Orthopedic Braces & Support Systems Market by Product (Knee Braces & Supports, Foot & Ankle Braces and Supports, Spinal Orthoses, Upper Extremity Softgoods) by End-User (Orthopedic Clinics, Hospitals) - Global Analysis & Forecast to 2019

This report covers the definition, description, and forecast for the global orthopedic braces & support system market. It involves a detailed analysis of the market segmentation, which comprises product and end-user. The report also provides the strategic analysis of the key players in this market. Based on type, the global orthopedic braces & support system market is segmented into knee braces and support, foot & ankle braces and support, spinal orthoses, wherein the knee braces and support segment dominates the market having accounted for a share of 42.5% in 2014. The market based on end-user includes orthopedic clinics, hospitals, and other end-users wherein the orthopedic clinics segment accounted for a share of 38.6% in 2014.

Factors such as rising aging population, rising incidences of sports injuries, increasing cases of road accidents, and others are driving the growth of the orthopedic braces & support systems market.

The report also provides a detailed competitive landscaping of companies operating in this market. Segment and country-specific company shares, news & deals, M&A, segment specific pipeline products, product approvals and product recalls of the major companies would be detailed. The key players operating in this market are Biomet, Inc. (U.S.), Bledsoe Brace Systems (U.S.), Bauerfeind AG (Germany) Breg, Inc. (U.S.) Chase Ergonomics (U.S.), DeRoyal Industries, Inc. (U.S.), DJO Global Inc. (U.S.), Ossur (Iceland), Ottobock (Germany), and BSN Medical (Germany) among others.

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Integrated Ecosystem of Orthopedic Braces & Support Systems Market

2.2 Arriving at the Global Orthopedic Braces & Support Systems Market Size

2.2.1 Top-Down Approach

2.2.2 Demand Side Approach

2.2.3 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 22)

4 Market Overview (Page No. - 24)

4.1 Introduction

4.2 Comparison With Parent Market

4.3 Market Drivers and Inhibitors

4.4 Key Market Dynamics

5 Global Orthopedic Braces & Support Systems Market, By Product (Page No. - 29)

5.1 Introduction

5.2 Global: Orthopedic Braces & Support Systems Market, Type Comparison With Parent Market

5.3 Global: Knee Braces & Support Market, By Geography

5.4 Global: Foot & Ankle Braces and Supports Market, By Geography

5.4.1 Global: Hinged Braces Market, By Geography

5.4.2 Global: Soft Braces Market, By Geography

5.5 Global: Spinal Orthoses Market, Geography

5.6 Global: Upper Extremity Softgoods Market, By Geography

6 Global Orthopedic Braces & Support Systems Market, By End-User (Page No. - 38)

6.1 Introduction

6.2 End-User Comparison With Parent Market

6.3 Orthopedic Braces & Support Systems in Orthopedic Clinics, By Geography

6.4 Orthopedic Braces & Support Systems in Hospitals, By Geography

7 Global Orthopedic Braces & Support Systems Market, By Geography (Page No. - 43)

7.1 Introduction

7.2 North America

7.2.1 North America: Orthopedic Braces & Support Systems Market,By Product

7.2.1.1 North America: Foot & Ankle Braces Market, By Type

7.2.2 North America: Orthopedic Braces & Support Systems Market,By End-User

7.3 Europe

7.3.1 Europe: Orthopedic Braces & Support Systems Market, By Product

7.3.1.1 Europe: Foot & Ankle Braces Market, By Type

7.3.2 Europe: Orthopedic Braces & Support Systems Market, By End-User

7.4 Asia-Pacific

7.4.1 Asia-Pacific: Orthopedic Braces & Support Systems Market, By Product

7.4.1.1 Asia-Pacific: Foot & Ankle Braces Market, By Type

7.4.2 Asia-Pacific: Orthopedic Braces & Support Systems Market, By End-User

7.5 RoW:

7.5.1 RoW: Orthopedic Braces & Support Systems Market, By Product

7.5.1.1 RoW: Foot & Ankle Braces Market, By Type

7.5.2 RoW: Orthopedic Braces & Support Systems Market, By End-User

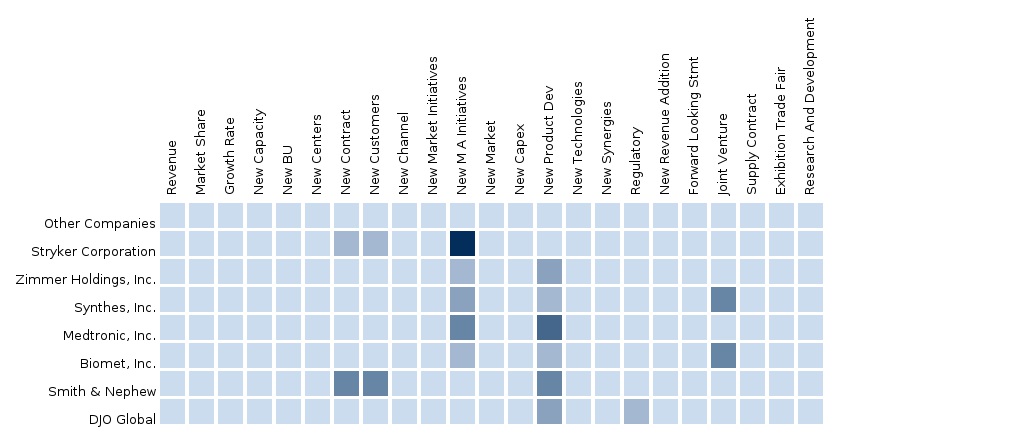

8 Global Orthopedic Braces & Support Systems Market: Competitive Landscape (Page No. - 65)

8.1 Company Share Analysis

8.2 Company Presence in Orthopedic Braces & Support Systems Market,By Product

8.3 Mergers & Acquisitions

8.4 Expansions

8.5 New Product Development

8.6 Partnership

9 Global Orthopedic Braces & Support Systems Market, By Company (Page No. - 71)

(Overview, Financials, Products & Services, Strategy, and Developments)*

9.1 Biomet, Inc.

9.2 Bledsoe Brace Systems

9.3 Bauerfeind AG

9.4 Breg, Inc.

9.5 Deroyal Industries, Inc.

9.6 DJO, LLC

9.7 Ossur

9.8 Ottobock

9.9 BSN Medical

9.1 Chase Ergonomics, Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Company

10 Appendix (Page No. - 100)

10.1 Customization Options

10.1.1 Product Analysis

10.1.2 Epidemiology Data

10.1.3 Procedure Volume Data

10.1.4 Surgeons/Physicians Forum

10.1.5 Perception Matrix

10.2 Related Reports

10.3 Introducing RT: Real-Time Market Intelligence

10.3.1 RT Snapshots

List of Tables (43 Tables)

Table 1 Global: Orthopedic Braces & Support System Peer Market Size,2014 (USD MN)

Table 2 Global: Aging Population, By Country, 2014

Table 3 Macroindicator,By Geography, 2014 (USD MN)

Table 4 Comparison With Parent Market, 2013 – 2019 (USD MN)

Table 5 Drivers and Inhibitors

Table 6 Global: Orthopedic Braces & Support Systems Market, By Product,2013 – 2019 (USD MN)

Table 7 Global: Foot & Ankle Braces and Supports Market, By Type,2013 – 2019 (USD MN)

Table 8 Global: Orthopedic Braces & Support Systems Market, By End-User,2013 – 2019 (USD MN)

Table 9 Global: Orthopedic Braces & Support Systems Market, By Geography ,2013 - 2019 (USD MN)

Table 10 Global: Orthopedic Braces & Support Systems Market, By Product,2013 - 2019 (USD MN)

Table 11 Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 12 Global: Knee Braces & Support Market, By Geography, 2013–2019 (USD MN)

Table 13 Global: Foot & Ankle Braces and Supports Market, By Geography,2013–2019 (USD MN)

Table 14 Global: Hinged Braces Market, By Geography, 2013–2019 (USD MN)

Table 15 Global: Soft Braces Market, By Geography, 2013–2019 (USD MN)

Table 16 Global: Spinal Orthoses Market, By Geography, 2013–2019 (USD MN)

Table 17 Global: Upper Extremity Softgoods Market, By Geography,2013–2019 (USD MN)

Table 18 Global: Orthopedic Braces & Support Systems Market, By End-User,2013 - 2019 (USD MN)

Table 19 Type Comparison With Parent Market, 2013–2019 (USD MN)

Table 20 Global: Market in Orthopedic Clinics, By Geography, 2013–2019 (USD MN)

Table 21 Global: Market in Hospitals,By Geography, 2013–2019 (USD MN)

Table 22 Global: Orthopedic Braces & Support Systems Market, By Geography,2013 - 2019 (USD MN)

Table 23 North America: Orthopedic Braces & Support Systems Market, By Product, 2013-2019 (USD MN)

Table 24 North America: Foot & Ankle Braces Market, By Type, 2013-2019 (USD MN)

Table 25 North America: Orthopedic Braces & Support Systems Market,By End-User, 2013 - 2019 (USD MN)

Table 26 Europe: Orthopedic Braces & Support Systems Market, By Product,2013-2019 (USD MN)

Table 27 Europe: Foot & Ankle Braces Market, By Type, 2013-2019 (USD MN)

Table 28 Europe: Orthopedic Braces & Support Systems Market, By End-User,2013 - 2019 (USD MN)

Table 29 Asia-Pacific: Orthopedic Braces & Support Systems Market, By Product, 2013-2019 (USD MN)

Table 30 Asia-Pacific: Foot & Ankle Braces Market, By Type, 2013-2019 (USD MN)

Table 31 Asia-Pacific: Orthopedic Braces & Support Systems Market, By End-User, 2013 - 2019 (USD MN)

Table 32 RoW: Market, By Product,2013-2019 (USD MN)

Table 33 RoW: Foot & Ankle Braces Market, By Type, 2013-2019 (USD MN)

Table 34 RoW: Market, By End-User,2013 - 2019 (USD MN)

Table 35 Company Share Analysis, 2013 (%)

Table 36 Mergers & Acquisitions

Table 37 Expansions

Table 38 New Product Development

Table 39 Partnership

Table 40 Biomet, Inc.: Key Financials, 2010 - 2014 (USD MN)

Table 41 DJO, LLC: Key Operations Data, 2012 - 2014 (USD MN)

Table 42 DJO, LLC: Key Financials, 2010 - 2014 (USD MN)

Table 43 Ossur: Key Financials, 2010 - 2014 (USD MN)

List of Figures (51 Figures)

Figure 1 Segmentation & Coverage

Figure 2 Integrated Ecosystem

Figure 3 Research Methodology

Figure 4 Top-Down Approach

Figure 5 Demand Side Approach: Global Aging Population, 2014

Figure 6 Macro Indicator-Based Approach

Figure 7 Global: Orthopedic Braces & Support Systems Market Snapshot

Figure 8 Global: Orthopedic Braces & Support Systems Types, By Product,2014 (USD MN)

Figure 9 Global: Market, By Product,2014 - 2019 (USD MN)

Figure 10 Type Comparison With Parent Market, 2013–2019 (USD MN)

Figure 11 Global: Knee Braces & Support Market, By Geography, 2013–2019 (USD MN)

Figure 12 Global: Foot & Ankle Braces and Supports Market, By Geography,2013–2019 (USD MN)

Figure 13 Global: Hinged Braces Market, By Geography, 2013–2019 (USD MN)

Figure 14 Global: Soft Braces Market, By Geography, 2013–2019 (USD MN)

Figure 15 Global: Spinal Orthoses Market, By Geography, 2013–2019 (USD MN)

Figure 16 Global: Upper Extremity Softgoods Market, By Geography,2013–2019 (USD MN)

Figure 17 Global: Orthopedic Braces & Support Systems Market, By End-User,2014- 2019 (USD MN)

Figure 18 End-User Comparison With Parent Market, 2013–2019 (USD MN)

Figure 19 Global: Market in Orthopedic Clinics, By Geography, 2013–2019 (USD MN)

Figure 20 Global: Market in Hospitals,By Geography, 2013–2019 (USD MN)

Figure 21 Growth Analysis,By Geography, 2014-2019 (USD MN)

Figure 22 North America: Orthopedic Braces & Support Systems Market Overview, 2014 & 2019 (%)

Figure 23 North America: Market, By Product, 2013-2019 (USD MN)

Figure 24 North America: Foot & Ankle Braces Market, By Type, 2013-2019 (USD MN)

Figure 25 North America: Orthopedic Braces & Support Systems Market: Product Snapshot

Figure 26 North America: Market,By End-User, 2013 - 2019 (USD MN)

Figure 27 North America: Orthopedic Braces & Support Systems Market Share,By End-User, 2014-2019 (%)

Figure 28 Europe: Orthopedic Braces & Support Systems Market Overview,2014 & 2019 (%)

Figure 29 Europe: Market, By Product,2013-2019 (USD MN)

Figure 30 Europe: Foot & Ankle Braces Market, By Type, 2013-2019 (USD MN)

Figure 31 Europe: Orthopedic Braces & Support Systems Market: Product Snapshot

Figure 32 Europe: Market, By End-User,2013 - 2019 (USD MN)

Figure 33 Europe: Orthopedic Braces & Support Systems Market Share, By End-User, 2014-2019 (%)

Figure 34 Asia-Pacific: Orthopedic Braces & Support Systems Market Overview,2014 & 2019 (%)

Figure 35 Asia-Pacific: Orthopedic Braces & Support Systems Market, By Product, 2013-2019 (USD MN)

Figure 36 Asia-Pacific: Foot & Ankle Braces Market, By Type, 2013-2019 (USD MN)

Figure 37 Asia-Pacific: Orthopedic Braces & Support Systems Market: Product Snapshot

Figure 38 Asia-Pacific: Orthopedic Braces & Support Systems Market, By End-User, 2013 - 2019 (USD MN)

Figure 39 Asia-Pacific: Orthopedic Braces & Support Systems Market Share,By End-User, 2014-2019 (%)

Figure 40 RoW: Market Overview,2014 & 2019 (%)

Figure 41 RoW: Market, By Product,2013-2019 (USD MN)

Figure 42 RoW: Foot & Ankle Braces Market, By Type, 2013-2019 (USD MN)

Figure 43 RoW: Market: Product Snapshot

Figure 44 RoW: Market, By End-User,2013 - 2019 (USD MN)

Figure 45 RoW: Market Share, By End-User, 2014-2019 (%)

Figure 46 Company Share Analysis, 2013 (%)

Figure 47 Orthopedic Braces & Support Systems: Company Product Coverage,By Product, 2013

Figure 48 Biomet, Inc.: Revenue Mix, 2013 (%)

Figure 49 Contribution of Spine, Bone Healing, & Microfixation Segment Towards Company Revenue, 2011-2013 (USD MN)

Figure 50 DJO, LLC: Revenue Mix, 2014 (%)

Figure 51 Ossur : Revenue Mix, 2013 (%)

The global orthopedic braces and supports system market was valued at $3,963.1 million in 2014, and is estimated to reach $4,918.7 million by 2019, at a CAGR of 4.4% from 2014 to 2019. The market has been segmented on the basis of product, end-user, and region.

The cumulative number of people actively engaged in sports is a significant factor driving this market. In addition, the growth rate of musculoskeletal injuries and rise in surgical procedures complements the growth of this market, since patients require orthopedic braces and support post-surgery as well.

The product segment includes a detailed study for knee braces and support, foot & ankle braces and support, spinal orthoses, and upper extremity soft goods. The upper extremity orthopedics market continues to be one of the fastest-growing segments in the orthopedic devices market and comprises for a significant share. The knee braces and support segment registered the largest market share, followed by foot and ankle. This market is mainly driven by an increase in sports related injuries, incidences of knee and ankle arthritis, and increasing number of patients with diabetes and other vascular diseases.

The market on the basis of end-users has been further segmented into hospitals, orthopedic clinics, and other end-users (gyms/health clubs, sports academy/outlets, pharmacy outlets, emergency centers, and trauma centers). The global orthopedic braces and supports system market covers regions such as North America, Europe, Asia-Pacific and Rest of World (RoW).

The key players operating in this market are Biomet, Inc. (U.S.), Bledsoe Brace Systems (U.S.), Bauerfeind AG (Germany) Breg, Inc. (U.S.) Chase Ergonomics (U.S.), DeRoyal Industries, Inc. (U.S.), DJO Global Inc. (U.S.), Ossur (Iceland), Ottobock (Germany), and BSN Medical (Germany), among others.

Please visit http://www.micromarketmonitor.com/custom-research-services.html to specify your custom Research Requirement

| PRODUCT TITLE | PUBLISHED | |

|---|---|---|

|

North America Orthopedic Braces & Support Systems The report “North American Braces & Support Devices Market forecast, 2012-2018 “analyzes the market of devices by 7 segments such as Wrist Braces Devices, Upper Extremity Braces Devices, Knee Braces& Support Devices, Spinal Orthosis Devices, Cold therapy systems, Disposable pain infusion pumps and Ankle Braces & Support Devices. Most of these markets are expected to experience slow to moderate growth because of an aging population, growing prevalence of obesity and osteoarthritis and increasing use of braces as prophylaxis to prevent sporting injuries. All of these segments experienced a positive growth since 2012 with an increased awareness for procedures and sophisticated diagnostic techniques. |

Apr 2015 |

|

Europe Orthopedic Braces & Support Systems The report “European Braces & Support Devices Market forecast, 2012-2018 “analyzes the market of devices by 7 segments such as Wrist Braces Devices, Upper Extremity Braces Devices, Knee Braces& Support Devices, Spinal Orthosis Devices, Cold therapy systems, Disposable pain infusion pumps and Ankle Braces & Support Devices. Most of these markets are expected to experience slow to moderate growth because of an aging population, growing prevalence of obesity and osteoarthritis and increasing use of braces as prophylaxis to prevent sporting injuries. All of these segments experienced a positive growth since 2012 with an increased awareness for procedures and sophisticated diagnostic techniques.The report also provides an extensive competitive landscaping of companies operating in this market. The main companies operating in Joint reconstruction device market and extensively covered in this report are Aircast, Inc., Bauerfeind USA, Inc., Becton Dickinson, Beiersdorf Inc. & Royce Medical. |

Apr 2015 |

|

Asia-Pacific Orthopedic Braces & Support System This report provides a detailed competitive landscape of companies operating in this market. The report also provides segment and country-specific company shares, news & deals, M&A, segment-specific pipeline products, product approvals, and product recalls of major companies. The key players operating in this market are Biomet, Inc. (U.S.), Bledsoe Brace Systems (U.S.), Bauerfeind AG (Germany), Breg, Inc. (U.S.), Chase Ergonomics (U.S.), DeRoyal Industries, Inc. (U.S.), DJO Global (U.S.), Ossur (Iceland), Ottobock (Germany), and Zimmer, Inc. (U.S.), among others. |

Apr 2015 |