United Kingdom Communication Test and Measurement (CT&M) Market

The U.K communication test and measurement market is expected to grow from $0.55 million in 2013 to $0.84 million by 2018, at a CAGR of 8.8% during the period 2013 to 2018. The market is primarily driven by the demand by telecom operators for high bandwidth and efficient delivery of data (text, voice, and video).

The communication test and measurement market has grown rapidly in recent years, and further growth will depend highly on the growth of the telecommunication market. The increased demand for networks such as 2G, 3G, and 4G by subscribers, along with operators moving towards LTE technology, is fueling the communication test and measurement market. The communication test and measurement product helps the network providers and broadband service providers to deliver high quality voice data and signals over mobile and fixed networks.

The demand in the U.K market is growing rapidly because of the increasing penetration of smart phones and use of mobile data, and moreover, there is a rapid drive to increase the demand for mobile data capacity. According to Cisco, the mobile data capacity will grow 12 times by 2016, as compared to the capacity in 2011. Such an increase in mobile data capacity will bring a upsurge in the CT&M solutions market.

The market report provides a competitive benchmarking of the leading players in this market such as JDSU, Agile Technologies, EXFO, Danaher, and National Instruments. The CT & M market report gives the financial analysis, which includes CAGR and market share of the different region, vendors, overall adoption scenario, competitive landscape, key drivers, restraints, and opportunities.

Report Options:

The market segmentation detailed in this report is as given below:

- By Types of Test Solutions: Wireless test solutions, and wireline test solutions

- By Types of Tests: Enterprise test, field network test, lab and manufacturing test, and network assurance test

- By Services: Product support services, professional services, and managed services

- By End-Users: Network equipment manufacturers(NEMs), mobile device manufacturers , telecommunication service providers, and enterprises

Customization Options:

Along with the MMM assessment, customize the report in alignment with your company’s specific needs. The following customization options provide a comprehensive summary of the industry standards and a deep dive analysis:

Communication Test and Measurement Market Solutions Matrix:

- A comprehensive analysis and benchmarking by types of test solution, by types of test , by services, by end-users, and by regions in the market

Communication Test and Measurement Market Competitive Benchmarking:

- Value-chain evaluation using events, developments, market data for vendors in the market ecosystem, across various services, market segmentation and categorization

- To uncover hidden opportunities by connecting related markets using cascaded value chain analysis

Communication Test and Measurement Market Vendor Landscaping:

- Vendor market watch and predictions, vendor market shares and offerings, categorization of adoption trends and market dominance (leaders, challengers, and followers)

- Network operators or end-users usage pattern analysis and brand preference

Communication Test and Measurement Market Data Tracker

- Country-specific market forecast and analysis

- The identification of key end-user segments by country

Communication Test and Measurement Market Emerging Vendor Landscape:

- To evaluate Tier-2/3 vendors’ market offerings using a 2X2 framework (realizing leaders, challengers, and followers)

Communication Test and Measurement Market Channel Analysis:

- Channel/distribution partners/alliances for tier-1 vendors and application-specific products being build towards the customer end of value chain

Communication Test and Measurement Market Client Tracker:

- The listing and analysis of deals, case studies, R&D investments, events, discussion forums, campaigns, alliances and partners of tier-1 and tier-2/3 vendors for the last 3 years

Communication Test and Measurement Market Product Analysis

- Usage pattern (in-depth trend analysis) of products (segment-wise)

- Product matrix, which gives a detailed comparison of product portfolio of each company, mapped at country and sub-segment levels

- The applications of the products (segment-wise and country-wise)

- A comprehensive coverage of product portfolio comparison for specified parameters (price and features)

1 Introduction

1.1 Key Take-aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Key Data Points

1.5.2 Data Triangulation and Market Forecasting

1.6 Forecast Assumptions

2 Executive Summary

2.1 Abstract

2.2 Overall Market Size

3 Market Overview

3.1 Market Definition

3.2 Market Evolution

3.3 Market Segmentation

3.4 Market Dynamics

3.4.1 Impact Analysis of DRO

3.4.2 Drivers

3.4.3 Challenges

3.4.4 Opportunities

3.5 Value Chain

4 U.K. CT&M: Market Size and Forecast By Type of Test Solutions

4.1 Introduction

4.2 Wireless Test Solutions

4.2.1 Overview

4.2.2 Market Size and Forecast

4.3 Wireline Test Solutions

4.3.1 Overview

4.3.2 Market Size and Forecast

5 U.K. CT&M: Market Size and Forecast Products By Type of Tests

5.1 Introduction

5.2 Enterprise Test

5.2.1 Overview

5.2.2 Market Size and Forecast

5.3 Field Network Test

5.3.1 Overview

5.3.2 Market Size and Forecast

5.4 Lab and Manufacturing Test

5.4.1 Overview

5.4.2 Market Size and Forecast

5.5 Network Assurance Test

5.5.1 Overview

5.5.2 Market Size and Forecast

6 U.K. CT&M: Market Size and Forecast By Services

6.1 Introduction

6.2 Product Support Services

6.2.1 Overview

6.2.2 Market Size and Forecast

6.3 Professional Services

6.3.1 Overview

6.3.2 Market Size and Forecast

6.4 Managed Services

6.4.1 Overview

6.4.2 Market Size and Forecast

7 U.K. CT&M: Market Size and Forecast By End-Users

7.1 Introduction

7.2 Network Equipment Manufacturers (NEM)

7.2.1 Overview

7.2.2 Market Size and Forecast

7.3 Mobile Device Manufacturers

7.3.1 Overview

7.3.2 Market Size and Forecast

7.4 Telecommunication Service Providers

7.4.1 Overview

7.4.2 Market Size and Forecast

7.5 Enterprises

7.5.1 Overview

7.5.2 Market Size and Forecast

8 U.K. CT&M: Competitive Landscape

8.1 Competitive Landscape

8.1.1 Ecosystem and Roles

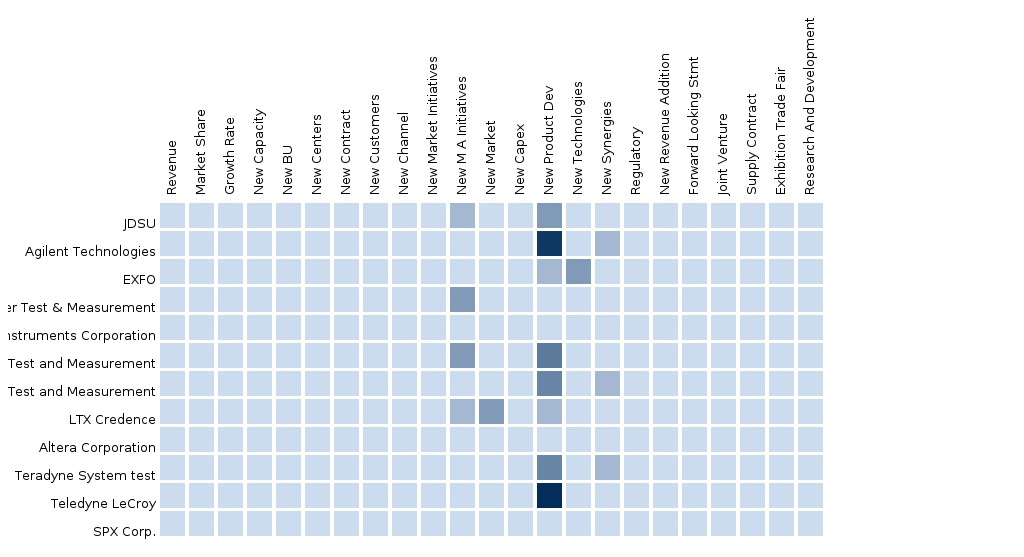

8.1.2 Portfolio Comparison

8.1.3 Market Opportunity Analysis

8.1.4 End-User Analysis

8.1.4.1 The Software-Defined Testing Market is Expected To Surpass $1 Billion By 2019

8.1.4.2 244 Commercial LTE Deployments Across 92 Countries Worldwide

8.1.4.3 Global Smartphone Sales is Expected To Reach 1.6 Billion Units By 2019

9 Company Profiles (MMM View, Overview, Products & Services, Financials, Swot Analysis, Strategy & Analyst Insights)

9.1 Anritsu

9.2 Agilent Technologies

9.3 Danaher Corporation

9.4 Exfo

9.5 Ixia

9.6 Jds Uniphase Corporation

9.7 National Instruments Corporation

9.8 Rohde & Schwarz

9.9 Spirent Communications

9.10 Yokogawa

9.11 F5 Networks

9.12 Citrix Systems

9.13 Cisco

9.14 Juniper

9.15 Brocade

List of Tables

Table 1 Communications Test and Measurement (CT&M) Market, 2013-2019 ($Billion, Y-O-Y %)

Table 2 U.K. CT&M Market, By Type of Test Solution, 2013-2019 ($Billion)

Table 3 U.K. Communications Test and Measurement (CT&M) Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Table 4 U.K. Wireless Test Solutions Market, By Equipment and Services, 2013-2019 ($Million)

Table 5 U.K. Wireless Test Solutions Market, By Equipment and Services, 2013-2019 (Y-O-Y %)

Table 6 U.K. Wireless Test Solutions Market, By Countries, 2013-2019 ($Million)

Table 7 U.K. Wireless Test Solutions Market, By Countries, 2013-2019 (Y-O-Y %)

Table 8 U.K. Wireline Test Solutions Market, By Equipment and Services, 2013-2019 ($Million)

Table 9 U.K. Wireline Test Solutions Market, By Equipment and Services, 2013-2019 (Y-O-Y %)

Table 10 U.K. Wireline Test Solutions Market, By Countries, 2013-2019 ($Million)

Table 11 U.K. Wireline Test Solutions Market, By Countries, 2013-2019 (Y-O-Y %)

Table 12 U.K. Communications Test and Measurement (CT&M) Market, By Type of Test, 2013-2019 ($Million)

Table 13 U.K. CT&M Market, By Type of Test, 2013-2019 (Y-O-Y %)

Table 14 U.K. Enterprise Test Market, By Type of Test Solutions, 2013-2019 ($Million)

Table 15 U.K. Enterprise Test Market, By Type of Test Solutions, 2013-2019 (Y-O-Y %)

Table 16 U.K. Enterprise Test Market, By Countries, 2013-2019 ($Million)

Table 17 U.K. Enterprise Test Market, By Countries, 2013-2019 (Y-O-Y %)

Table 18 U.K. Field Network Test Market, By Type of Test Solutions, 2013-2019 ($Million)

Table 19 U.K. Field Network Test Market, By Type of Test Solutions, 2013-2019 (Y-O-Y %)

Table 20 U.K. Field Network Test Market, By Countries, 2013-2019 ($Million)

Table 21 U.K. Field Network Test Market, By Countries, 2013-2019 (Y-O-Y %)

Table 22 U.K. Lab and Manufacturing Test Market, By Type of Test Solution, 2013-2019 ($Million)

Table 23 U.K. Lab and Manufacturing Test Market, By Type of Test Solutions, 2013-2019 (Y-O-Y %)

Table 24 U.K. Lab and Manufacturing Test Market, By Countries, 2013-2019 ($Million)

Table 25 U.K. Lab and Manufacturing Test Market, By Countries, 2013-2019 (Y-O-Y %)

Table 26 U.K. Network Assurance Test Market, By Type of Test Solution, 2013-2019 ($Million)

Table 27 U.K. Network Assurance Test Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Table 28 U.K. Network Assurance Test Market, By Countries, 2013-2019 ($Million)

Table 29 U.K. Network Assurance Test Market, By Countries, 2013-2019 (Y-O-Y %)

Table 30 U.K. Communications Test and Measurement (CT&M) Market, By Services, 2013-2019 ($Million)

Table 31 U.K. CT&M Market, By Services, 2013-2019 (Y-O-Y %)

Table 32 U.K. Product Support Services Market, By Type of Test Solution, 2013-2019 ($Million)

Table 33 U.K. Product Support Services Market, By Type of Test Solution, 2013-2019 ($Million)

Table 34 U.K. Product Support Services Market, By Countries, 2013-2019 ($Million)

Table 35 U.K. Product Support Services Market, By Countries, 2013-2019 (Y-O-Y %)

Table 36 U.K. Professional Services Market, By Type of Test Solution, 2013-2019 ($Million)

Table 37 U.K. Professional Services Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Table 38 U.K. Professional Services Market, By Countries, 2013-2019 ($Million)

Table 39 U.K. Professional Services Market, By Countries, 2013-2019 (Y-O-Y %)

Table 40 U.K. Managed Services Market, By Type of Test Solution, 2013-2019 ($Million)

Table 41 U.K. Managed Services Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Table 42 U.K. Managed Services Market, By Countries, 2013-2019 ($Million)

Table 43 U.K. Managed Services Market, By Countries, 2013-2019 (Y-O-Y %)

Table 44 U.K. Communications Test and Measurement (CT&M) Market, By End-Users, 2013-2019 ($Million)

Table 45 U.K. CT&M Market, By End-Users, 2013-2019 (Y-O-Y %)

Table 46 U.K. NEMs Market, By Type of Test Solution, 2013-2019 ($Million)

Table 47 U.K. NEMs Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Table 48 U.K. NEMs Market, By Equipment and Services, 2013-2019 ($Million)

Table 49 U.K. NEMs Market, By Equipment and Services, 2013-2019 (Y-O-Y %)

Table 50 U.K. Mobile Device Manufacturers Market, By Type of Test Solution, 2013-2019 ($Million)

Table 51 U.K. Mobile Device Manufacturers Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Table 52 U.K. Mobile Device Manufacturers Market, By Equipment and Services, 2013-2019 ($Million)

Table 53 U.K. Mobile Device Manufacturers Market, By Equipment and Services, 2013-2019 (Y-O-Y %)

Table 54 U.K. Telecommunication Service Provider Market, By Type of Test Solution, 2013-2019 ($Million)

Table 55 U.K. Telecommunication Service Provider Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Table 56 U.K. Telecommunication Service Provider Market, By Equipment and Services, 2013-2019 ($Million)

Table 57 U.K. Telecommunication Service Provider Market, By Equipment and Services, 2013-2019 (Y-O-Y %)

Table 58 U.K. Enterprise Market, By Type of Test Solution, 2013-2019 ($Million)

Table 59 U.K. Enterprise Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Table 60 U.K. Enterprise Market, By Equipment and Services, 2013-2019 ($Million)

Table 61 U.K. Enterprise Market, By Equipment and Services, 2013-2019 (Y-O-Y %)

Table 62 U.K. Communications Test and Measurement (CT&M) Market, By Countries, 2013-2019 ($Million)

Table 63 U.K. CT&M Market, By Countries, 2013-2019 (Y-O-Y %)

Table 64 U.K. Market, By Type of Test Solution, 2013-2019 ($Million)

Table 65 U.K. Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Table 66 U.K. Market, By Type of Test, 2013-2019 ($Million)

Table 67 U.K. Market, By Type of Test, 2013-2019 (Y-O-Y %)

Table 68 U.K. Market, By Services, 2013-2019 ($Million)

Table 69 U.K. Market, By Services, 2013-2019 (Y-O-Y %)

List of Figures

Figure 1 Secondary and Primary Research

Figure 2 Data Triangulation and Market Forecasting

Figure 3 U.K. Communications Test and Measurement (CT&M) Market, 2013-2019 (Y-O-Y %)

Figure 4 Impact Analysis of DRO

Figure 5 Value Chain

Figure 6 U.K. CT&M Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Figure 7 U.K. Wireless Test Solutions Market, By Equipment and Services, 2013-2019 (Y-O-Y %)

Figure 8 U.K. Wireline Test Solutions Market, By Equipment and Services, 2013-2019 (Y-O-Y %)

Figure 9 U.K. Communications Test and Measurement (CT&M) Market, By Type of Test, 2013-2019 (Y-O-Y %)

Figure 10 U.K. Enterprise Test Market, By Type of Test Solutions, 2013-2019 (Y-O-Y %)

Figure 11 U.K. Field Network Test Market, By Type of Test Solutions, 2013-2019 (Y-O-Y %)

Figure 12 U.K. Lab and Manufacturing Test Market, By Type of Test Solutions, 2013-2019 (Y-O-Y %)

Figure 13 U.K. Network Assurance Test Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Figure 14 U.K. CT&M Market, By Services, 2013-2019 (Y-O-Y %)

Figure 15 U.K. Product Support Services Market, By Type of Test Solution, 2013-2019 ($Million)

Figure 16 U.K. Professional Services Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Figure 17 U.K. Managed Services Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Figure 18 U.K. Communications Test and Measurement (CT&M) Market, By End-Users, 2013-2019 (Y-O-Y %)

Figure 19 U.K. NEMs Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Figure 20 U.K. NEMs Market, By Equipment and Services, 2013-2019 (Y-O-Y %)

Figure 21 U.K. Mobile Device Manufacturers Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Figure 22 U.K. Mobile Device Manufacturers Market, By Equipment and Services, 2013-2019 (Y-O-Y %)

Figure 23 U.K. Telecommunication Service Provider Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Figure 24 U.K. Telecommunication Service Provider Market, By Equipment and Services, 2013-2019 (Y-O-Y %)

Figure 25 U.K. Enterprise Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Figure 26 U.K. Enterprise Market, By Equipment and Services, 2013-2019 (Y-O-Y %)

Figure 27 U.K. Communications Test and Measurement (CT&M) Market, By Countries, 2013-2019 (Y-O-Y %)

Figure 28 U.K. CT&M Market: Parfait Chart

Figure 29 U.K. Market, By Type of Test Solution, 2013-2019 (Y-O-Y %)

Figure 30 U.K. Market, By Type of Test, 2013-2019 (Y-O-Y %)

Figure 31 U.K. Market, By Services, 2013-2019 (Y-O-Y %)

Figure 32 U.K. Ecosystem and Market Players

Figure 33 U.K. Product Portfolio Comparison

Figure 34 U.K. Communications Test and Measurement (CT&M) Market Opportunity Analysis

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement