The well completion equipment are used for packing and sand controlling. The well completion services include performing casing, cementing, perforating, gravel packing, and installing a production tree for the well to start production. The growing demand for offshore and onshore activities leads to increase in new oil and gas field, which ultimately expands the well completion market. The well completion market in South America is expected to reach $3105 million by 2019, at a CAGR of 16.3% from 2014 to 2019.

The well completion equipment market by types covers packers, sand control tools, multi-stage fracturing tools, liner hangers, smart wells, and safety valves. The South America market is also split by geography including countries such as Argentina, Brazil, Colombia, Ecuador, Trinidad & Tobago, Peru, and Venezuela.

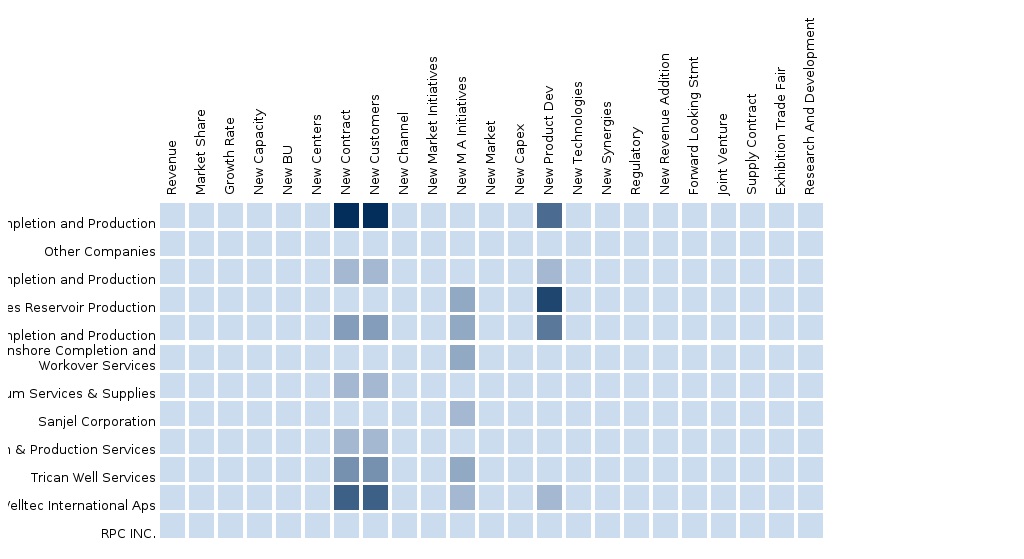

Market share analysis of top companies is validated based on key facts, annual financial information, and interview with key expert such as CEOS, directors, and marketing executives.

In order to present an in-depth understanding of competitive landscape, the well completion report consists of profile of some major players such as Halliburton (U.S.), Baker Hughes (U.S.), Weatherford (Switzerland), and Schlumberger (U.S.)

Customization Options

Along with the market data, you can also customize MMM assessments that meet your company’s specific needs. Customize to get comprehensive industry standard and deep dive analysis of the following parameters:

- Key competitors/consumers product benchmarking

- Limited addition of market segment assessment by geography/application

- Additional company profiles and landscape

Product Analysis

- Comparison of product portfolio of each company mapped at regional level

- Number of onshore and offshore projects forecasted

Additional Information

- The data for oil reserves and capital expenditure at regional level

- The rig count at regional and country level

- The number of wells drilled in a particular region

Expert forum

- Qualitative inputs on offshore drilling activities

1 Introduction

1.1 Objective of the study

1.2 Market Definitions

1.3 Market Segmentation & Aspects Covered

1.4 Research Methodology

1.4.1 Assumptions (Market Size, Forecast, etc)

2 Executive Summary

3 Market Overview

4 Well Completion - Tools-South America, By Segments

4.1 Split By Geography

4.1 Well Completion - Tools-Brazil by Markets

4.1 Well Completion - Tools-Venezuela by Markets

4.1 Well Completion - Tools-Colombia by Markets

4.1 Well Completion - Tools-Argentina by Markets

4.1 Well Completion - Tools-South America - Other Geographies by Markets

4.1 Well Completion - Tools-Ecuador by Markets

4.1 Well Completion - Tools-Peru by Markets

4.2 others- well completion tools-South America

4.2.1 others- well completion tools-South America, By Geographies

4.2.1.1 others- well completion tools-Brazil

4.2.1.2 others- well completion tools-Venezuela

4.2.1.3 others- well completion tools-Colombia

4.2.1.4 others- well completion tools-Argentina

4.2.1.5 others- well completion tools-South America - Other Geographies

4.3 Safety Valves-South America

4.3.1 Safety Valves-South America, By Geographies

4.3.1.1 Safety Valves-Brazil

4.3.1.2 Safety Valves-Venezuela

4.3.1.3 Safety Valves-Colombia

4.3.1.4 Safety Valves-Argentina

4.3.1.5 Safety Valves-South America - Other Geographies

4.4 Multi Stage Frac Tools-South America

4.4.1 Multi Stage Frac Tools-South America, By Geographies

4.4.1.1 Multi Stage Frac Tools-Brazil

4.4.1.2 Multi Stage Frac Tools-Venezuela

4.4.1.3 Multi Stage Frac Tools-Colombia

4.4.1.4 Multi Stage Frac Tools-Argentina

4.4.1.5 Multi Stage Frac Tools-South America - Other Geographies

4.5 Smart Wells-South America

4.5.1 Smart Wells-South America, By Geographies

4.5.1.1 Smart Wells-Brazil

4.5.1.2 Smart Wells-Venezuela

4.5.1.3 Smart Wells-Colombia

4.5.1.4 Smart Wells-Argentina

4.5.1.5 Smart Wells-South America - Other Geographies

4.6 Sand Control Equipment-South America

4.6.1 Sand Control Equipment-South America, By Geographies

4.6.1.1 Sand Control Equipment-Brazil

4.6.1.2 Sand Control Equipment-Venezuela

4.6.1.3 Sand Control Equipment-Colombia

4.6.1.4 Sand Control Equipment-Argentina

4.6.1.5 Sand Control Equipment-South America - Other Geographies

4.7 Liner Hanger-South America

4.7.1 Liner Hanger-South America, By Geographies

4.7.1.1 Liner Hanger-Brazil

4.7.1.2 Liner Hanger-Venezuela

4.7.1.3 Liner Hanger-Colombia

4.7.1.4 Liner Hanger-Argentina

4.7.1.5 Liner Hanger-South America - Other Geographies

4.8 Packers and flow control-South America

4.8.1 Packers and flow control-South America, By Geographies

4.8.1.1 Packers and flow control-Brazil

4.8.1.2 Packers and flow control-Venezuela

4.8.1.3 Packers and flow control-Colombia

4.8.1.4 Packers and flow control-Argentina

4.8.1.5 Packers and flow control-South America - Other Geographies

5 Well Completion - Tools-South America, By Geographies

5.1 Well Completion - Tools-Brazil

5.1.1 Well Completion - Tools-Brazil, By Companies

5.1.1.1 Well Completion - Tools-Baker Hughes Completion and Production-Brazil

5.1.2 Well Completion - Tools-Brazil, By Segments

5.1.2.1 others- well completion tools-Brazil

5.1.2.2 Safety Valves-Brazil

5.1.2.3 Multi Stage Frac Tools-Brazil

5.1.2.4 Smart Wells-Brazil

5.1.2.5 Sand Control Equipment-Brazil

5.1.2.6 Liner Hanger-Brazil

5.1.2.7 Packers and flow control-Brazil

5.2 Well Completion - Tools-Venezuela

5.2.1 Well Completion - Tools-Venezuela, By Segments

5.2.1.1 others- well completion tools-Venezuela

5.2.1.2 Safety Valves-Venezuela

5.2.1.3 Multi Stage Frac Tools-Venezuela

5.2.1.4 Smart Wells-Venezuela

5.2.1.5 Sand Control Equipment-Venezuela

5.2.1.6 Liner Hanger-Venezuela

5.2.1.7 Packers and flow control-Venezuela

5.3 Well Completion - Tools-Colombia

5.3.1 Well Completion - Tools-Colombia, By Companies

5.3.1.1 Well Completion - Tools-Welltec International Aps-Colombia

5.3.2 Well Completion - Tools-Colombia, By Segments

5.3.2.1 others- well completion tools-Colombia

5.3.2.2 Safety Valves-Colombia

5.3.2.3 Multi Stage Frac Tools-Colombia

5.3.2.4 Smart Wells-Colombia

5.3.2.5 Sand Control Equipment-Colombia

5.3.2.6 Liner Hanger-Colombia

5.3.2.7 Packers and flow control-Colombia

5.4 Well Completion - Tools-Argentina

5.4.1 Well Completion - Tools-Argentina, By Segments

5.4.1.1 others- well completion tools-Argentina

5.4.1.2 Safety Valves-Argentina

5.4.1.3 Multi Stage Frac Tools-Argentina

5.4.1.4 Smart Wells-Argentina

5.4.1.5 Sand Control Equipment-Argentina

5.4.1.6 Liner Hanger-Argentina

5.4.1.7 Packers and flow control-Argentina

5.5 Well Completion - Tools-South America - Other Geographies

5.5.1 Well Completion - Tools-South America - Other Geographies, By Segments

5.5.1.1 others- well completion tools-South America - Other Geographies

5.5.1.2 Safety Valves-South America - Other Geographies

5.5.1.3 Multi Stage Frac Tools-South America - Other Geographies

5.5.1.4 Smart Wells-South America - Other Geographies

5.5.1.5 Sand Control Equipment-South America - Other Geographies

5.5.1.6 Liner Hanger-South America - Other Geographies

5.5.1.7 Packers and flow control-South America - Other Geographies

5.6 Well Completion - Tools-Ecuador

5.7 Well Completion - Tools-Peru

6 Well Completion - Tools-South America, By Companies

6.1 Split By Geography

6.2 Well Completion - Tools-Brazil by Companies

6.1 Well Completion - Tools-Venezuela by Companies

6.1 Well Completion - Tools-Colombia by Companies

6.1 Well Completion - Tools-Argentina by Companies

6.1 Well Completion - Tools-South America - Other Geographies by Companies

6.1 Well Completion - Tools-Ecuador by Companies

6.1 Well Completion - Tools-Peru by Companies

6.2 Well Completion - Tools-South America-Halliburton Completion and Production

6.3 Well Completion - Tools-South America-Other Companies

6.4 Well Completion - Tools-South America-Baker Hughes Completion and Production

6.5 Well Completion - Tools-South America-Weatherford Completion and Production

6.6 Well Completion - Tools-South America-Superior Energy Services Onshore Completion and Workover Services

6.7 Well Completion - Tools-South America-Schlumberger Oilfield Services Reservoir Production

6.8 Well Completion - Tools-Welltec International Aps-South America

6.8.1 Well Completion - Tools-Welltec International Aps-South America, By Geographies

6.8.1.1 Well Completion - Tools-Welltec International Aps-Colombia

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

South America Oilfield Tools The increasing demand of oil and gas, and increase in investment made by foreign players in the onshore and offshore activities is driving the South American oilfield tools market. This market is expected to grow approximately at a CAGR of 13% from 2014 to 2019. |

Upcoming |

|

North America Oilfield Tools The continuous increase in oil production, presence of large shell reserves and major multinational companies is driving the North American oilfield tools market. This market is expected to grow approximately at a CAGR of 8% from 2014 to 2019. |

Upcoming |

|

Middle East Oilfield Tools The rising energy demand along with increasing drilling activities and increased investment in onshore and offshore exploration is driving the oilfield tools market in Middle East. This market is expected to grow approximately at a CAGR of 9% from 2014 to 2019. |

Upcoming |

|

Europe Oilfield Tools The rising oil extraction along with the technological advancement and investment in onshore and offshore exploration and production activities are driving the European oilfield tools market. The oilfield tools market in Europe is expected to grow approximately at a CAGR of 8% from 2014 to 2019. |

Upcoming |

|

Asia-Pacific Oilfield Tools The energy demand in Asia-Pacific has increased due to growth in population, improvement in economic condition and increase in industrial development. The oilfield tools market in Asia-Pacific is expected to grow approximately at a CAGR of 10% from 2014 to 2019. |

Upcoming |

|

Africa Oilfield Tools The rising oil extraction along with the increased government support and investment in onshore and offshore exploration & production activities is driving the global oilfield tools market. The oilfield tools market in Africa is expected to grow approximately at a CAGR of 10% from 2014 to 2019. |

Upcoming |