7.2 Traction Transformer in Electric Locomotive, By Type

7.3 Traction Transformer in Emu, By Type

7.4 Traction Transformer in Trams, By Type

8 Traction Transformer Market, By Geography (Page No. - 50)

8.1 Introduction

8.2 South American Traction Transformer Market: Growth Analysis, By Geography (Value)

8.3 South American Traction Transformer Market: Growth Analysis, By Geography (Volume)

8.4 Brazil Traction Transformer Market

8.4.1 Brazil Traction Transformer Market, By Type

8.4.2 Brazil Traction Transformer Market, By Voltage Range

8.5 Argentina Traction Transformer Market

8.5.1 Argentina Traction Transformer Market, By Type

8.5.2 Argentina Traction Transformer Market, By Voltage Range

9 Traction Transformers Market: Competitive Landscape (Page No. - 58)

9.1 Traction Transformers Market: Company Share Analysis

9.2 Company Presence in Traction Transformers Market, By Type

9.3 Acquisitions & Contracts

10 Traction Transformer Market, By Company (Page No. - 61)

10.1 ABB Ltd.

10.1.1 Overview

10.1.2 Products & Services

10.1.3 Key Financials

10.1.4 Developments

10.1.5 MMM Analysis

10.2 Alstom

10.2.1 Overview

10.2.2 Products & Services

10.2.3 Key Financials

10.2.4 Developments

10.2.5 MMM Analysis

10.3 Siemens Energy Inc.

10.3.1 Overview

10.3.2 Products & Services

10.3.3 Key Financials

10.3.4 Developments

10.3.5 MMM Analysis

10.4 Crompton Greaves

10.4.1 Overview

10.4.2 Products & Services

10.4.3 Key Financials

10.4.4 Developments

10.4.5 MMM Analysis

10.5 Brush Traction

10.5.1 Overview

10.5.2 Products & Services

10.5.3 Key Financials

10.5.4 Developments

10.5.5 MMM Analysis

11 Appendix (Page No. - 74)

11.1 Customization Options

11.1.1 Product Portfolio Analysis

11.1.2 Country Level Data Analysis

11.1.3 Product Comparison of Various Competitors

11.1.4 Trade Analysis

11.2 Related Reports

12 Introducing RT: Real Time Market Intelligence (Page No. - 76)

12.1.1 RT Snapshots

List of Tables (51 Tables)

Table 1 South America Traction Transformers Market Size, By Geography 2014 (USD ‘000)

Table 2 South America Traction Transformers Application Market, 2014 (USD ‘000 )

Table 3 South America Traction Transformers Market: Macro Indicators, 2012 & 2013 (USD MN)

Table 4 South America Traction Transformers Market: Comparison With Parent Market, 2013 – 2019 (USD ‘000)

Table 5 South America Traction Transformers Market: Drivers and Inhibitors

Table 6 South America Traction Transformers Market, By Application, 2013 - 2019 (USD ‘000)

Table 7 South America Traction Transformers Market, By Application, 2013 – 2019 (In Units)

Table 8 South America Traction Transformers Market, By Type, 2013 - 2019 (USD ‘000)

Table 9 South America Traction Transformers Market, By Type, 2013 - 2019 (In Units)

Table 10 South America Traction Transformers Market: Comparison With Application Markets, 2013 - 2019 (USD ‘000)

Table 11 South America Traction Transformers Market, By Type, 2013 - 2019 (USD ‘000)

Table 12 South America Traction Transformers Market, By Type, 2013 - 2019 (In Units)

Table 13 South America Traction Transformers Market: Type Comparison With Parent Market, 2013–2019 (USD ‘000)

Table 14 South America Tap Changing Market, By Geography, 2013–2019 (USD ‘000)

Table 15 South America Tap Changing Market, By Geography, 2013–2019 (In Units)

Table 16 South America Tapped Market, By Geography, 2013 - 2019 (USD ‘000)

Table 17 South America Tapped Market, By Geography, 2013 - 2019 (In Units)

Table 18 South America Rectifier Market, By Geography, 2013 - 2019 (USD ‘000)

Table 19 South America Traction Transformers Market, By Voltage Range, 2013 - 2019 (USD ‘000)

Table 20 South America Traction Transformers Market, By Voltage Range, 2013 - 2019 (In Units)

Table 21 South America Traction Transformers Market: Voltage Range Comparison With Parent Market, 2013–2019 (USD ‘000)

Table 22 South America Ac Market, By Geography, 2013–2019 (USD ‘000)

Table 23 South America Ac Market, By Geography, 2013–2019 (In Units)

Table 24 South America Dc Market, By Geography, 2013 - 2019 (USD ‘000)

Table 25 South America Traction Transformer Market, By Application, 2013 - 2019 (USD ‘000)

Table 26 South America Traction Transformers: Market, By Application, 2013 - 2019 (Inunits)

Table 27 South America Traction Transformer in Electric Locomotive, By Type, 2013 - 2019 (USD ‘000)

Table 28 South America Traction Transformer in Electric Locomotive, By Type, 2013 - 2019 (In Units)

Table 29 South America Traction Transformer in Emu, By Type, 2013 - 2019 (USD ‘000)

Table 30 South America Traction Transformer in Trams, By Type, 2013 – 2019 (USD ‘000)

Table 31 South American Traction Transformer Market, By Geography, 2013 - 2019 (USD ‘000)

Table 32 South America Traction Transformer Market, By Geography, 2013 - 2019 (In Units)

Table 33 Brazil Traction Transformer Market, By Type, 2013-2019 (USD ‘000)

Table 34 Brazil Traction Transformer Market, By Type, 2013-2019 (In Units)

Table 35 Brazil Traction Transformer Market, By Voltage Range, 2013-2019 (USD ‘000)

Table 36 Brazil Traction Transformer Market, By Voltage Range, 2013-2019 (In Units)

Table 37 Argentina Traction Transformer Market, By Type, 2013-2019 (USD ‘000)

Table 38 Argentina Traction Transformer Market, By Type, 2013-2019 (In Units)

Table 39 Argentina Traction Transformer Market, By Voltage Range, 2013-2019 (USD ‘000)

Table 40 Traction Transformer Market: Company Share Analysis, 2013 (%)

Table 41 South American Traction Transformer Market: Acquisitions & Contracts

Table 42 ABB Ltd.: Market Revenue By Geography, 2009-2013 (USD MN)

Table 43 ABB Ltd.: Annual Revenue, By Geographic Region Segments, 2009–2013 (USD MN)

Table 44 ABB Ltd.: Ebit and Net Income, 2009–2013 (USD MN)

Table 45 Alstom: Market Revenue By Geography: (USD MN)

Table 46 Alstom: Market Revenue By Business Segments: (USD MN)

Table 47 Siemens Energy Inc.: Annual Revenue, By Business Segments, 2010–2014 (USD MN)

Table 48 Siemens Energy Inc.: Annual Revenue, By Geography, 2010–2014 (USD MN)

Table 49 Siemens Energy Inc.: Annual Revenue, 2010–2014 (USD MN)

Table 50 Crompton Greaves: Total Revenue By Geography, 2010 – 2014 (USD MN)

Table 51 Crompton Greaves: Total Revenue By Segment, 2010 – 2014 (USD MN)

List of Figures (35 Figures)

Figure 1 South America Traction Transformers Market: Segmentation & Coverage

Figure 2 Traction Transformers Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Demand Side Approach

Figure 7 Macro Indicator-Based Approach

Figure 8 South America Traction Transformers Market Snapshot

Figure 9 Traction Transformers Market: Growth Aspects

Figure 10 South America Traction Transformers Market, By Application, 2014 & 2019

Figure 11 South America Traction Transformers Market: Growth Analysis, By Type, 2014–2019 (%)

Figure 12 South America Traction Transformers Market, By Type, 2014 & 2019 (USD ‘000)

Figure 13 South America Traction Transformers Market, By Type, 2014 & 2019 (In Units)

Figure 14 South America Traction Transformers Market: Type Comparison With Transformer Market, 2013–2019 (USD ‘000)

Figure 15 South America Tap Changing Market, By Geography, 2013–2019 (USD ‘000)

Figure 16 South America Tapped Market, By Geography, 2013 - 2019 (USD ‘000)

Figure 17 South America Rectifier Market, By Geography, 2013 - 2019 (USD ‘000)

Figure 18 South America Traction Transformers Market, By Voltage Range, 2014 & 2019 (USD ‘000)

Figure 19 South America Traction Transformers Market, By Voltage Range, 2014 & 2019 (In Units)

Figure 20 South America Traction Transformers Market: Voltage Range Comparison With Transformer Market, 2013–2019 (USD ‘000)

Figure 21 South America Ac Market, By Geography, 2014–2019 (USD ‘000)

Figure 22 South America Dc Market, By Geography, 2013 - 2019 (USD ‘000)

Figure 23 South America Traction Transformer Market, By Application, 2014 - 2019 (USD ‘000)

Figure 24 South America Traction Transformer Market, By Application, 2014 - 2019 (In Units)

Figure 25 South America Traction Transformer Market in Electric Locomotive, By Type, 2013 - 2019 (USD ‘000)

Figure 26 South American Traction Transformers Market in Emu, By Type, 2013 - 2019 (USD ‘000)

Figure 27 South American Traction Transformers Market in Trams, By Type, 2013 - 2019 (USD ‘000)

Figure 28 South American Traction Transformers Market: Growth Analysis, By Geography, 2014-2019 (USD ‘000)

Figure 29 South American Traction Transformer Market: Growth Analysis, By Geography, 2014-2019 (In Units)

Figure 30 Brazil Traction Transformer Market, By Type, 2013-2019 (USD ‘000)

Figure 31 Brazil Traction Transformer Market, By Voltage Range, 2013-2019 (USD ‘000)

Figure 32 Argentina Traction Transformer Market, By Type, 2013-2019 (USD ‘000)

Figure 33 Argentina Traction Transformer Market, By Volatge Range, 2013-2019 (USD ‘000)

Figure 34 Traction Transformers Market: Company Share Analysis, 2013 (%)

Figure 35 Traction Transformers: Company Product Coverage, By Type, 2014

The traction transformer is an integral part of the electric traction system.

On the basis of types, the traction transformer is divided into three major segments, namely tap changing, tapped, and rectifier. Tapped transformers contribute the maximum revenue (93.4% in 2014) to the South American traction transformer market as they are used in locomotives due to their higher power rating. Other two types of transformers are used in models such as EMUs and trams.

The traction transformer is segmented by application (Locomotives, EMUs, and Trams), product (solid state transformer and other products) and voltage network (AC and DC).

Electric traction using traction transformers has many critical advantages over the conventional diesel-based traction systems as they offer environmental benefits, low maintenance costs, and power efficiency. The advanced traction transformers can further reduce CO2 emissions by using bio-degradable coolants instead of mineral-based coolants and minimize the energy consumption during operations.

The purpose of this study is to analyze the South American market for traction transformers. This report includes revenue forecasts, market trends and opportunities for the period from 2014 to 2019 and the overview of the competitive landscape for the period from 2011 to 2014. The analysis has been conducted on the various market segments derived on the basis of type, products, models, voltage network, and geography. On the basis of type, the market is segmented into tap changing, tapped, and rectifier; on the basis of application, the market is segmented into Locomotives, EMUs, and Trams; and on the basis of voltage stock, the market is segmented into AC & DC traction transformers market. The report also includes the key market drivers and inhibitors, along with their impact, in detail.

Apart from a general overview of the major companies in this market, this report also provides financial analysis, products, services, and the key developments of the major players in the industry. ABB (Switzerland), Siemens AG (Germany), and Alstom SA (France) are leading players covered in the South American traction transformer market.

The South American traction transformer market is estimated to grow due to various factors. The market for traction transformers in South America is estimated to grow from $51.8 million in 2014 to $64.3 million by 2019, at a CAGR of 4.4% from 2014 to 2019.

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement