Vietnam Pesticides Market By Category (Synthetic & Bio-Pesticides), Synthetic Pesticides (Herbicides, Insecticides, Fungicides & Others), Bio-Pesticides (Bio-Herbicides, Bio-Insecticides, Bio-Fungicides & Others), & by Crop Type - Trends & Forecasts to 2020

The Vietnam pesticides market is estimated to be valued at USD 979.5 million in 2015 and is projected to reach USD 1,212.5 million by 2020 at a CAGR of 4.4% from 2015 to 2020. The Vietnamese pesticides market is segmented on the basis of type and crop type. With the increasing demand for enhanced quality agricultural output and the rising need for organic and environment-friendly pesticides, the use of bio-pesticides is expected to enhance the market growth.

This report includes estimations of market sizes for value (USD million) with the base year as 2014, and forecast period from 2015 to 2020. Top-down and bottom-up approaches have been used to estimate and validate the size of the Vietnam pesticides market and to estimate the size of various other dependent submarkets. Key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

Breakdown of primary interviews

*Others include sales managers, marketing managers, and product managers

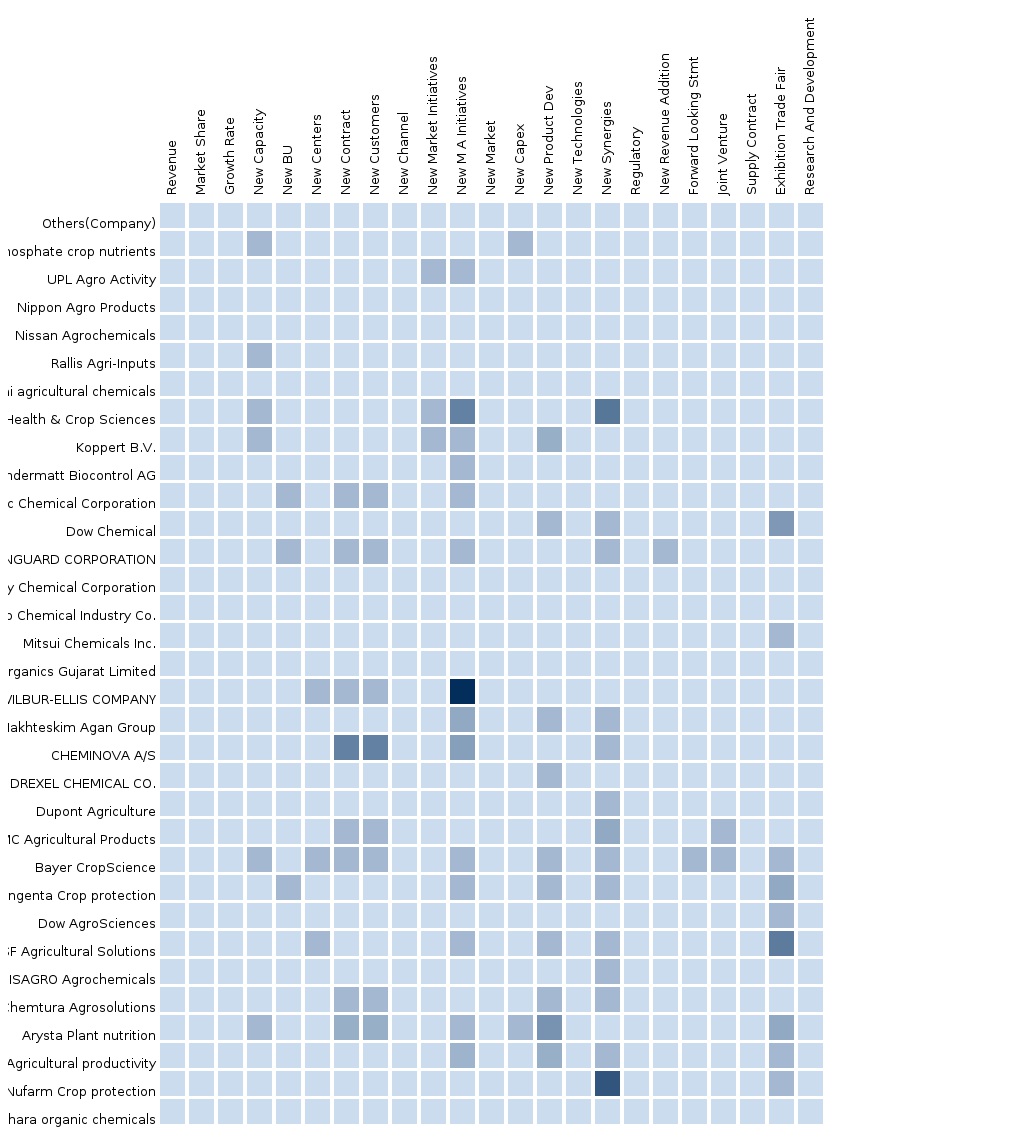

This report provides both qualitative and quantitative analyses of the Vietnamese pesticides market, the competitive landscape, and the preferred development strategies of key players. The key players preferred new product developments, expansions and investments, and partnerships & agreements as their key strategies to gain a larger share in the market. The report also analyzes the market dynamics and issues faced by leading players.

“To know about assumptions considered for this research report, download the pdf brochure.”

Vietnam Pesticides Market report is targeted to existing players in the industry including:

- Existing players in the industry, which include chemical manufacturers, raw material suppliers, pesticide traders & distributors, pesticide exporters & importers, and research institutions.

- Key participants in the supply chain of Vietnamese pesticides are raw material suppliers, government bodies, distributors, exporters related to Vietnamese pesticides, and end users such as farmers engaged in agribusiness.

- Upstream players offering pesticides to other manufacturers involved in pesticide manufacturing and treating have also been included in this report.

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the Report

On the basis of type, Vietnam Pesticides Market is segmented as follows:

- Synthetic pesticides

- Bio-pesticides

On the basis of crop type, Vietnam Pesticides Market is segmented as follows:

- Cereals & grains

- Fruits & vegetables

- Oilseeds & pulses

- Others (sugarcane, plantation crops, and turf & ornamentals)

On the basis of formulation, the bio-pesticides market is segmented as follows:

- Liquid formulations

- Solid formulations

On the basis of mode of application, the bio-pesticides market is segmented as follows:

- Seed treatment

- Soil treatment

- Foliar spray

- Post-harvest

On the basis of origin, the bio-pesticides market is segmented as follows:

- Biochemical pesticides

- Microbial pesticides

- Beneficial insects

Available Customizations

With the given market data, MicroMarketMonitor offers customizations according to the client’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Related Reports

Bacterial Biopesticides Market

Global Bacterial Biopesticides Market by Application (Seed Treatment, On Farm and Post-Harvest),by Type (Bacillus Thuringiensis, Bacillus Subtilis, Pseudomonas Fluorescens), by Crop Type, by Geography - Analysis and Forecast to 2019

http://www.micromarketmonitor.com/market-report/bacteria-pip-reports-2267187784.html

Latin America Biostimulants Market

Latin America Biostimulants Market by End-User (Row Crops, Fruits & Vegetables, Turfs & Ornamentals), by Mode of Application (Foliar, Seed, Soil), by Active Ingredients (Acid-based, Extracts-based), by Geography - Analysis and Forecast to 2019

http://www.micromarketmonitor.com/market/latin-america-bio-stimulants-6148072228.html

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Agriculture: Main Source of Income

2.2.2.1.1 Contribution of Agriculture in Vietnam GDP

2.2.2.1.2 Rice – Major Crop Under Cultivation in Vietnam

2.2.2.2 Increasing Foreign Trade of Agricultural Products

2.2.3 Supply Side Analysis

2.2.3.1 Growth of Agrochemicals Market

2.2.3.2 Technological Advancements in the Pesticides Market

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities in Vietnam Pesticides Market

4.2 Vietnamese Pesticides Market Size, By Type, 2014–2020 (USD Million)

4.3 Vietnam: Synthetic Pesticides Market, By Type, 2015 Vs. 2020 (USD Million)

4.4 Vietnam: Bio-Pesticides Market, By Type, 2015 Vs. 2020 (USD Million)

4.5 Vietnam: Synthetic Pesticides Market, By Crop Type, 2015 Vs. 2020 (USD Million)

4.6 Vietnam: Bio-Pesticides Market, 2015 Vs. 2020 (USD Million)

4.7 Seed Treatment is Projected to be the Fastest-Growing Mode of Application in Vietnam’s Bio-Pesticides Market

4.8 Vietnam: Bio-Pesticides Market, By Formulation, 2015 Vs. 2020 (USD Million)

4.9 Vietnam: Bio-Pesticides Market, By Origin, 2015 Vs. 2020 (USD Million)

5 Market Overview

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Rising Trade of Rice

5.4.1.2 Adoption of New Farming Practices

5.4.1.3 Measures to Control Infestations Though Government Initiatives

5.4.2 Restraints

5.4.2.1 Pesticide Residue Issues and Toxicity

5.4.2.2 Weak Functioning of State Authorities Responsible for Pesticide Management

5.4.3 Opportunities

5.4.3.1 Fdi and Foreign Ownership in Vietnam

5.4.3.2 R&D Activities

5.4.4 Challenges

5.4.4.1 Lack of New Skills and Understanding of Pests Among Farmers

6 Industry Trends

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Prominent Companies

6.3.2 Small & Medium Enterprises

6.3.3 End Users/Consumers

6.4 Pesticide Regulations in Vietnam

6.5 Porter’s Five Forces Analysis

6.5.1 Intensity of Competitive Rivalry

6.5.2 Bargaining Power of Suppliers

6.5.3 Bargaining Power of Buyers

6.5.4 Threat of New Entrants

6.5.5 Threat of Substitutes

7 Vietnam Pesticides Market, By Type

7.1 Introduction

7.2 Synthetic Pesticides

7.2.1 Herbicides

7.2.2 Insecticides

7.2.3 Fungicides

7.2.4 Others

7.3 Bio-Pesticides

7.3.1 Bio-Herbicides

7.3.2 Bio-Fungicides

7.3.3 Bio-Insecticides

7.3.4 Bio-Nematicides

7.3.5 Others

8 Vietnam Pesticides Market, By Crop Type

8.1 Introduction

8.2 Cereals & Grains

8.3 Oilseeds & Pulses

8.4 Fruits & Vegetables

8.5 Others

9 Vietnam Bio-Pesticides Market, By Origin

9.1 Introduction

9.2 Microbial Pesticides

9.3 Biochemical Pesticides

9.4 Beneficial Insects

10 Vietnam Bio-Pesticides Market, By Formulation

10.1 Introduction

10.2 Liquid Formulations

10.3 Solid Formulations

11 Vietnam Bio-Pesticides Market, By Mode of Application

11.1 Introduction

11.2 Seed Treatment

11.3 Soil Treatment

11.4 Foliar Spray

11.5 Post-Harvest

12 Competitive Landscape

12.1 Overview

12.2 Vietnam Pesticides Market: Market Share Analysis

12.3 Competitive Situation & Trends

12.3.1 Expansions & Investments

12.3.2 Acquisitions

12.3.3 New Product Launches, Registrations, & Approvals

12.3.4 Partnerships & Agreements

13 Company Profiles

13.1 Introduction

13.2 Arysta Lifescience Corporation

13.2.1 Business Overview

13.2.2 Products Offered

13.2.3 Recent Developments

13.2.4 Swot Analysis

13.2.5 MMM View

13.3 Basf Se

13.3.1 Business Overview

13.3.2 Products Offered

13.3.3 Recent Developments

13.3.4 Swot Analysis

13.3.5 MMM View

13.4 Bayer Cropscience Ag

13.4.1 Business Overview

13.4.2 Products Offered

13.4.3 Recent Developments

13.4.4 Swot Analysis

13.4.5 MMM View

13.5 Tân Thành Biochem Company

13.5.1 Business Overview

13.5.2 Products Offered

13.5.3 MMM View

13.6 Vietnam Fumigation Joint Stock Company

13.6.1 Business Overview

13.6.2 Products Offered

13.6.3 Recent Developments

13.6.4 MMM View

13.7 Golden Rice Agrochemical Company Limited

13.7.1 Business Overview

13.7.2 Products Offered

13.7.3 MMM View

13.8 Adc Group

13.8.1 Business Overview

13.8.2 Products Offered

13.8.3 MMM View

13.9 Sai Gon Plant Protection Joint Stock Company

13.9.1 Business Overview

13.9.2 Products Offered

13.9.3 MMM View

13.10 Hai Agrochem Joint Stock Company

13.10.1 Business Overview

13.10.2 Products Offered

13.10.3 Recent Developments

13.10.4 MMM View

13.11 Map Pacific (Vietnam) Company Limited

13.11.1 Business Overview

13.11.2 Products Offered

13.11.3 MMM View

13.12 Hop Tri Agrochemicals Co.,Ltd

13.12.1 Business Overview

13.12.2 Products Offered

13.12.3 MMM View

13.13 Phu Nong Co., Ltd

13.13.1 Business Overview

13.13.2 Products Offered

13.13.3 MMM View

14 Appendix

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Company Developments

14.3.1 New Product Launches, Registrations, & Approvals

14.3.2 Partnerships and Agreements

14.3.3 Acquisitions

14.3.4 Expansions and Investments

14.4 Knowledge Store: Micromarketmonitor Subscription Portal

14.5 Introducing Rt: Real-Time Market Intelligence

14.6 Available Customizations

14.7 Related Reports

List of Tables

Table 1 General Characteristics of Agriculture in Vietnam, 2012

Table 2 Rice Export Quantity and Export Value in Vietnam (2005–2014)

Table 3 Major Pesticide Families

Table 4 Agriculture and Rice-Statistics in 2011

Table 5 Rice Export Quantity and Export Value in Vietnam (2005-2014)

Table 6 Impact of Key Drivers on the Pesticides Market

Table 7 Food Poisoning in Vietnam, 2012-2007

Table 8 Summary of Suggested Needs for Improving Pesticide Regulations in Vietnam By Who

Table 9 Impact of Key Restraints on the Pesticides Market

Table 10 Research Funding By Subsector, 2012

Table 11 Opportunities for Pesticides Market

Table 12 Challenges to the Pesticides Market

Table 13 Vietnam Pesticides Market Size, By Type, 2013–2020 (USD Million)

Table 14 Vietnam Pesticides Market Size, By Type, 2013–2020 (Tons)

Table 15 Vietnam: Synthetic Pesticides Market Size, By Type, 2013–2020 (USD Million)

Table 16 Vietnam: Synthetic Pesticides Market Size, By Type, 2013–2020 (Tons)

Table 17 Vietnam: Bio-Pesticides Market Size, By Type, 2013–2020 (USD Million)

Table 18 Vietnam: Bio-Pesticides Market Size, By Type, 2013–2020 (Tons)

Table 19 Vietnam: Synthetic Pesticides Market Size, By Crop Type, 2013–2020 (USD Million)

Table 20 Vietnam: Synthetic Pesticides Market Size, By Crop Type, 2013–2020 (Tons)

Table 21 Vietnam: Bio-Pesticides Market Size, By Crop Type, 2013–2020 (USD Million)

Table 22 Vietnam: Bio-Pesticides Market Size, By Crop Type, 2013–2020 (Tons)

Table 23 Vietnam: Bio-Pesticides Market Size, By Origin, 2013–2020 (USD Million)

Table 24 Vietnam: Bio-Pesticides Market Size, By Formulation, 2013–2020 (USD Million)

Table 25 Vietnamese Bio-Pesticides Market Size, By Mode of Application, 2013–2020 (USD Million)

Table 26 Expansions & Investments, 2011–2015

Table 27 Acquisitions, 2011–2015

Table 28 New Product Launches, Registrations & Approvals, 2011–2015

Table 29 Partnerships & Agreements, 2011–2015

List of Figures

Figure 1 Vietnam Pesticides Market Segmentation

Figure 2 Research Design

Figure 1 Expected Gdp From Agriculture (2015 & 2020)

Figure 2 Vietnam: Area Harvested, Rice, 2010-2014

Figure 3 Import & Export of Agricultural Products, 2009–2013

Figure 4 Import-Export of Pesticides in Vietnam, 2009–2012

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Vietnam Pesticides Market Snapshot: Bio-Pesticides Segment Set for Promising Growth 2015 Vs. 2020 (USD Million)

Figure 9 Vietnam Synthetic Pesticides Market Size, By Type, 2015 Vs. 2020 (USD Million)

Figure 10 Vietnam Bio-Pesticides Market Size, By Type, 2015 Vs. 2020 (USD Million)

Figure 11 Vietnam Synthetic Pesticides Market Size, By Crop Type, 2015 Vs. 2020 (USD Million)

Figure 12 Vietnam Bio-Pesticides Market Size, By Crop Type, 2015 Vs. 2020 (USD Million)

Figure 13 Vietnam Bio-Pesticides Market Size, By Formulation, 2015 Vs. 2020 (USD Million)

Figure 14 Vietnam Bio-Pesticides Market Size, By Mode of Application, 2015 Vs. 2020 (USD Million)

Figure 15 Vietnam Bio-Pesticides Market Size, By Origin, 2015 Vs. 2020 (USD Million)

Figure 16 Trends in Vietnam’s Pesticides Market, 2015-2020 (USD Million)

Figure 17 Bio-Pesticides Segment is Projected to Grow At the Highest Rate During the Forecast Period (2014-2020)

Figure 18 Insecticides Segment is Projected to Dominate the Vietnamese Synthetic Pesticides Market (2015-2020)

Figure 19 Bio-Herbicides Segment is Projected to Dominate the Vietnamese Bio-Pesticides Market (2015-2020)

Figure 20 Cereals & Grains Segment is Projected to Account for the Largest Share in the Vietnamese Synthetic Pesticides Market (2015-2020)

Figure 21 Cereals & Grains Segment is Projected to Account for the Largest Share in the Vietnamese Bio-Pesticides Market (2015-2020)

Figure 22 Foliar Spray Segment is Projected to Dominate the Vietnamese Bio-Pesticides Market (2015-2020)

Figure 23 Liquid Formulations Segment is Projected to Account for the Largest Share in the Vietnamese Bio-Pesticides Market (2015-2020)

Figure 24 Biochemical Pesticides Segment is Projected to Account for the Largest Share in Vietnam’s Bio-Pesticides Market (2015-2020)

Figure 25 Development of Pesticides Market

Figure 26 Vietnam Pesticides Market Segmentation

Figure 27 Changing Farmers’ Perception Regarding Crop Health and Quality is Driving the Pesticides Market

Figure 28 Total Foreign Direct Investment in Vietnam

Figure 29 R&D and Registration Processes Contribute the Most to Overall Value of Pesticides

Figure 30 Manufacturing and Distribution: Integral Part of Supply Chain of Pesticides Market

Figure 31 Porter’s Five Forces Analysis: Pesticides Market

Figure 32 Bio-Pesticides is Projected to be the Fastest-Growing Segment in Vietnam’s Pesticides Market During the Forecast Period (2015-2020)

Figure 33 Cereals & Grains to be Fastest-Growing Crop Type in Vietnam’s Synthetic Pesticides Market (2015-2020)

Figure 34 Cereals & Grains to be Fastest-Growing Crop Type in Vietnam’s Bio-Pesticides Market (2015-2020)

Figure 35 Vietnam Cereal Production, 1991-2013 (‘000 Metric Tons)

Figure 36 Vietnam Soybean Production, 2012-2016-E (‘000 Metric Tons)

Figure 37 Vietnam’s Fruits & Vegetables Export Revenue, 2005–2012 (USD Million)

Figure 38 Vietnam Fruit Crops Production, 2008-2013 (USD Billion)

Figure 39 Vietnam’s Sugarcane Production (‘000 Metric Tons) & Rubber Production (Tons, 1990-2013)

Figure 40 Biochemical Pesticides to be Fastest-Growing Segment in the Vietnamese Bio-Pesticides Market (2015-2020)

Figure 41 Liquid Formulation to be Fastest-Growing Segment in the Vietnamese Bio-Pesticides Market (2015-2020)

Figure 42 Seed Treatment is Projected to be the Fastest-Growing Segment in the Vietnamese Bio-Pesticides Market During the Forecast Period (2015-2020)

Figure 43 New Product Launches: Key Startegy Adopted By the Key Players (2011-2015)

Figure 44 Vietnam Pesticides Market Share (Revenue), By Key Player, 2014

Figure 45 Trend of Strategies Adopted By the Leading Companies in Vietnami, 2014–2015

Figure 46 New Product Launch: the Key Strategy, 2011–2015

Figure 47 Geographical Revenue Mix of Top Five Market Players, 2014

Figure 48 Platform Specialty Products Company: Company Snapshot

Figure 49 Arysta Lifescience Corporation: Swot Analysis

Figure 50 Basf Se: Company Snapshot

Figure 51 Basf Se: Swot Analysis

Figure 52 Bayer Cropscience Ag: Company Snapshot

Figure 53 Bayer Cropscience Ag: Swot Analysis

Figure 54 Micromarketmonitor Knowledge Store Snapshot

Figure 55 Micromarketmonitor Knowledge Store: Agriculture Industry Snapshot

The Vietnam pesticides market is projected to grow at a CAGR of 4.4% from 2015 to reach a projected value of USD 1.2 billion by 2020. The market for pesticides in Vietnam is further driven by factors such as rising trade of agricultural products such as rice, coffee, and pepper; technological advancement in the pesticides industry; introduction of innovative pesticides to avoid pest resistance and environment hazards; and changing farmers’ knowledge and perception regarding crop health and quality.

On the basis of crop type, the Vietnamese pesticides market is led by the cereals & grains segment, followed by the fruits & vegetables and oilseeds & pulses segments. Cereals & grains is also the fastest-growing crop type in the Vietnamese pesticides market. Vietnam is the one of the largest producers of rice resulting in the highest utilization of pesticides, mainly insecticides in rice cultivation. Also, the production of fruits and vegetables in the country is high leading to an increased usage of pesticides.

On the basis of type, synthetic pesticides accounted for the largest market share in 2014, followed by bio-pesticides. Synthetic pesticides play a vital role in the agricultural sector in Vietnam and are extensively used by farmers. Among synthetic pesticides, insecticides are the most frequently used pesticides in Vietnam. Since Vietnam is one of the largest producers of rice, most pesticides used in Vietnam are related to the rice crop. Since insects are the major pests infecting rice cultivation, insecticides are the highest used pesticides in the country.

Vietnam Pesticides Market, By Type, 2020 (USD Million)

Source: MicroMarketMonitor Analysis

Along with pesticide toxicity and residual issues, the weak functioning of statutory authorities managing the pesticide use and application has affected the pesticides market in Vietnam.

The key players identified in the Vietnamese pesticides market include BASF SE (Germany), Arysta LifeScience Corporation (Japan), Bayer CropScience AG (Germany), Vietnam Fumigation Joint Stock Company, and HAI Agrochem Joint Stock Company. Along with these companies, the other players having a strong presence this market include Tan Thanh Biochem company (Vietnam), Golden Rice Agrochemical company limited (Vietnam), ADC Group (Vietnam), Sai Gon Plant Protection Joint Stock Company (Vietnam), MAP Pacific (Vietnam) Company Limited, Hop Tri Agrochemicals Co., Ltd (Vietnam), and Phu Nong Co., Ltd (Vietnam).

To speak to our analyst for a discussion on the above findings, please fill up the required details by clicking on the Speak to Analyst tab.

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America Agrochemicals Agrochemicals-North America and Pesticides, Agricultural... |

Upcoming |

|

Europe Agrochemicals Agrochemicals-Europe and Pesticides, Agricultural... |

Upcoming |