The South American market for wireline services, valued at $2.55 billion in 2014, is projected to reach $5.41 billion in 2019, at a CAGR of 16.3%, from 2014 to 2019.

The South American wireline services market, by type, covers logging, well intervention, and completion. The market is also split by geography, into Argentina, Brazil, Colombia, Ecuador, Trinidad & Tobago, Peru, and Venezuela, among others.

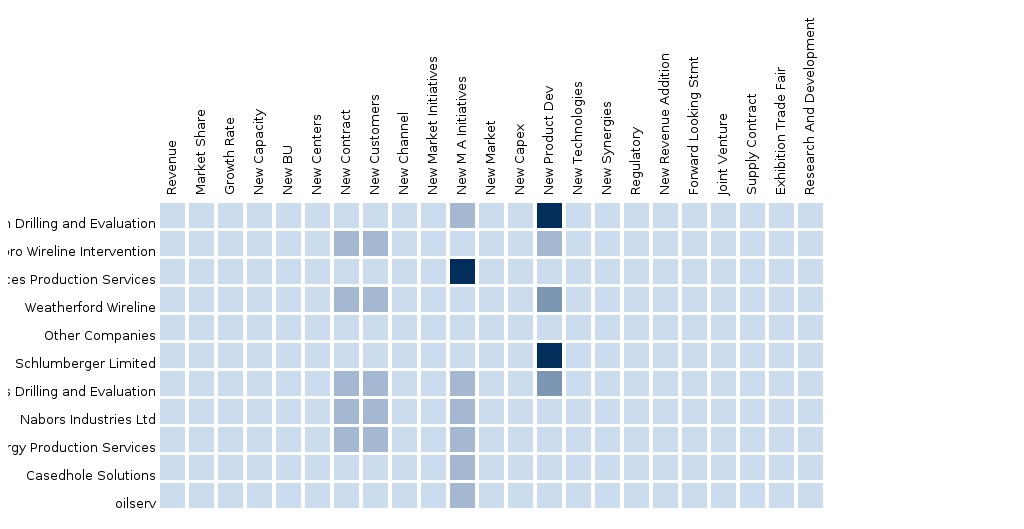

The wireline services report consists of the profiles of some of the major players in the market, such as Schlumberger, Halliburton, and Baker Hughes of the United States, and Weatherford International Ltd. of Switzerland, among others.

Customization Options:

Along with market data, customize the MMM assessment in alignment with your company’s specific needs. Customize to get a comprehensive summary of the industry standards and a deep dive analysis of the following parameters:

Benefits of this report:

- To explore market prospects worldwide from your desktop

- To determine the project feasibility before investing

- To discover hidden production opportunities

Product Benchmarking Outlook:

- Key competitors/operators’ products and geographic benchmarking

- A comparison of service portfolios of each company, mapped at regional level

Customer Segment Outlook:

- Oil & gas fields information

- Region

- Country

- Operator Name, address and contract details

- Field Name

- Field ID

- Date/Year Discovered

- Date/Year on Stream

- Depletion Date/Year

- Field Life

- Location

- Project Status

- Reserves Oil, Gas & Condensate

- Production Rates Oil, Gas & Condensate

Contract and Ownership Information:

- Current contract (license and block)

- Participants (individual company or group of companies)

- Historic details (original and previous participant)

Development History:

- No. of wells drilled and still active

- General development remarks

- Costs data and associated remarks

- Field event history

Production and Reserves:

- Cumulative and annual production volumes (historic and current)

- Country total production history (onshore/offshore split)

- IOR/EOR secondary methods information

- Fields reserves figures

- Reservoirs reserves figures

Field Outline, Images, and Bibliography:

- Field outline

- Scanned images

- Bibliographic references database

1 Introduction

1.1 Objective of the study

1.2 Market Definitions

1.3 Market Segmentation & Aspects Covered

1.4 Research Methodology

1.4.1 Assumptions (Market Size, Forecast, etc)

2 Executive Summary

3 Market Overview

4 Wireline Services-South America, By Applications

4.1 Split By Geography

4.1 Wireline Services-South America - Other Geographies by Applications

4.1 Wireline Services-Brazil by Applications

4.1 Wireline Services-Venezuela by Applications

4.1 Wireline Services-Argentina by Applications

4.1 Wireline Services-Colombia by Applications

4.1 Wireline Services-Mexico by Applications

4.2 Wireline Services-South America-Logging

4.2.1 Wireline Services-South America-Logging, By Geographies

4.2.1.1 Wireline Services-South America - Other Geographies-Logging

4.2.1.2 Wireline Services-Brazil-Logging

4.2.1.3 Wireline Services-Venezuela-Logging

4.2.1.4 Wireline Services-Argentina-Logging

4.2.1.5 Wireline Services-Colombia-Logging

4.3 Wireline Services-South America-Well Intervention

4.3.1 Wireline Services-South America-Well Intervention, By Geographies

4.3.1.1 Wireline Services-South America - Other Geographies-Well Intervention

4.3.1.2 Wireline Services-Brazil-Well Intervention

4.3.1.3 Wireline Services-Venezuela-Well Intervention

4.3.1.4 Wireline Services-Argentina-Well Intervention

4.3.1.5 Wireline Services-Colombia-Well Intervention

4.4 Wireline Services-South America-Well Completion

4.4.1 Wireline Services-South America-Well Completion, By Geographies

4.4.1.1 Wireline Services-South America - Other Geographies-Well Completion

4.4.1.2 Wireline Services-Brazil-Well Completion

4.4.1.3 Wireline Services-Venezuela-Well Completion

4.4.1.4 Wireline Services-Argentina-Well Completion

4.4.1.5 Wireline Services-Colombia-Well Completion

5 Wireline Services-South America, By Geographies

5.1 Wireline Services-South America - Other Geographies

5.1.1 Wireline Services-South America - Other Geographies, By Applications

5.1.1.1 Wireline Services-South America - Other Geographies-Logging

5.1.1.2 Wireline Services-South America - Other Geographies-Well Intervention

5.1.1.3 Wireline Services-South America - Other Geographies-Well Completion

5.2 Wireline Services-Brazil

5.2.1 Wireline Services-Brazil, By Applications

5.2.1.1 Wireline Services-Brazil-Logging

5.2.1.2 Wireline Services-Brazil-Well Intervention

5.2.1.3 Wireline Services-Brazil-Well Completion

5.2.2 Wireline Services-Brazil, By Companies

5.2.2.1 Wireline Services-Expro Wireline Intervention-Brazil

5.3 Wireline Services-Venezuela

5.3.1 Wireline Services-Venezuela, By Applications

5.3.1.1 Wireline Services-Venezuela-Logging

5.3.1.2 Wireline Services-Venezuela-Well Intervention

5.3.1.3 Wireline Services-Venezuela-Well Completion

5.4 Wireline Services-Argentina

5.4.1 Wireline Services-Argentina, By Applications

5.4.1.1 Wireline Services-Argentina-Logging

5.4.1.2 Wireline Services-Argentina-Well Intervention

5.4.1.3 Wireline Services-Argentina-Well Completion

5.5 Wireline Services-Colombia

5.5.1 Wireline Services-Colombia, By Applications

5.5.1.1 Wireline Services-Colombia-Logging

5.5.1.2 Wireline Services-Colombia-Well Intervention

5.5.1.3 Wireline Services-Colombia-Well Completion

5.5.2 Wireline Services-Colombia, By Companies

5.5.2.1 Wireline Services-Pioneer Energy Production Services-Colombia

5.6 Wireline Services-Mexico

5.6.1 Wireline Services-Mexico, By Companies

5.6.1.1 Wireline Services-Nabors Industries Ltd-Mexico

6 Wireline Services-South America, By Companies

6.1 Split By Geography

6.2 Wireline Services-South America - Other Geographies by Companies

6.1 Wireline Services-Brazil by Companies

6.1 Wireline Services-Venezuela by Companies

6.1 Wireline Services-Argentina by Companies

6.1 Wireline Services-Colombia by Companies

6.1 Wireline Services-Mexico by Companies

6.2 Wireline Services-South America-Schlumberger Limited

6.3 Wireline Services-South America-Halliburton Drilling and Evaluation

6.4 Wireline Services-South America-Baker Hughes Drilling and Evaluation

6.5 Wireline Services-South America-Other Companies

6.6 Wireline Services-South America-Weatherford Wireline

6.7 Wireline Services-South America-Superior Energy Services Production Services

6.8 Wireline Services-South America-Expro Wireline Intervention

6.9 Wireline Services-Nabors Industries Ltd-South America

6.9.1 Wireline Services-Nabors Industries Ltd-South America, By Geographies

6.9.1.1 Wireline Services-Nabors Industries Ltd-Mexico

6.10 Wireline Services-Pioneer Energy Production Services-South America

6.10.1 Wireline Services-Pioneer Energy Production Services-South America, By Geographies

6.10.1.1 Wireline Services-Pioneer Energy Production Services-Colombia

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

South America Oilfield Services The oilfield services market in South America was valued around $14.04 billion in 2013, with a market share of 9.3% globally. Projected to grow at a CAGR of 17% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Apr 2015 |

|

Asia-Pacific Oilfield Services The oilfield services market in Asia Pacific was valued around $31598 million in 2013, with a market share of almost 20% globally. Projected to grow at a CAGR of 14% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries in the region. |

Apr 2015 |

|

Middle East Oilfield Services Middle East oilfield services market was valued at $73,405.6 million in 2014 and is projected to grow at a CAGR of 4.2% from 2014 to 2019 to reach a market size of $90,150.1 by 2019. The large share is attributed to the rise in exploration of new reserves which requires increased drilling activities. |

May 2015 |

|

Africa Oilfield Services The oilfield services market in Africa was valued around $7642 million in 2013, with a market share of 5% globally. Projected to grow at a CAGR of 14.4% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Apr 2015 |

|

Europe Oilfield Services The European oilfield services market was valued at $45,592.5 million in 2014, and is projected to reach $60,017.5 million by 2019, at a CAGR of 5.7% from 2014 to 2019. The growth of this market can be attributed to the rise in exploration activities of new reserves, which requires increased drilling activities. The drilling services segment accounted for the largest share of 59.2% of the European oilfield services market in 2014. |

Apr 2015 |

|

North America Oilfield Services The oilfield services market in North America was valued around $76.85 billion in 2013, with a market share of 50.8% globally. Projected to grow at a CAGR of 9.8% from 2014 to 2019, the market is led by Weatherford, Halliburton, Schlumberger, and Baker Hughes. It is segmented on the basis of types of oilfield services and countries present in the region. |

Upcoming |