Global In Situ Hybridization Market Study (2014-2019) by Type (DNA ISH, RNA ISH), By Application (Cancer Diagnostics, Immunology, Neurosciences, Cytology, Others), By End User (Hospitals, Pharma & Biotech Companies, Research Labs, CROs)

The global in-situ hybridization market is broadly classified on the basis of product type. The products are segmented into DNA in-situ hybridization and RNA in-situ hybridization. Based on the types of DNA, in-situ hybridization is further segmented into DNA-FISH and DNA-CISH. DNA-FISH held the largest share in the global in-situ hybridization market in 2014 and accounted for a market share of 55.7%. By geography, the global in-situ hybridization market is segmented into North America, Europe, Asia-Pacific, and rest of the World (RoW). The North American region led the global in-situ hybridization market in 2014 and accounted for a market share of 40%, followed by Europe.

In-situ hybridization (ISH) is a technique that helps to identify the exact location of a specific segment of nucleic acid that is a DNA or RNA, in a cell or tissue (in-situ). The most commonly used in-situ hybridization is DNA-FISH. DNA-FISH finds various applications ranging from detection of chromosomal aberrations, diagnosing hematological malignancies, and solid tumors to gene mapping and recognition of oncogenes.

A number of factors, such as increasing prevalence of cancer disease, growing initiatives and funding from government to increase awareness about cancer and support researches related to it, and increasing usage of personalized medicines for treatment of cancer are driving the global in-situ hybridization market. This market is witnessing various technological advancements, due to which new and advanced products are being launched in the market. For instance, Exiqon A/S (Denmark) launched a new product named LNA GapmeRs for RNA functional analysis, especially for inactivation of RNA in functional studies. However, availability of better technologies, such as high-throughput whole genome sequencing and microarray, among others are restraining the growth of the global in-situ hybridization market.

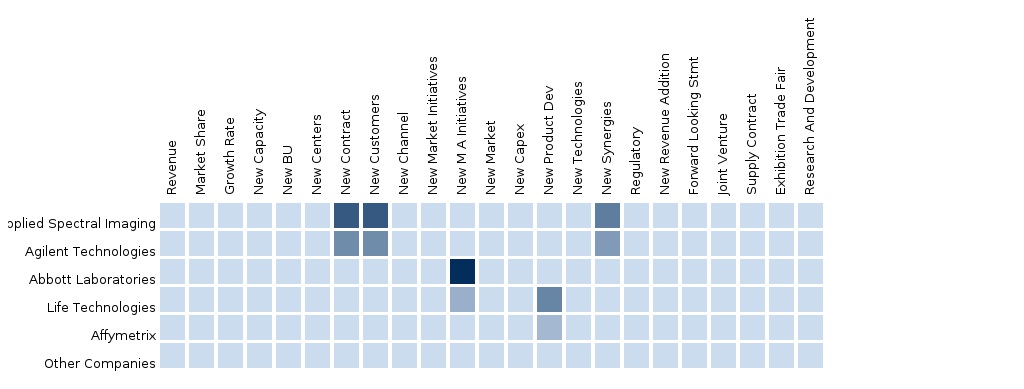

The report also provides a detailed competitive landscaping of the companies operating in the global in-situ hybridization market. The report contains information about segment and country specific company shares, news & deals, mergers & acquisitions, segment specific pipeline products, product approvals, and product recalls of the key companies. The key companies operating in this market are Abbott (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Affymetrix, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), and Agilent Technologies, Inc. (U.S.).

Table Of Contents

1 Introduction (Page No. - )

1.1. Key Takeaways

1.2. Report Description

1.3. Markets Covered

1.4. Research Methodology

1.4.1. Market Size

1.4.2. Market Share

1.4.3. Key Data Points From Secondary Source

1.4.4. Key Data Points From Primary Source

1.4.5. Assumptions

2 Executive Summary (Page No. - )

3 Market Overview (Page No. - )

3.1. Introduction

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. New Product Launches

4 Global In Situ Hybridization Market Value ($ Million), By Geography, 2013-2019 ($Million) (Page No. - )

4.1. Introduction

4.2. North America Market By Country

4.3. Europe Market By Country

4.4. Asia-Pacific Market By Country

4.5. Rest Of The World Market By Country

5 Global In Situ Hybridization Market Value ($ Million), By Type, 2013-2019 (Page No. - )

5.1. Dna In Situ Hybridization

5.1.1. Dna - Fish

5.1.2. Dna - Cish

5.2. Rna In Situ Hybridization

5.2.1. Rna - Fish

5.2.2. Rna - Cish

6 Global In Situ Hybridization Market Value (Units) , By Application, 2013-2019 (Page No. - )

6.1. Cancer Diagnostics

6.2. Cytology

6.3. Neurosciences

6.4. Immunology

6.5. Others

7 Global In Situ Hybridization Market Value, By End Users ($Million), 2013-2019 (Page No. - )

7.1. Hospitals

7.2. Pharma & Bio-Tech Companies

7.3. Research Labs

7.3. Cro

7.3. Others

8 Competitive Landscape (Page No. - )

8.1. Introduction

8.2. Global Market Share: Dna In Situ Hyrbidization By Companies

8.3. Global Market Share: Rna In Situ Hyrbidization By Companies

9 Company Profiles (Page No. - )

9.1. Abbott

9.2. F. Hoffmann-La Roche Ltd

9.3. Thermo Fisher Scientific Inc.

9.4. Affymetrix Inc.

9.5. Agilent Technologies

9.6. Advanced Cell Diagnostics (Acd)

9.8. Sigma Aldrich Co. Llc.

9.9. Others

List Of Tables

Table 1 Global In Situ Hybridization Market Size, By Type, 2013 – 2019, ($Million)

Table 2 Global Dna In Situ Hybridization Market Size, By Geography, 2013 – 2019, ($Million)

Table 3 Global Dna Fluorescent In Situ Hybridization (Fish) Market Size, By Geography, 2013 – 2019, ($Million)

Table 4 Global Dna Chromogenic In Situ Hybridization (Cish) Market Size, By Geography, 2013 – 2019, ($Million)

Table 5 Global Rna In Situ Hybridization (Fish) Market Size, By Geography, 2013 – 2019, ($Million)

Table 6 Global Rna Fluorescent In Situ Hybridization (Fish) Market Size, By Geography, 2013 – 2019, ($Million)

Table 7 Global Rna Chromogenic In Situ Hybridization (Cish) Market Size, By Geography, 2013 – 2019, ($Million)

Table 8 Global In Situ Hybridization Market Size, By Application, 2013 – 2019, ($Million)

Table 9 Global Cancer Diagnostics Market Size, By Geography, 2013 – 2019, ($Million)

Table 10 Global Cytology Market Size, By Geography, 2013 – 2019, ($Million)

Table 11 Global Neuroscience Market Size, By Geography, 2013 – 2019, ($Million)

Table 12 Global Immunology Market Size, By Geography, 2013 – 2019, ($Million)

Table 13 Global Other Applications Market Size, By Geography, 2013 – 2019, ($Million)

Table 14 Global In Situ Hybridization Market Size, By End User, 2013 – 2019, ($Million)

Table 15 Global In Situ Hybridization Hospitals Market Size, By Geography, 2013 –2019, ($Million)

Table 16 Global In Situ Hybridization Pharma & Biotech Companies Market Size, By Geography, 2013 – 2019, ($Million)

Table 17 Global In Situ Hybridization Research Labs Market Size, By Geography, 2013 – 2019, ($Million)

Table 18 Global In Situ Hybridization Cro’s Market Size, By Geography, 2013 – 2019, ($Million)

Table 19 Global In Situ Hybridization Other End Users Market Size, By Geography, 2013 – 2019, ($Million)

Table 20 Global In Situ Hybridization Market Size, By Geography, 2013 – 2019, ($Million)

Table 21 North America In Situ Hybridization Market Size, By Type, 2013 – 2019, ($Million)

Table 22 North America In Situ Hybridization Market Size, By Application, 2013 – 2019, ($Million)

Table 23 North America In Situ Hybridization Market Size, By End User, 2013 – 2019, ($Million)

Table 24 Europe In Situ Hybridization Market Size, By Type, 2013 – 2019, ($Million)

Table 25 Europe In Situ Hybridization Market Size, By Application, 2013 – 2019, ($Million)

Table 26 Europe In Situ Hybridization Market Size, By End User, 2013 – 2019, ($Million)

Table 27 Apac In Situ Hybridization Market Size, By Type, 2013 – 2019, ($Million)

Table 28 Apac In Situ Hybridization Market Size, By Application, 2013 – 2019, ($Million)

Table 29 Apac In Situ Hybridization Market Size, By End User, 2013 – 2019, ($Million)

Table 30 Row In Situ Hybridization Market Size, By Type, 2013 – 2019, ($Million)

Table 31 Row In Situ Hybridization Market Size, By Application, 2013 – 2019, ($Million)

Table 32 Row In Situ Hybridization Market Size, By End User, 2013 – 2019, ($Million)

Table 33 Annual Contracts & Agreements, 2012–2014

Table 34 Expansions, 2012-2014

Table 35 Mergers & Acquisitions, 2012-2014

Table 36 New Product Launches, 2012-2014

Table 37 Other Developments, 2012-2014

Table 38 Companies: Financials And Product Matrix, 2012-2014

List Of Figures

Figure 1 Global In Situ Hybridization Market Size, By Type, 2013 – 2019, ($Million)

Figure 2 Global Dna In Situ Hybridization Market Size, By Geography, 2013 – 2019, ($Million)

Figure 3 Global Dna Fluorescent In Situ Hybridization (Fish) Market Size, By Geography, 2013 – 2019, ($Million)

Figure 4 Global Dna Chromogenic In Situ Hybridization (Cish) Market Size, By Geography, 2013 – 2019, ($Million)

Figure 5 Global Rna In Situ Hybridization (Fish) Market Size, By Geography, 2013 – 2019, ($Million)

Figure 6 Global Rna Fluorescent In Situ Hybridization (Fish) Market Size, By Geography, 2013 – 2019, ($Million)

Figure 7 Global Rna Chromogenic In Situ Hybridization (Cish) Market Size, By Geography, 2013 – 2019, ($Million)

Figure 8 Global In Situ Hybridization Market Size, By Application, 2013 – 2019, ($Million)

Figure 9 Global Cancer Diagnostics Market Size, By Geography, 2013 – 2019, ($Million)

Figure 10 Global Cytology Market Size, By Geography, 2013 – 2019, ($Million)

Figure 11 Global Neuroscience Market Size, By Geography, 2013 – 2019, ($Million)

Figure 12 Global Immunology Market Size, By Geography, 2013 – 2019, ($Million)

Figure 13 Global Other Applications Market Size, By Geography, 2013 – 2019, ($Million)

Figure 14 Global In Situ Hybridization Market Size, By End User, 2013 – 2019, ($Million)

Figure 15 Global In Situ Hybridization Hospitals Market Size, By Geography, 2013 –2019, ($Million)

Figure 16 Global In Situ Hybridization Pharma & Biotech Companies Market Size, By Geography, 2013 – 2019, ($Million)

Figure 17 Global In Situ Hybridization Research Labs Market Size, By Geography, 2013 – 2019, ($Million)

Figure 18 Global In Situ Hybridization Cro’s Market Size, By Geography, 2013 – 2019, ($Million)

Figure 19 Global In Situ Hybridization Other End Users Market Size, By Geography, 2013 – 2019, ($Million)

Figure 20 Global In Situ Hybridization Market Size, By Geography, 2013 – 2019, ($Million)

Figure 21 North America In Situ Hybridization Market Size, By Type, 2013 – 2019, ($Million)

Figure 22 North America In Situ Hybridization Market Size, By Application, 2013 – 2019, ($Million)

Figure 23 North America In Situ Hybridization Market Size, By End User, 2013 – 2019, ($Million)

Figure 24 Europe In Situ Hybridization Market Size, By Type, 2013 – 2019, ($Million)

Figure 25 Europe In Situ Hybridization Market Size, By Application, 2013 – 2019, ($Million)

Figure 26 Europe In Situ Hybridization Market Size, By End User, 2013 – 2019, ($Million)

Figure 27 Apac In Situ Hybridization Market Size, By Type, 2013 – 2019, ($Million)

Figure 28 Apac In Situ Hybridization Market Size, By Application, 2013 – 2019, ($Million)

Figure 29 Apac In Situ Hybridization Market Size, By End User, 2013 – 2019, ($Million)

Figure 30 Row In Situ Hybridization Market Size, By Type, 2013 – 2019, ($Million)

Figure 31 Row In Situ Hybridization Market Size, By Application, 2013 – 2019, ($Million)

Figure 32 Row In Situ Hybridization Market Size, By End User, 2013 – 2019, ($Million)

Figure 33 Annual Contracts & Agreements, 2012–2014

Figure 34 Expansions, 2012-2014

Figure 35 Mergers & Acquisitions, 2012-2014

Figure 36 New Product Launches, 2012-2014

Figure 37 Other Developments, 2012-2014

Figure 38 Companies: Financials And Product Matrix, 2012-2014

In-situ hybridization (ISH) is a powerful technique used for focusing on specific nucleic acid targets within fixed tissues and cells, to obtain temporal and spatial information about gene expression. The in-situ hybridization technique is divided into two types, namely DNA and RNA. This is because, normally ISH requires isolation of DNA or RNA which is done by separating it on a gel, blotting it onto nitrocellulose, and probing it with a complementary sequence.

ISH is a powerful technique used for the detection of chromosomal abnormalities. The ISH technique is very beneficial for the diagnosis of breast cancer owing to its reliability, in terms of qualitative as well as quantitative evaluation of the biomarker. Other than breast cancer, ISH-based companion diagnostics are also used to detect mutations in patients with gastric cancer. The high sensitivity and specificity of ISH and the high speed of assay performance have made ISH an upcoming technique in both, research and diagnosis of hematological malignancies and solid tumors.

The two major types of in-situ hybridization techniques are DNA in-situ hybridization and RNA in-situ hybridization. DNA in-situ hybridization technique led the global in-situ hybridization market in 2014, among types and accounted for a market share of 75.4%. This segment is estimated to grow at a CAGR of 4.2% from 2014 to 2019. The DNA and RNA in-situ hybridizations can further be divided into fluorescent in-situ hybridization (FISH) and chromogenic ssin-situ hybridization (CISH). Amongst these, DNA fluorescent in-situ hybridization (FISH) segment accounted for the largest share of 55.7% in the global in-situ hybridization market in 2014. It is estimated to grow at a CAGR of 4.0% during the forecast period.

The major end users of In-Situ Hybridization kits are hospitals, pharma & biotech companies, research labs, and contract research organizations (CROs). The hospital segment accounted for the largest share of 49.6% in the global In-Situ Hybridization market in 2014 and is estimated to witness a CAGR of 4.5% during the forecast period. The major application of in-situ hybridization involves cancer diagnostics, immunology, neurosciences, cytology, and others. Among applications, the cancer diagnostics segment accounted for the largest share in the global in-situ hybridization market in 2014 and accounted for a market share of 56.7%. It is estimated witness a CAGR of 4.7% during the forecast period, 2014 to 2019 due to increased application of the in-situ hybridization techniques in the diagnosis of cancer.

The major drivers for the global in-situ hybridization market are the increasing prevalence of cancer disease and growing usage of personalized medicines for its treatment. Besides, the increase in the number of initiatives undertaken by the government, such as create awareness about cancer disease and providing funding to support researches related to it are also fueling the growth of this market. On the other hand, the availability of the advanced techniques, such as next generation sequencing, and uncertain reimbursement scenarios are factors that are expected to restrict growth of this market to a certain extent.

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America In Situ Hybridization The North American hybridization market has gained a significant share in the total hybridization market. The market was pegged at $277 million in 2012 and is estimated to achieve $528 million by 2018, with a growing CAGR of 11.2%. The market can be segmented on the basis of types and various types of applications, the report further segments the market into major geographies, companies, and macro indicators. Deep-dive analysis of the top players of this market have been considered in this report |

Upcoming |

|

Asia-Pacific In Situ Hybridization The Asian hybridization market has gained a significant share in the total hybridization market. The market was pegged at $200 million in 2012 and is estimated to achieve $403 million by 2018, with a growing CAGR of 12.4%. The market can be segmented on the basis of types and various types of applications, the report further segments the market into major geographies, companies, and macro indicators. Deep-dive analysis of the top players of this market have been considered in this report |

Upcoming |

|

Europe In Situ Hybridization The European hybridization market has gained a significant share in the total hybridization market. The market was pegged at $221 million in 2012 and is estimated to achieve $417 million by 2018, with a growing CAGR of 11%. The market can be segmented on the basis of types and various types of applications, the report further segments the market into major geographies, companies, and macro indicators. Deep-dive analysis of the top players of this market have been considered in this report |

Upcoming |