Protease is the second largest enzyme, which is widely applied in food and beverage segment. It is the most essential enzyme for the digestion of protein. Proteases are involved in catabolism of protein in which hydrolysis of the peptide bonds takes place. Protease is classified as alkaline, acidic, and neutral, of which acidic and neutral variants are used in food and beverage industry.

Table Of Contents

1 Introduction (Page No. - 16)

1.1 Objectives

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Market Size Estimation

1.5.2 Market Crackdown & Data Triangulation

1.5.3 Protein Hydrolysis Enzymes: Market Estimation

1.5.4 Assumptions Made For This Report

1.5.4.1 Key Data Points Taken From Secondary Sources

1.5.4.2 Key Data Points Taken From Primary Sources

2 Executive Summary (Page No. - 30)

3 Market Overview (Page No. - 33)

3.1 Introduction

3.2 Market Segmentation

3.2.1 Market Segmentation

3.3 Burning Issue

3.3.1 Excess of Exposure Causes Irritations & Allergic Reactions

3.4 Winning Imperative

3.4.1 New Product Launches & R&D

3.5 Impact Analysis

3.6 Market Dynamics

3.6.1 Drivers

3.6.1.1 Modification of Properties in Food Proteins

3.6.1.2 Uncovering Health Values

3.6.1.3 Reduction In Feed Costs

3.6.1.4 Controlling Phosphorus Pollution & Nitrogen Content

3.6.1.5 Improved Nutritional Value of Poultry Meal

3.6.1.6 Low Allergic Infant Food

3.6.1.7 Sustainability As A Result of Various Sources

3.6.2 Restraints

3.6.2.1 Effect of Temperature

3.6.2.2 Limited Food Application

3.6.2.3 Replacement By Chemicals

3.6.3 Opportunities

3.6.3.1 Optimization of Animal Nutrition

3.6.3.2 As A Class of Therapeutic Agents

3.6.3.3 Clean Labeling

3.6.3.4 Increase in Demand of Non-Allergic Food Products in Dairy Segment

3.6.3.5 Increase in Demand of Environmental and Health Friendly Products

3.7 Porter’s Five Forces Analysis

3.7.1 Degree of Competition

3.7.2 Bargaining Power of Suppliers

3.7.3 Bargaining Power of Customers

3.7.4 Threat From New Entrants

3.7.5 Threat From Substitutes

4 Total Addressable Market (Page No. - 49)

4.1 Introduction

4.1.1 Detergents & Cleaning Industry

4.1.2 Pharmaceuticals

4.1.3 Bakery

4.1.4 Beverages

4.1.5 Dairy

4.1.6 Animal Feed

4.1.7 Textile

5 Premium Insights (Page No. - 54)

5.1 Market Overview

5.1.1 Key Features

5.1.2 Global & Regional Overview

5.1.3 Global & Regional Overview, By Application

5.1.4 APAC: Fastest Growing Market

5.1.4.1 China & India Drive The APAC Market

5.1.5 Microbial Source – Most Preferred

5.1.6 Detergents & Pharmaceuticals – The Biggest Application Markets

5.1.7 Global & Regional Overview, By Application

5.1.8 Market, By Country, 2014 Vs 2019

5.1.9 Novozymes A Market Leader; Strategy Followed – New Product Launch

5.1.10 SWOT Analysis

6 Protease Market, By Source (Page No. - 69)

6.1 Introduction

6.2 Market Size, By Source

6.3 Microorganisms As A Source

6.3.1 By Geography

6.3.2 By Application

6.4 Animals As A Source

6.4.1 By Geography

6.4.2 By Application

6.5 Plants As A Source

6.5.1 Plants Protease Market Size, By Geography

6.5.2 Plants Protease Market Size, By Application

7 Protease Market, By Application (Page No. - 82)

7.1 Introduction

7.2 Detergent Industry

7.2.1 By Geography

7.2.2 By Source

7.3 Pharmaceuticals

7.3.1 By Geography

7.3.2 By Source

7.4 Food Industry

7.4.1 By Geography

7.4.2 By Source

7.5 Others

7.5.1 By Geography

8 Protease Market, By Geography (Page No. - 102)

8.1 Introduction

8.2 North America (U.S., Canada, Mexico)

8.3 Europe (Germany, U.K., France, Italy, Spain)

8.4 Asia-Pacific (China, Japan, India)

8.5 ROW (South Africa, Brazil)

9 Competitive Landscape (Page No. - 181)

9.1 Introduction

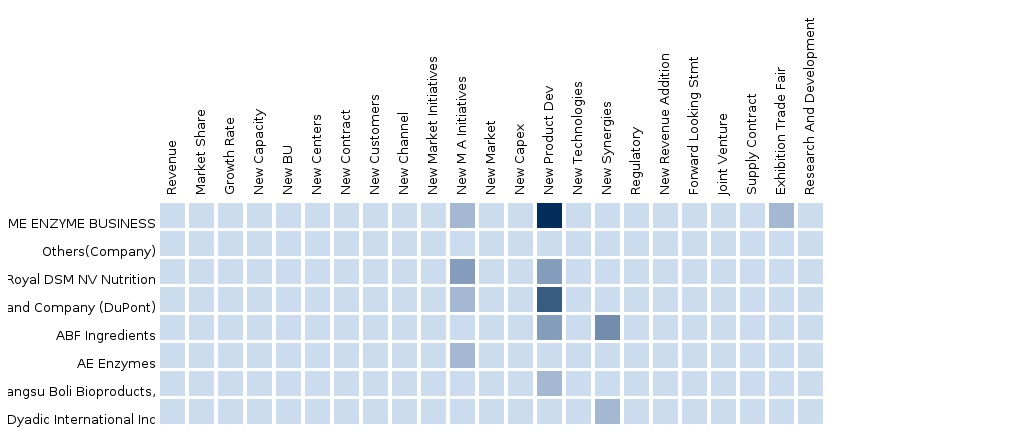

9.1.1 New Product Launches, Research & Development – Most Preferred Strategy

9.1.2 Key Market Strategies

9.2 Agreements/Partnerships/Collaborations/Joint Ventures

9.3 New Product Launch & R&D

9.4 Mergers & Acquisitions

9.5 Expansions & Investments

10 Company Profile (Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)* (Page No. - 195)

10.1 Ab Enzymes

10.2 Novozymes

10.3 Royal Dsm

10.4 Specialty Enzymes & Biotechnologies Co.

10.5 Advanced Enzymes

10.6 Dyadic International, Inc.

10.7 Jiangsu Boli Bioproducts Co., Ltd

10.8 E.I. Dupont De Nemours & Company

10.9 Solvay Enzymes

10.10 Amano Enzymes

*Details on Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

List of Tables (98 Tables)

Table 1 Market Size, By Value ($Million) & Volume (KT), 2012-2019

Table 2 Addressable Market, 2014-2019 ($Million)

Table 3 Market Facts: Enzymes

Table 4 Animal Proteases Types & Applications in Metabolic Processes

Table 5 Market Size, By Source, 2012-2019 ($Million)

Table 6 Microorganisms Protease Market Size, By Geography, 2012-2019 ($Million)

Table 7 Microorganisms Protease Market Size, By Application, 2012-2019 ($Million)

Table 8 Animal’s Protease Market Size, By Geography, 2012-2019 ($Million)

Table 9 Animal’s Protease Market Size, By Application, 2012-2019 ($Million)

Table 10 Plants Protease Market Size, By Geography, 2012-2019 ($Million)

Table 11 Plants Protease Market Size, By Application, 2012-2019 ($Million)

Table 12 Market Size, By Application, 2012-2019 ($Million)

Table 13 Market Size in Detergent Industry, By Geography, 2012-2019 ($Million)

Table 14 Market Size in Detergent Industry, By Geography, 2012-2019 (KT)

Table 15 Market Size in Detergent Industry, By Source, 2012-2019 ($Million)

Table 16 Pharmaceuticals Protease Market Size, By Geography, 2012-2019 ($Million)

Table 17 Pharmaceuticals Protease Market Size, By Geography, 2012-2019 (KT)

Table 18 Pharmaceuticals Protease Market Size, By Source, 2012-2019 ($Million)

Table 19 Food Industry Protease Market Size, By Geography, 2012-2019 ($Million)

Table 20 Food Industry Protease Market Size, By Geography, 2012-2019 (KT)

Table 21 Food Industry Protease Market Size, By Source, 2012-2019 ($Million)

Table 22 Market Size For Other Applications, By Geography, 2012-2019 ($Million)

Table 23 Other Applications Market Size, By Geography, 2012-2019 (KT)

Table 24 Other Enzyme Market Size, By Source, 2012-2019 ($Million)

Table 25 Enzymes Market Size, By Geography, 2012-2019 ($Million)

Table 26 Enzyme Market Size, By Geography, 2012-2019 (KT)

Table 27 North America: Market Size, By Country, 2012-2019 ($Million)

Table 27 North America: Market Size, By Country, 2012-2019 ($Million)

Table 28 North America: Market Size, By Country, 2012-2019 (KT)

Table 29 North America: Market Size, By Source, 2012-2019 ($Million)

Table 30 North America: Market Size, By Application, 2012-2019 ($Million)

Table 31 North America: Market Size, By Application, 2012-2019 (KT)

Table 32 U.S.: Protease Enzymes Market Size, By Source, 2012-2019 ($Million)

Table 33 U.S.: Protease Enzyme Market Size, By Application, 2012-2019 ($Million)

Table 34 U.S.: Protease Enzyme Market Size, By Application, 2012-2019 (KT)

Table 35 Canada: Protease Enzymes Market Size, By Source, 2012-2019 ($Million)

Table 36 Canada: Protease Enzyme Market Size, By Application, 2012-2019 ($Million)

Table 37 Canada: Protease Enzyme Market Size, By Application, 2012-2019 (KT)

Table 38 Mexico: Protease Enzymes Market Size, By Source, 2012-2019 ($Million)

Table 39 Mexico: Protease Enzyme Market Size, By Application, 2012-2019 ($Million)

Table 40 Mexico: Protease Enzyme Market Size, By Application, 2012-2019 (KT)

Table 41 Europe: Market Size, By Country, 2012-2019 ($Million)

Table 42 Europe: Market Size, By Source, 2012-2019 ($Million)

Table 43 Europe: Market Size, By Application, 2012-2019 ($Million)

Table 44 Europe: Market Size, By Country, 2012-2019 (KT)

Table 45 Europe: Market Size, By Application, 2012-2019 (KT)

Table 46 Germany: Protease Enzymes Market Size, By Source, 2012-2019 ($Million)

Table 47 Germany: Protease Enzyme Market Size, By Application, 2012-2019 ($Million)

Table 48 Germany: Protease Enzyme Market Size, By Application, 2012-2019 (KT)

Table 49 France: Protease Enzymes Market Size, By Source, 2012-2019 ($Million)

Table 50 France: Protease Enzyme Market Size, By Application, 2012-2019 ($Million)

Table 51 France: Protease Enzyme Market Size, By Application, 2012-2019 (KT)

Table 52 Italy: Protease Enzymes Market Size, By Source, 2012-2019 ($Million)

Table 53 Italy: Protease Enzyme Market Size, By Application, 2012-2019 ($Million)

Table 54 Italy: Protease Enzyme Market Size, By Application, 2012-2019 (KT)

Table 55 Spain: Protease Enzymes Market Size, By Source, 2012-2019 ($Million)

Table 56 Spain: Protease Enzyme Market Size, By Application, 2012-2019 ($Million)

Table 57 Spain: Protease Enzyme Market Size, By Application, 2012-2019 (KT)

Table 58 U.K.: Protease Enzymes Market Size, By Source, 2012-2019 ($Million)

Table 59 U.K.: Protease Enzyme Market Size, By Application, 2012-2019 ($Million)

Table 60 U.K.: Protease Enzyme Market Size, By Application, 2012-2019 (KT)

Table 61 Rest of Europe: Market Size, By Source, 2012-2019 ($Million)

Table 62 Rest of Europe: Market Size, By Application, 2012-2019 ($Million)

Table 63 U.K.: Protease Enzyme Market Size, By Application, 2012-2019 (KT)

Table 64 APAC: Market Size, By Country, 2012-2019 ($Million)

Table 65 APAC: Market Size, By Source, 2012-2019 ($Million)

Table 66 APAC: Market Size, By Application, 2012-2019 ($Million)

Table 67 APAC: Market Size, By Country, 2012-2019 (KT)

Table 68 APAC: Market Size, By Application, 2012-2019 (KT)

Table 69 China: Protease Enzymes Market Size, By Source, 2012-2019 ($Million)

Table 70 China: Protease Enzyme Market Size, By Application, 2012-2019 ($Million)

Table 71 China: Protease Enzyme Market Size, By Application, 2012-2019 (KT)

Table 72 Japan: Protease Enzymes Market Size, By Source, 2012-2019 ($Million)

Table 73 Japan: Protease Enzyme Market Size, By Application, 2012-2019 ($Million)

Table 74 Japan: Protease Enzymes Market Size, By Application, 2012-2019 (KT)

Table 75 India: Protease Enzymes Market Size, By Source, 2012-2019 ($Million)

Table 76 India: Protease Enzyme Market Size, By Application, 2012-2019 ($Million)

Table 77 India: Protease Enzymes Market Size, By Application, 2012-2019 (KT)

Table 78 Rest of Asia-Pacific: Market Size, By Source, 2012-2019 ($Million)

Table 79 Rest of Asia-Pacific: Market Size, By Application, 2012-2019 ($Million)

Table 80 Rest of Asia-Pacific: Market Size, By Application, 2012-2019 (KT)

Table 81 ROW: Market Size, By Country, 2012-2019 ($Million)

Table 82 ROW: Market Size, By Country, 2012-2019 (KT)

Table 83 ROW: Market Size, By Source, 2012-2019 ($Million)

Table 84 ROW: Market Size, By Application, 2012-2019 ($Million)

Table 85 ROW: Market Size, By Application, 2012-2019 (KT)

Table 86 South Africa: Protease Enzyme Market Size, By Source, 2012-2019 ($Million)

Table 87 South Africa: Protease Enzyme Market Size, By Application, 2012-2019 ($Million)

Table 88 South Africa: Protease Enzymes Market Size, By Application, 2012-2019 (KT)

Table 89 Brazil: Protease Enzymes Market Size, By Source, 2012-2019 ($Million)

Table 90 Brazil: Protease Enzyme Market Size, By Application, 2012-2019 ($Million)

Table 91 Brazil: Protease Enzyme Market Size, By Application, 2012-2019 (KT)

Table 92 Rest of ROW: Market Size, By Source, 2012-2019 ($Million)

Table 93 Rest of ROW: Market Size, By Application, 2012-2019 ($Million)

Table 94 Rest of ROW: Market Size, By Application, 2012-2019 (KT)

Table 95 Agreements/Partnerships/Collaborations/Joint Ventures (2010-2014)

Table 96 New Product Launch/Research & Development, 2010-2014

Table 97 Acquisitions (2011-2013)

Table 98 Expansions & Investments, 2010-2014

List of Figures (31 Figures)

Figure 1 Classification of Protease Enzymes

Figure 2 Research Methodology

Figure 3 Protein Hydrolysis Enzymes: Market Size Estimation Methodology

Figure 4 Data Triangulation Methodology

Figure 5 Market Share, By Geography, 2012

Figure 6 Market Segmentation

Figure 7 New Product Development By Key Players & Other Growth Strategies

Figure 8 Impact Analysis of Market Drivers, Restraints & Opportunities

Figure 9 Porter’s Model Analysis

Figure 10 Protease Market: Global & Regional Overview

Figure 11 Protease Market: Global & Regional Overview, By Application

Figure 12 Asia-Pacific Protease Market

Figure 13 China & India’s Market Share in Asia-Pacific

Figure 14 Sources: Market Size & Growth Trends

Figure 15 Enzymes Application: Market Size & Growth Trends

Figure 16 Global & Regional Overview, By Application (2012-2019)

Figure 17 Market, By Country, 2014 Vs 2019 ($Million)

Figure 18 Market: Industrial Players, By New Product Launch

Figure 19 Market: SWOT Analysis

Figure 20 Classification of Sources of Protease Enzymes

Figure 21 Protease Enzymes Market Share (Value), By Geography, 2012

Figure 22 North America: Protease Enzyme Market Share (Value), By Country, 2013

Figure 23 Europe: Protease Enzyme Market Share (Value), By Country, 2013

Figure 24 Asia-Pacific: Protease Enzyme Market Share (Value), By Country, 2013

Figure 25 ROW: Protease Enzymes Market Share (Value), By Country, 2013

Figure 26 Market: Growth Strategies, 2010-2014

Figure 27 Enzymes Market Developments, 2010-2014

Figure 28 Agreements/Partnerships/Collaborations Joint Ventures, 2010-2014

Figure 29 New Product Launch & R&D, 2010–2014

Figure 30 Mergers & Acquisitions, 2011-2013

Figure 31 Expansions & Investments, 2010-2014

Please fill in the form below to receive a free copy of the Summary of this Report

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America Protease The North American protease market was valued at $0.9 billion in 2013, with a share of 46.2% globally. It is projected to grow at a CAGR of 5.2% during the forecast period, 2013 to 2018. The market is led by Novozymes A/S (30%) and DSM (18%). |

Upcoming |

|

Europe Protease The European protease market was valued at $458.3 million in 2013, at a CAGR of 5.2%, between 2013 and 2018. The market constituted 22.8% of the global Protease market in 2013. Novozymes AS (31%) and DSM (20%) are the leading players in the European market. |

Upcoming |

|

Asia-Pacific Protease The Asia-Pacific protease market was valued at $0.4 billion in 2013, with a share of 18.4% globally. This market is projected to grow at a CAGR of 5.2% between 2013 and 2018, and is led by Novozymes A/S (35%) and DSM (20%). |

Upcoming |