Asia Pacific Swine Feed Market By Type (Starters, Growers & SoW), By Ingredients (Antibiotics, Amino Acids, Feed Enzymes, Feed Acidifiers and Others) and By Country - Analysis and Forecast to 2019

Pork is a cheap source of animal protein as compared to beef. The production of pork involves lower operating costs for producers and quick return on investments. These factors have led to an increase in the consumption of pork in Asia-Pacific, which acts as a driver for the increasing consumption of swine feed as well.

The Asia Pacific swine feed market is estimated to grow at a CAGR of 5.7% between 2014 and 2019. In Asia Pacific, different types of swine feed are available, including starters, pig growers, and sow. Starter feed is the diet formulated for newly-born piglets. The main purpose of the nutritional program is to adjust the piglets to dry feed and prepare them for the grow-finish stage. A pig grower is a pig between the phase of weaning and sale or transfer to the breeding herd and is sold for slaughter. A sow is a breeding female or female after first or second litter.

The Asia Pacific swine feed market is led by China with 63.9% market share, followed by Vietnam. Asia -pacific has the highest population among all regions and is growing continuously. The increasing population will require proportional increase in quantity of pork meat. The Asia-Pacific has always witnessed extensive pork consumption owing to high levels of disposable income. The only competitor for pork is fish and related products, especially in Japan. However, the Pacific fish bank is also constrained due to intense trawling activities which have led to a decrease in the population of fish in those areas. Thus, it is expected that there will be increasing demand for pork and subsequently the pork feed from this region in coming years.

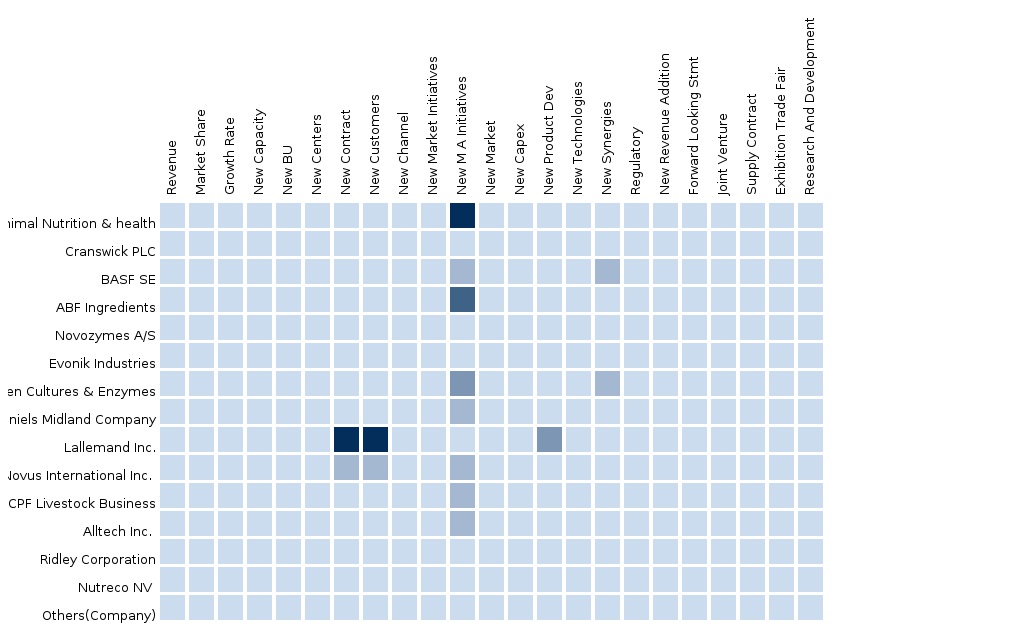

The swine feed market in Asia Pacific is served by various companies. The leading company, Chareon Pokphand Food PLC (Thailand), has followed the strategy of expansion which has helped to expand its presence beyond Thailand to other Asia-Pacific countries. The Archer Daniels Midland Company (U.S.) has adopted the strategies of expansions and mergers & acquisitions to reach out to the maximum number of producers of swine feeds. Other firms, for instance Nutreco N.V. (The Netherlands) and ABF PLC (U.K.) have significant presence across the region, which helps them to serve the market efficiently.

Scope of the Report

This research report categorizes the Asia Pacific swine feed market into the following segments and sub-segments:

By Type

- Starters

- Pig Growers

- Sow

By Additive

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

By Geography

- China

- Vietnam

- Japan

- Others

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of Swine Feed Market

2.2 Arriving at the Size of the Swine Feed Market

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 19)

4 Market Overview (Page No. - 20)

4.1 Introduction

4.2 Asia-Pacific Swine Feed Market: Comparison With Parent Market

4.3 Market Drivers & Inhibitors

4.4 Key Market Dynamics

5 Asia-Pacific Swine Feed Ingredient Market (Page No. - 29)

5.1 Introduction

5.2 Antibiotics in Asia-Pacific Swine Feed, By Country

5.3 Vitamins in Asia-Pacific Swine Feed, By Country

5.4 Antioxidants in Asia-Pacific Swine Feed, By Country

5.5 Amino Acids in Asia-Pacific Swine Feed, By Country

5.6 Feed Enzymes in Asia-Pacific Swine Feed, By Country

5.7 Feed Acidifiers in Asia-Pacific Swine Feed, By Country

6 Asia-Pacific Swine Feed Market, By Type (Page No. - 44)

6.1 Introduction

6.2 Asia-Pacific Swine Feed Market, Type Comparison With Animal Feed Market

6.3 Asia-Pacific Starters Feed Market, By Country

6.4 Asia-Pacific Growers Feed Market, By Country

6.5 Asia-Pacific Sow Feed Market, By Country

6.6 Sneak View: Asia-Pacific Swine Feed Market, By Type

7 Asia-Pacific Swine Feed Market, By Country (Page No. - 55)

7.1 Introduction

7.2 Vendor-Side Analysis

7.3 China Swine Feed Market

7.3.1 China Swine Feed Market, By Ingredients

7.3.2 China Swine Feed Market, By Type

7.4 Japan Swine Feed Market

7.4.1 Japan Swine Feed Market, By Ingredient

7.4.2 Japan Swine Feedmarket, By Type

7.5 Vietnam Swine Feed Market

7.5.1 Vietnam Swine Feed Market, By Ingredient

7.5.2 Vietnam Swine Feedmarket, By Type

8 Swine Feed Market in Asia-Pacific: Competitive Landscape (Page No. - 74)

8.1 Swine Feed Market: Company Share Analysis

8.2 Company Presence in Asia-Pacific Swine Feed Market, By Type

8.3 Mergers & Acquisitions

8.4 Expansions

8.5 Investments

9 Swine Feed Market, By Company (Page No. - 78)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Charoen Pokphand Foods

9.2 Associated British Foods

9.3 Archer Daniels Midland Company

9.4 Nutreco N.V.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Company

10 Appendix (Page No. - 94)

10.1 Customization Options

10.1.1 Technical Analysis

10.1.2 Low-Cost Sourcing Locations

10.1.3 Regulatory Framework

10.1.4 Swine Feed Usage Data

10.1.5 Impact Analysis

10.1.6 Trade Analysis

10.1.7 Historical Data and Trends

10.2 Related Reports

10.3 Introducing RT: Real Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (62 Tables)

Table 1 Global Swine Feed Peer Market Size, 2014 (USD MN)

Table 2 Asia-Pacific Swine Feed: Macro Indicators, By Country, 2014 (MN)

Table 3 Asia-Pacific Swine Feed: Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 4 Asia-Pacific Swine Feed: Comparison With Parent Market, 2013 – 2019 (KT)

Table 5 Asia-Pacific Swine Feed: Drivers & Inhibitors

Table 6 Asia-Pacific Swine Feed Ingredient Market, 2013 – 2019 (USD MN)

Table 7 Asia-Pacific Swine Feed Ingredient Market, 2013 – 2019 (KT)

Table 8 Asia-Pacific Swine Feed Market, By Country, 2013 – 2019 (USD MN)

Table 9 Asia-Pacific Swine Feed Market, By Country, 2013 – 2019 (KT)

Table 10 Asia-Pacific Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Table 11 Asia-Pacific Swine Feed Market, By Type, 2013 – 2019 (KT)

Table 12 Asia-Pacific Swine Feed Ingredient Market, 2013 – 2019 (USD MN)

Table 13 Asia-Pacific Swine Feed Ingredient Market, 2013 – 2019 (KT)

Table 14 Antibiotics in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (USD MN)

Table 15 Antibiotics in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (KT)

Table 16 Vitamins in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (USD MN)

Table 17 Vitamins in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (KT)

Table 18 Antioxidants in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (USD MN)

Table 19 Antioxidants in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (KT)

Table 20 Amino Acids in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (USD MN)

Table 21 Amino Acids in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (KT)

Table 22 Feed Enzymes in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (USD MN)

Table 23 Feed Enzymes in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (KT)

Table 24 Feed Acidifiers in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (USD MN)

Table 25 Feed Acidifiers in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (KT)

Table 26 Asia-Pacific Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Table 27 Asia-Pacific Swine Feed Market, By Type, 2013 – 2019 (KT)

Table 28 Asia-Pacific Swine Feed Market: Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 29 Asia-Pacific Starters Feed Market, By Country, 2013–2019 (USD MN)

Table 30 Asia-Pacific Starters Feed Market, By Country, 2013–2019 (KT)

Table 31 Asia-Pacific Growers Feed Market, By Country, 2013–2019 (USD MN)

Table 32 Asia-Pacific Growers Feed Market, By Country, 2013–2019 (KT)

Table 33 Asia-Pacific Sow Feed Market, By Country, 2013–2019 (USD MN)

Table 34 Asia-Pacific Sow Feed Market, By Country, 2013–2019 (KT)

Table 35 Asia-Pacific Swine Feed Market, By Country, 2013 – 2019 (USD MN)

Table 36 Asia-Pacific Swine Feed Market, By Country, 2013 – 2019 (KT)

Table 37 China Swine Feed Market, By Ingredients, 2013-2019 (USD MN)

Table 38 China Swine Feed Market, By Ingredients, 2013-2019 (KT)

Table 39 China Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Table 40 China Swine Feed Market, By Type, 2013 – 2019 (KT)

Table 41 Japan Swine Feed Market, By Ingredients, 2013-2019 (USD MN)

Table 42 Japan Swine Feed Market, By Ingredients, 2013-2019 (KT)

Table 43 Japan Swine Feed Market, 2013 – 2019 (USD MN)

Table 44 Japan Swine Feed Market, By Type, 2013 – 2019 (KT)

Table 45 Vietnam Swine Feed Market, By Ingredients, 2013 – 2019 (USD MN)

Table 46 Vietnam Swine Feed Market, By Ingredients, 2013-2019 (KT)

Table 47 Vietnam Swine Feed Market, 2013 – 2019 (USD MN)

Table 48 Vietnam Swine Feed Market, By Type, 2013 – 2019 (KT)

Table 49 Swine Feed Market: Company Share Analysis, 2014 (%)

Table 50 Asia-Pacific Swine Feed Market: Mergers & Acquisitions

Table 51 Asia-Pacific Swine Feed Market: Expansions

Table 52 Asia-Pacific Swine Feed Market: Investments

Table 53 Charoen Pokphand Foods: By Segment, 2008–2013 (USD MN)

Table 54 Charoen Pokphand Foods : Key Financial Data, 2008–2013(USD MN)

Table 55 Associated British Foods: By Segment, 2009 – 2013 (USD MN)

Table 56 Associated British Foods : By Country, 2009 - 2013 (USD MN)

Table 57 Associated British Foods : Key Financials, 2009 - 2013 (USD MN)

Table 58 Archer Daniels Midland Company: Key Operations Data, 2009 – 2013 (USD MN)

Table 59 Archer Daniels Midland Company: Key Financials, 2009 – 2013 (USD MN)

Table 60 Archer Daniels Midland Company: By Geography, 2009 – 2013 (USD MN)

Table 61 Nutreco N.V.: Key Operations Data, 2009 – 2013 (USD MN)

Table 62 Nutreco N.V.: Key Financials, 2009 - 2013 (USD MN)

List of Figures (51 Figures)

Figure 1 Asia-Pacific Swine Feed Market: Segmentation & Coverage

Figure 2 Swine Feed Market: Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Macro Indicator-Based Approach

Figure 7 Asia-Pacific Swine Feed Market Snapshot

Figure 8 Swine Feed Market: Growth Aspects

Figure 9 Asia-Pacific Swine Feed Ingredient Market, 2014 vs 2019

Figure 10 Asia-Pacific Swine Feed Types, By Country, 2014 (USD MN)

Figure 11 Asia-Pacific Swine Feed Market: Growth Analysis, By Type, 2014–2019 (%)

Figure 12 Asia-Pacific Swine Feed Ingredient Market, 2014 – 2019 (USD MN)

Figure 13 Asia-Pacific Swine Feed Ingredient Market, 2014 – 2019 (KT)

Figure 14 Antibiotics in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (USD MN)

Figure 15 Vitamins in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (USD MN)

Figure 16 Antioxidants in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (USD MN)

Figure 17 Amino Acids in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (USD MN)

Figure 18 Feed Enzymes in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (USD MN)

Figure 19 Feed Acidifiers in Asia-Pacific Swine Feed, By Country, 2013 – 2019 (USD MN)

Figure 20 Asia-Pacific Swine Feed Market, By Type, 2014 – 2019 (USD MN)

Figure 21 Asia-Pacific Swine Feed Market, By Type, 2014 & 2019 (KT)

Figure 22 Asia-Pacific Swine Feed Market: Type Comparison With Animal Market, 2013–2019 (USD MN)

Figure 23 Asia-Pacific Starters Feed, By Country, 2013–2019 (USD MN)

Figure 24 Asia-Pacific Growers Feed, By Country, 2013–2019 (USD MN)

Figure 25 Asia-Pacific Sow Feed, By Country, 2013–2019 (USD MN)

Figure 26 Asia-Pacific Swine Feed Market: Growth Analysis, By Country, 2014 – 2019 (USD MN)

Figure 27 Asia-Pacific Swine Feed Market: Growth Analysis, By Country, 2014 – 2019 (KT)

Figure 28 China Swine Feed Market Overview, 2014 & 2019 (%)

Figure 29 China Swine Feed Market, By Key Ingredients, 2013-2019 (USD MN)

Figure 30 China Swine Feed Market: Ingredients Snapshot

Figure 31 China Swine Feed Market, By Type, 2013 – 2019 ($Mn)

Figure 32 China Swine Feed Market Share, By Type, 2014 – 2019 (%)

Figure 33 Japan Swine Feed Market Overview, 2014 & 2019 (%)

Figure 34 Japan Swine Feed Market, By Key Ingredient, 2013 – 2019 (USD MN)

Figure 35 Japan Swine Feed Market: Ingredients Snapshot

Figure 36 Japan Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Figure 37 Japan Swine Feed Market Share, By Type, 2014 & 2019 (%)

Figure 38 Vietnam Swine Feed Market Overview, 2014 & 2019 (%)

Figure 39 Vietnam Swine Feed Market, By Key Ingredient, 2013 – 2019 (USD MN)

Figure 40 Vietnam Swine Feed Market: Ingredients Snapshot

Figure 41 Vietnam Swine Feed Market, By Type, 2013 – 2019 (USD MN)

Figure 42 Vietnam Swine Feed Market Share, By Type, 2014 – 2019 (%)

Figure 43 Swine Feed Market: Company Share Analysis, 2014 (%)

Figure 44 Swine Feed: Company Product Coverage, By Type, 2014

Figure 45 Charoen Pokphand Foods: Reveue Mix, 2013 (%)

Figure 46 Contribution of Feed Segment Towards Company Revenues, 2009 – 2013 (USD MN)

Figure 47 Associated British Foods Revenue Mix, 2013 (%)

Figure 48 Contribution of Agriculture Segment Towards Company Revenues, 2009 – 2013 (USD MN)

Figure 49 Archer Daniels Midland Company Revenue Mix, By Segment & Geography, 2013 (%)

Figure 50 Nutreco N.V., Revenue Mix, 2013 (%)

Figure 51 Contribution of Animal Nutrition Segment Towards Company Revenues, 2009 – 2013 (USD MN)

Swine is advantageous over other animals used for rearing as it is a cheap source of meat and animal protein. Swine incur lower operating cost and quick return on investment as compared to other livestock. Swine feed is used to provide nutrients to the swine for better growth and productivity. Swine feed is a major source of essential nutrients required for healthy pig.

The phases of pork production are breeding-gestation, farrowing, nursery, and grow-finish. During these phases, the pigs are fed as per their requirement. On the basis of feed type, pigs have been classified into starters, pig growers, sow, and others.

The purpose of this study is to analyze the Asia-Pacific swine feed market. This report includes revenue forecast, market trends, and opportunities for the period from 2014 to 2019. The analysis has been conducted on the various market segments derived on the basis of additives used in swine feed.

The Asia Pacific swine feed market was valued at $35.0 billion in 2014, which is projected to reach $46.2 billion by 2019, at a CAGR of 5.7% during the forecast period. Amino acids segment held the largest share among all additive types in 2014. Among countries, China held the largest share of 63.95% of the swine feed market in Asia Pacific.

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

Payment Link - Vietnam Feed The Vietnamese feed market is projected to reach a value of USD 9.52 billion by 2021, at a CAGR of 5.6% from 2016 to 2021. The market is driven by factors such as gradual shift from unorganized livestock farming to organized sector and the growing awareness regarding the importance of health and hygiene of livestock. The support provided by the government to foreign companies has also led to the development and growth of this market. |

Aug 2016 |